WEEKLY INTAKE 21. 2025

TRIBECA FESTIVAL. SOME NOTES ON HOLLYWOOD. USING AI AND NOT TALKING ABOUT IT. SAIL GP. CAN BURBERRY REBOUND? TILLMANS AT POMPIDO. CIRCLE. FORCED SAVINGS. CEO PAY. PALANTIR'S DATABASE. ROTTING APPLE.

This week, New York's Tribeca Festival reinforced its evolution beyond cinema with 20 music events and new categories, including immersive and gaming experiences. The festival has positioned itself as a multimedia showcase, contrasting with Cannes or Toronto, where Hollywood premieres major franchises.

The 10-day festival's expanded aperture fits the original goal set out by Robert De Niro, Craig Hatkoff, and Jane Rosenthal, which was to revive downtown (specifically Tribeca) in the wake of 9/11.

Over the past few years, Music has had a notable presence at the festival.

This year, Live Nation presented several projects, deepening its strategic move into film. The Miley Cirus co-directed visual companion to her new album, Something Beautiful. A proper 2-hour Billy Idol documentary, "Billy Idol Should Be Dead," chronicles the punk icon's "meteoric rise as a global superstar in the MTV era" and his struggles with addiction.

Anderson Paak's scripted comedy "K-Pops" about a father attempting to ride the fame of his long-lost son. You may forget Live Nation's blockbuster success with "A Star is Born." They're playing it slow with the studio arm of their business, but it makes sense.

I walked past a line two blocks long of people wearing their most epic Metallica merch heading into ‘Metallica Saved My Life’.

SOME NOTES ON HOLLYWOOD

In April, I wrote about Hollywood’s decline as a production hub, driven by self-inflicted challenges: complicated permits, exorbitant studio costs, and heavy taxation. Meanwhile, markets like New Orleans, British Columbia, Austin, and Atlanta have drawn talent and production with incentives, offering tax rebates of 30-40% on project budgets. Los Angeles has failed to match these as global regions capitalized on the trend.

Excluding 2020, 2024 marked the worst year for local filming in LA.

Lane Brown’s New York Magazine article details the industry’s downturn and emerging shifts. Like Brown, I find LA no longer magical but resembling a rust belt city, grim during work visits.

If production, which is really the magic, becomes scattered to the wind, Hollywood loses a reason for talent to concentrate, exchange knowledge, and inspire.

“The state of the business is so bleak now that even I am willing to consider shooting outside of L.A. because the opportunities here have just gone away.”

- Rob Lowe

What's positive is the expansion of the industry, Atlanta got Pinewood, and Netflix has opened massive offices in NYC and is building a 900 million mega studio in New Jersey. While one market loses concentration, it opens opportunities in others.

Hollywood is also grappling with the fact that everyone is using AI and hiding it.

6 months ago, there was staunch opposition, probably because the film slop wasn't the real threat that it is today to the VFX industry. Exponential growth is here, the genie is out of the bottle, and we're seeing two routes take shape, partnerships or lawsuits.

Last week, Disney and Universal sued Midjourney for copyright infringement (NYT). A 110-page lawsuit claims Midjourney "helped itself to countless" copyrighted works to train its software. This marks the first time major Hollywood studios have sued an AI company.

"Midjourney is the quintessential copyright free-rider and a bottomless pit of plagiarism,"

AI theft "threatens to upend the bedrock incentives of U.S. copyright law that drive American leadership in movies, television, and other creative arts."

Their stance is correct: piracy remains piracy, regardless of technological speed. IP protection shouldn't be discarded. If Getty Images sold Darth Vader or Homer Simpson photos, lawsuits would follow.

The best thing the studios can do is organize and negotiate with strength. A unified front across the media landscape is the only way to protect and actually monetize IP with decades and billions invested in its development.

Also, this week Reddit is suing Anthropic, with claims their site was crawled over 100,000 times. The models need to train on data, which is essentially the oil of this industry; almost every major AI company simply refuses to pay for that training.

Smart money is in deals; in the same week, Runway announced a partnership with AMC (they also have a partnership with Tribeca Festival).

AMC will use the New York firm’s tech to both generate marketing images and help pre-visualize shows that have yet to be produced.

Midjourney has not responded to multiple “cease and desist” notices from studios.

FAUX AI MARKETING TREND

Something I like about AI is that it bends our creative minds and extends outputs. Using AI for ideation gives us surreal, tangible outputs. Similar to how AI designed a chip in a way no human would have thought to (or even understand).

This is impacting experiential, product, and content creation.

SAIL GP AND NICHE LUXURY SPORTS

Niche sports with a specific lean to high net worth audiences are grabbing attention beyond watch brands and champagne.

F1 being the case study, as it reaches peak mainstream awareness from multi-year burn into the spotlight, culminating with this month's expected blockbuster ‘F1’ from Jerry Bruckheimer & Brad Pitt.

Sailing seems to be next. SailGP, marketed as Formula One of the seas came to New York City last week drawing 10,000 people to grandstands. Celebrity backing has brought attention to the sport, Kylian Mbappe invested in France’s team, Anne Hathaway is part of the female lead ownership group that bought the Italian team, and most recently Hugh Jackman and Ryan Reynolds became controlling owners Australian SailGP team.

DJ Khaled joined the league’s board of directors and will assume a title of ‘chief hype officer’ bringing the attention of his 40 million followers to the sport.

Some brands are starting to show up, but there seems to be huge room for opportunity here. It’s significantly less crowded than tennis, golf, F1, or other niche luxury adjacent sports. Rolex has been in since the race started in 2019, owning the tops of every sail. Tommy and L’Oreal have both entered the race; BOF ran a whole piece on the sport’s opportunities for fashion and beauty.

The Ritz has the primary on-ground presence, but otherwise it feels like a space ripe for brands to stake a claim.

Sports with niche angles into high net worth and heritage are where luxury brands can speak to a core audience as they move away from courting ‘aspirational’ consumers.

Chanel’s first sports sponsorship was to become the official timekeeper of The 2025 Boat Race, a peculiar and brutal race between Oxford and Cambridge.

“The race illustrates the pursuit of excellence and the engine itself.”

- Frédéric Grangié, President of Chanel Watches and Fine Jewelry

It’s about finding unsaturated areas where you can have an outsize return through early affiliation. The rise of Salone del Mobile over Miami Art Week would be a similar example. The latter is too crowded.

BURBERRY’S STRUGGLE TO RETURN TO ORIGIN

A year in, Burberry’s “back to basics” plan is seeing market approval paired with a mixed opinion of the campaign and creative efforts. 1,700 layoffs last month were followed by Citi and Barclays both increasing targets, mostly due to a return to outerwear, heritage, and reasonably priced quality products.

A decade trying for an upmarket image, attempting to go toe to toe with French and Italian luxury houses, three designers, three CEOs, and three rebrands, resulted in a 75% loss of share price along with confused and alienated consumers at both the aspirational and high-end spectrums.

It started with Ricardo Tisci, and continued with Daniel Lee, who deserves credit for being able to pivot amidst a reset. He delivered a well-received Winter 2025 show, seen as the return to timeless British luxury.

What feels good is the recent festival season nostalgia work. Shot by Drew Vickers, Iconic British talent like Alexa Chung, Liam Gallagher, and Cara Delevingne land a campaign that feels appropriate for the brand.

What’s less exciting but perhaps necessary is their summer campaign, which doesn’t feel connected to the other work aesthetically, isn’t styled as well, and feels very ‘catalog’. It’s SAFE and probably reactionary, a pitch right down the middle.

The brand's pivot from “modern British style” to “timeless British style” is driven by Joshua Schulman, the new CEO who joined from Coach last year. Coach is a good base point, through industry-wide challenges, Coach saw growth through a solid understanding of the core consumer.

To lure him over, Burberry has given Shulman a comp package that provides a significant bonus ($4.9 million) if he can bring the heritage brand back into the FTSE 100 within three years. This would require the share price to more than double.

ART AND CULTURE

WOLFGANG TILLMANS @ CENTRE POMPIDO

June through September, German photographer Wolfgang Tillmans will showcase a 35-year retrospective of his artistic practice in the form of a “curatorial experiment” on the 2nd floor of the Centre Pompidou in Paris. This will be the final major exhibition ahead of the Museum’s five-year renovation period.

Tillmans has brought rave culture to the forefront, a master of intimacy in subjects, his images populate the mood boards of an entire generation of creatives.

One of my favorite aspects of his exhibitions is the way he lays his work out, using scale and composition on the wall masterfully. A great interview on the upcoming exhibition.

HOW TO BE AN ARTIST

First off, I’m still trying to figure this out.

Nothing is new about the challenges artists face in turning their creative pursuits into a tenable career. Artist, sits along musician, actor, and professional athlete as careers that are ‘dream chases’ with near-impossible odds. One of the most real things someone ever said to me was ‘there are no middle-class artists’, it’s pretty much all or nothing.

As an artist myself, I spend a lot of time thinking about the science, politics, and game of it all. I found and frequently read ‘The Science of Art’ which digs into the careers and business of the art world. Juggling art and commerce is even harder as I have learned the two are not complementary.

T Magazine’s annual art issue interviews four artists in an environment where it may be getting harder to break through. In-depth conversations with Derrick Adams, William Kentridge, Howardena Pindell, and Lisa Yuskavage on their careers bring forth consistencies: Supporters, who help with confidence and persistence, as it’s often a long game. Lucky breaks. They play a role in almost every artist’s career; they can come early or late. The harder you work, the more opportunities for luck you create.

William Kentridge makes a point of taking the leap to even calling yourself an artist. Something I identify with heavily. I studied painting, I moved to New York to be an artist, but only recently (within the past year) did I feel comfortable telling people I was an ‘artist’ rather than a ‘business owner.’

“When I was 30, I stopped writing ‘technician’ on Visa and passport application forms and started writing ‘artist.’ It was just after the birth of our first child, and I thought, well, sink or swim, this is what I am. I’m not going to end up as anything else.”

- William Kentridge

The thing that keeps me going more than anything is that I can’t imagine NOT having the outlet. I paint as a version of meditation or therapy; without time in my studio, I could never manage the stress of the commercial side of my life.

Being an artist requires both the output and the exhibition, putting the work out, placing it in a forum for appreciation and critique, is the stage I’m working towards, and honestly, what I find hardest.

LONDON DESIGN BIENNALE

June brings design to London with its 5th Biennale. The international exhibition will span the city, but its hub is at the historic Somerset House. More than 30 different countries bring furniture, sculpture, material innovation, and identity expression to pavilions and installations.

Dezeen’s standout pavilion curation gives a great sense of what’s available.

I had to visit the New York Public Library for a walkthrough and stumbled across a small but worthwhile exhibit of prints by Robert Motherwell and books from the artist’s home donated by his family.

BUSINESS AND MARKETS

A strong week was disrupted late Thursday by Israel’s strike on Iran. Despite this major geopolitical escalation, the S&P ended Friday only 2.77% from its all-time high. Gold surged, up 30% year to date.

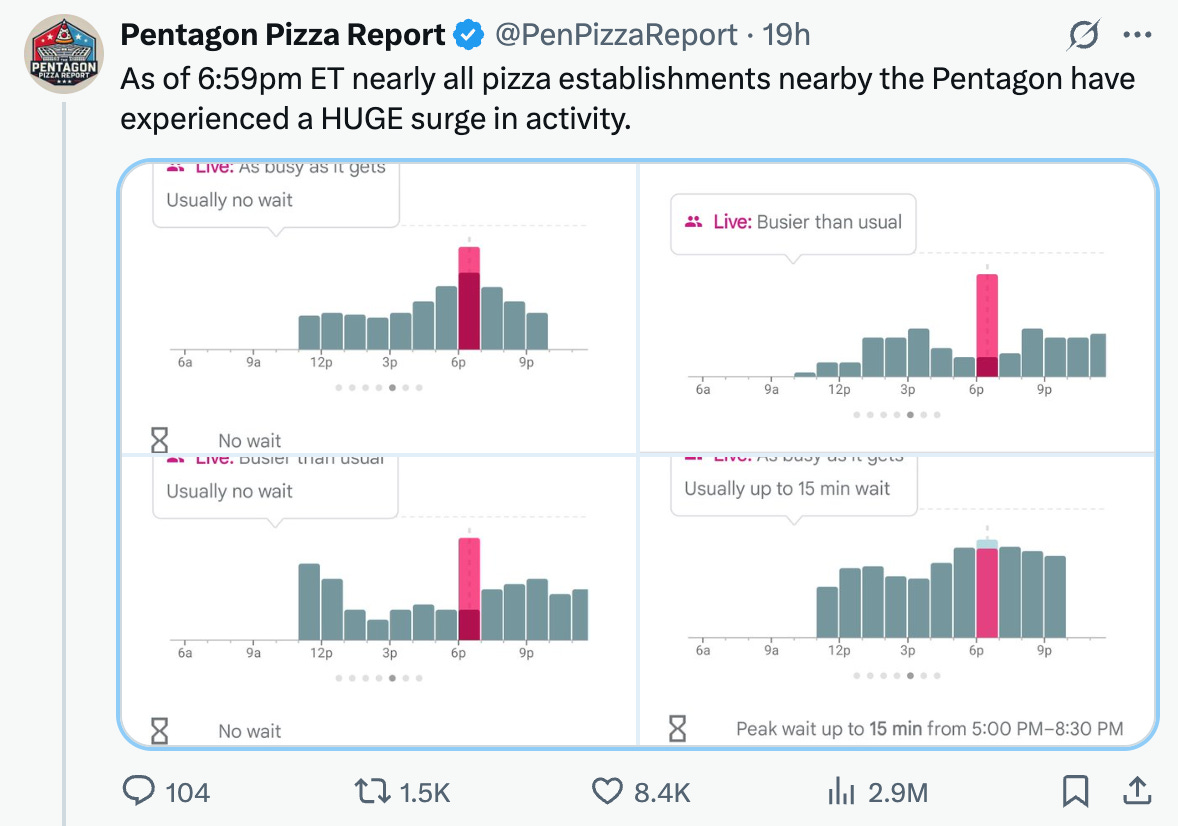

Pizza delivery spikes provided early warning signals. Soviet intelligence operatives coined "Pizzint" (Pizza Intelligence) during the Cold War to monitor food delivery surges to U.S. government buildings as indicators of pending military action. The theory suggests that government workers order more takeout during crisis situations requiring extended hours.

Pizzent has accurately predicted global crises since the 80s.

Most notably: The Grenada Invasion in ‘83, The Gulf War – Iraq’s Invasion of Kuwait, when Dominos recorded 21 pizza orders from CIA headquarters on August 1, 1990, the night before Iraq invaded Kuwait, and the Osama bin Laden Raid (2011).

INFLATION & OIL PRICES

Earlier in the week, we got a solid inflation report, remaining stable at around 2.4% annually, which was less than expected. Oil hitting $77 could have a negative impact here.

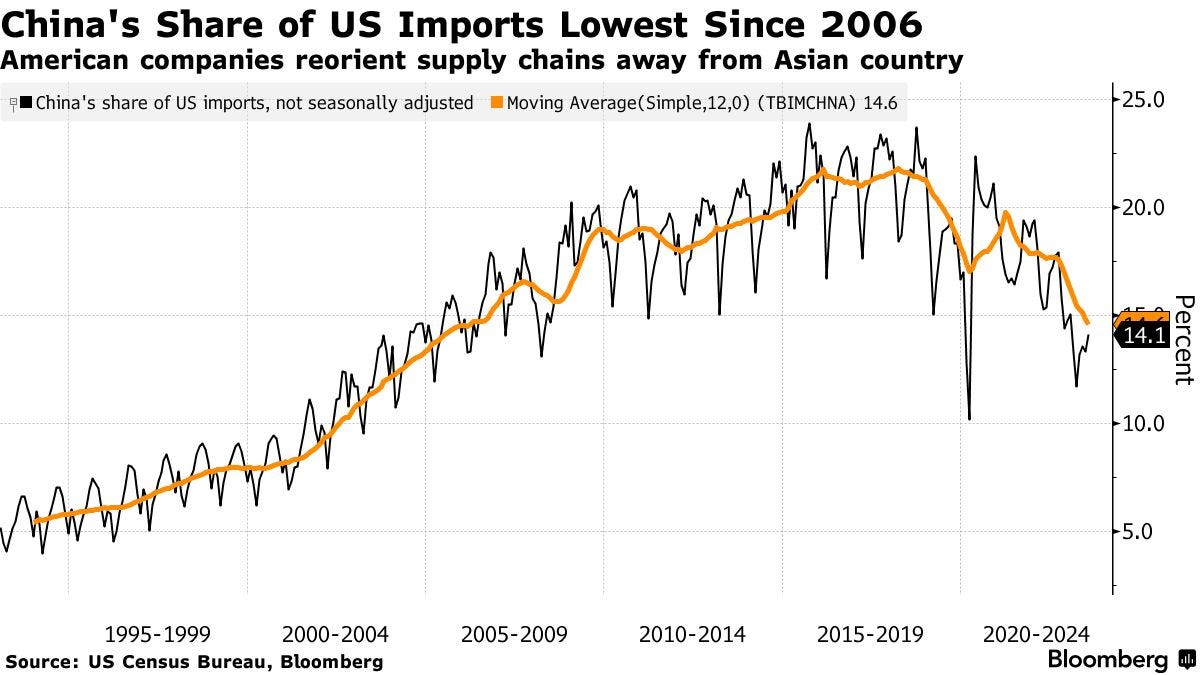

A US-China trade deal also looks positive. Outside of tariffs, China will provide us with rare earths, and we’ll let their students attend our universities. Chinese exports to the US fell by more than a third compared to the year before, despite the countries agreeing to pause their trade war.

“The girls are fighting.”

This year's most anticipated fallout finally happened, as Elon kicked off criticism of the ‘big beautiful bill’ and quickly spiraled into pedo accusations and some epic mud throwing. Group chats lit up, and meme accounts had a field day as Tesla shares fell by 14% on the day.

One of the largest wipe outs in the history of the company, and the second largest human wealth loss in a single day (Musk holds the other largest wealth loss in a day from November 2021.)

6 days later, TSLA had almost fully bounced back. For those who hold Tesla, this volatility is a regular Tuesday and par for the course. What is interesting is that company fundamentals really mean nothing with this stock; it’s the day-to-day temperament of Musk that drives it entirely.

Robotaxi was set to launch this week, but has been pushed due to ‘safety concerns’.

So much news has happened since then, and the two colossal egos are already flirting with reconciliation; it all just seems like great TV at this point.

On June 12th, Trump says, “I like Tesla.” Just keep your arms inside the roller coaster.

FORCED SAVINGS

Every U.S. citizen born between 2025 and 2028 would receive $1,000 in tax-deferred index fund investment with a new savings plan called the “Trump Account.” No withdrawals may be made until the child turns 18. Taxes are deferred on growth until the money is withdrawn.

Family and others may make ongoing annual contributions up to $5,000. Invest America founder Brad Gerstner has been advocating for a plan like this, along with increased financial literacy, to help reduce wealth and opportunity gaps.

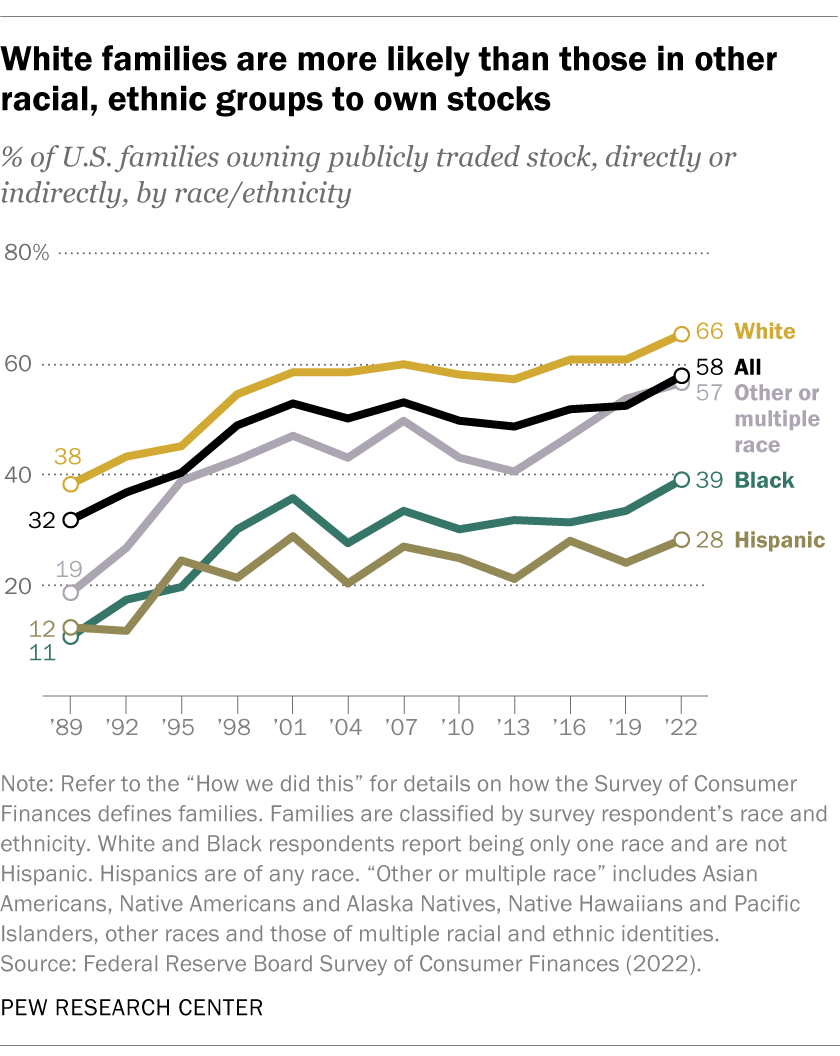

Unlike the 529 plans, this will be universal and automatic, which should go a long way in getting more Americans invested. One of the issues driving inequality is the fact that only 62% of Americans own stocks (according to Perplexity).

Stock ownership varies significantly by demographics: (see Pew Research article)

Income: 87% of households earning $100,000+ own stocks versus 28% earning under $50,000

Education: 84% of college graduates own stocks compared to 42% with high school education or less

Race: 70% of White adults, 53% of Black adults, and 38% of Hispanic adults own stocks

Marital status: 77% of married adults versus 49% of unmarried adults

Getting kids invested in America, invested in the success of American companies, and in capitalism will hopefully create a sentiment shift. When people don’t see the upside in company success or capitalism in general, it leads to disenfranchisement. If we had an entire generation seeing portfolios grow, it could lead to a shift in perspective and appreciation for America’s incredible ability to scale business.

Europe, in contrast, has a problem with its inability to scale.

CEO’s are joining in with matches. Michael Dell pledged to match the government's contribution for the children of his employees. Uber, Robinhood, Goldman Sachs, and others have also expressed support.

INVESTORS TRUST AI MORE THAN SOCIAL MEDIA

A new report from CFP showcases the rise in AI tools regarding financial planning. 1 in 3 investors said they would act on financial advice from AI without verifying it. 71% of investors have little to no level of trust in the financial planning advice received from social media.

The sweet spot seems to be in supplementing, not replacing, as the majority of people are looking to verify data with a reputable third-party source.

I found it interesting that younger investors appear to be more wary than older investors. This checks out in a similar way that boomers and up are also more easily duped with digital scams, fake news, and AI-generated content.

62% of Gen X & Boomer investors are very satisfied using generative AI tools for advice compared to just 38% of Millennial and Gen Z investors

CIRCLE LIGHTS UP THE IPO MARKET

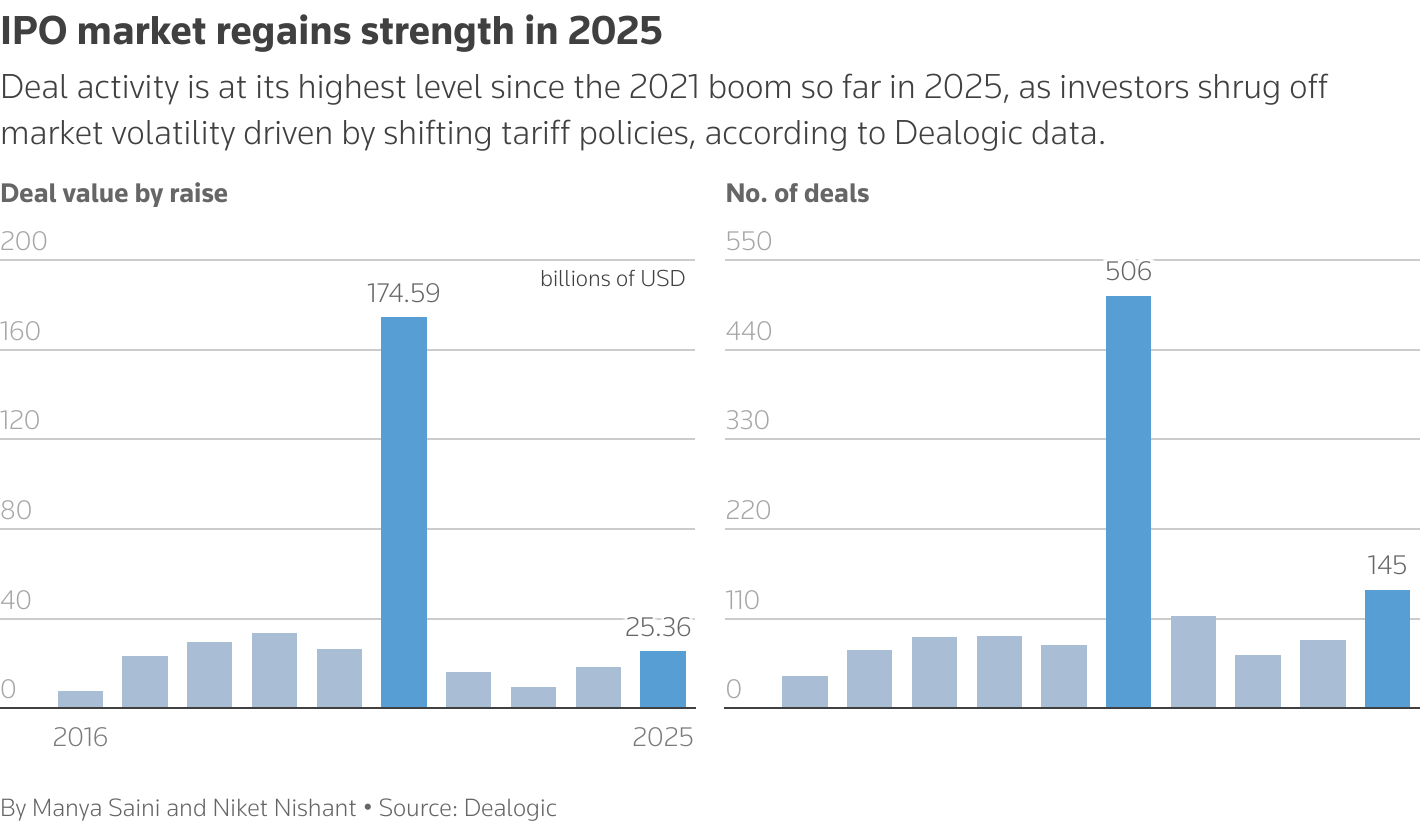

The largest IPO 2-day gain since 1980 at nearly 250%, Circle’s launch could signal an end to the backlogged IPO market, which has been tepid since 2021.

The stablecoin issuer, which operates USDC (the second-largest stablecoin by market capitalization), has distinguished itself by embracing U.S. regulatory compliance. Unlike Tether (USDT), the largest stablecoin by market cap, which is based out of El Salvador and has faced scrutiny over its reserve practices, aka nobody knows if it's actually backed or what Tether does with the money it holds.

USDC will benefit immensely from Wednesday’s Senate advancement of the GENIUS Act towards a final vote on June 17th. The bipartisan bill would establish a regulatory framework for stablecoins and usher in larger adoption across the financial industry.

Bank of America has shown up to express support for stablecoins:

“We're working with the industry, working individually. We have this pretty well understood … but the problem before was it wasn't clear we were allowed to do it under the banking regulations, and there was a lot of mystery about that,”

Bank of America CEO Brian Moynihan

A second-order effect of the Genius Act passing would be large purchases of Treasury notes, bonds, and dollar deposits necessary to back the digital tokens. Treasury Secretary Scott Bessent testified on Capitol Hill that Stablecoins could become larger than a $2 trillion market in the coming years. This would bring down treasury yields and strengthen the dollar.

Circle’s successful IPO was followed by two others on Thursday. Fintech startup Chime (CHYM.O) rose 37% in a day, while drone maker AIRO more than doubled.

Crypto exchange Gemini, buy-now-pay-later firm Klarna, Discord (with 200 million monthly active users), and fast-fashion e-commerce giant Shein are some of the most anticipated IPO’s of 2025.

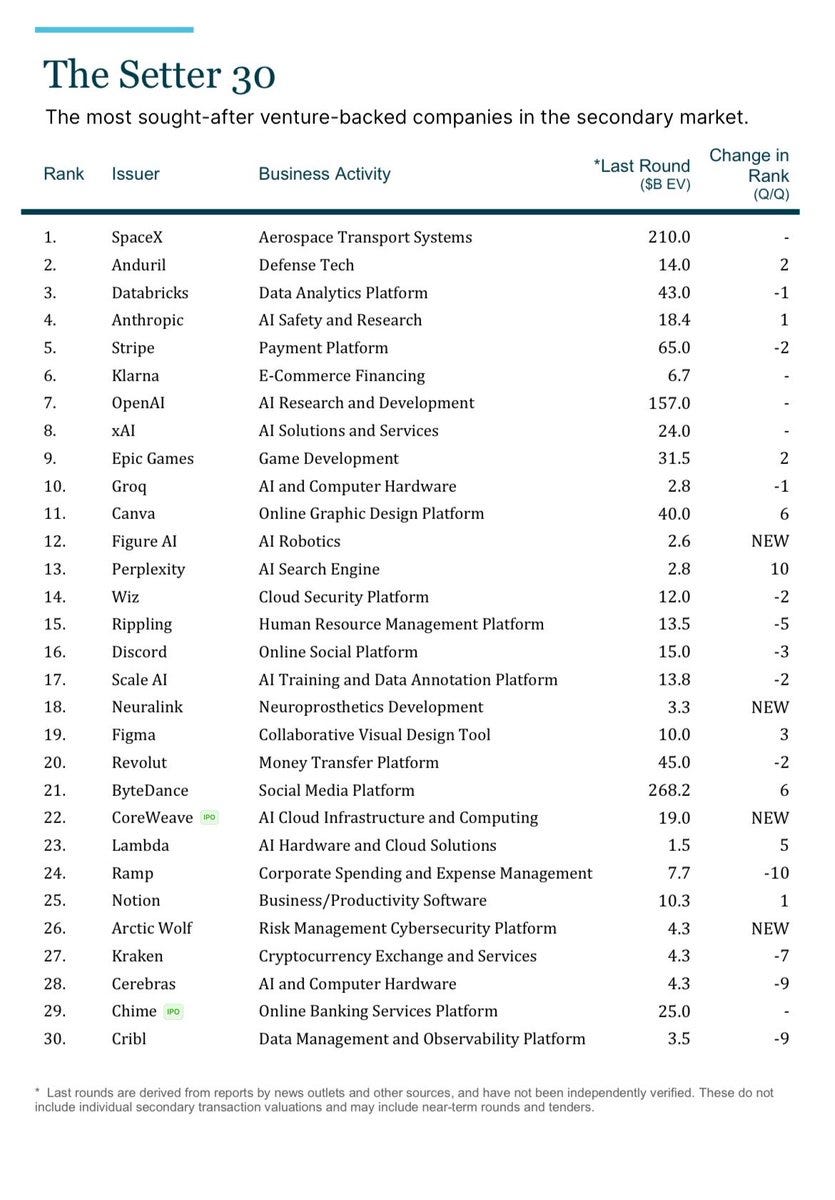

PE funds are sitting on an estimated $3 trillion of assets due to be taken public or sold, according to Bloomberg. Some of the most sought-after companies:

WANING OF EARLY STAGE INVESTING

A Carta article on VC dollar flow indicates a transition away from early-stage to late-stage investing. Seed stage deal count fell 30 %, seed stage funding fell 40%, and series A fell 20%

Investors are feeling burned from a lack of exits and many resets in valuations (down) that happened in 2023.

The report indicates investors are less likely to invest in early-stage. The seed stage is a ton of work; you’ve been in it for a decade, and oftentimes, it’s the worst part of the cap table. VCs are seeing it’s worth it to pay a premium for established market leaders.

For example, Thrive Capital is starting to invest in public companies, recently making $522 million from a Carvana trade.

A MYSTERIOUS AND WELL-TIMED DONATION

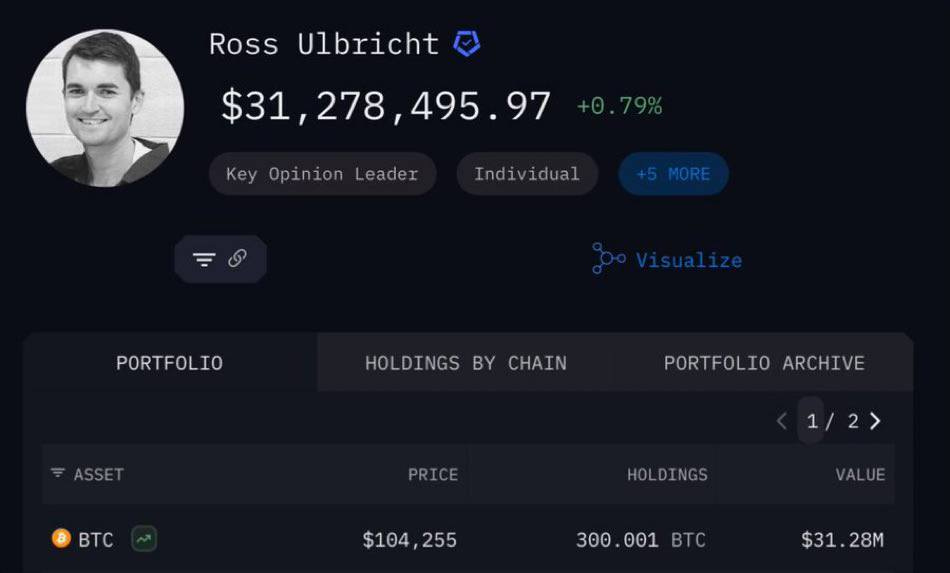

Ross Ulbricht, the recently released founder of the Silk Road marketplace, received an anonymous 300 BTC donation (roughly 31 million) last weekend. Rumors began that Ross may have been paying himself with dormant wallets after he was pardoned.

Things got stranger with a Wired article stating Chainalysis tracked the funds through multiple mixers meant to mask the transaction back to a different long-defunct dark-web black market: AlphaBay. One of Alpha Bay’s creators died mysteriously in a Bangkok jail cell, while the other founder is still at large.

CEO PAY

WSJ’s annual analysis of S&P CEO compensation shows pay hitting another record, with over half the people on the list making north of $17 million annually.

Rick Smith, co-founder of Axion, the maker of stun guns, tops the list at $165 million, 2x the person in 2nd place.

Elon Musk’s Tesla compensation was ranked last due to $0, as his compensation is tied up in a legal battle.

WARNER UNIVERSAL SPLIT UP

One of the more overcompensated CEOs has to be David Zaslav, at 51.9 million, 200% higher than the S&P average, while the stock is down 60% since he took over as CEO on April 8, 2022.

In that same period, Netflix is up nearly 250%.

Recently, a majority of shareholders voted against what they feel are excessive executive pay packages (60%), but Zaslav will get his compensation anyway.

Last week, the struggling company announced it would split into two publicly-traded entities, one focused on streaming & content, the other on traditional television. Puck’s Matthew Belloni sees this as admitting defeat.

It’s a problem similar to GE in the aughts, where good (HBO) gets grouped with bad (Warner, Discovery). Focus is key, as is quality. Warner has lacked original content and lost the NBA rights. HBO (Max?) has great content, but its branding fiasco is comical.

TECH & INNOVATION

THE DECLINE OF APPLE‘S INNOVATION

Last week's WWDC 2025 underwhelmed, evidence that Apple seems to be rotting, particularly lagging in innovation, which it was once famous for.

People wanted updates on AI, and were given a UX sideshow. No new timelines were given for the delayed AI-powered version of its Siri or anything regarding ‘Apple Intelligence’.

The stock fell 1.5% after the conference, reflecting broader concerns about Apple’s ability to keep pace in the AI race.

We got ‘Liquid Glass’, the first major graphical overhaul for iOS in 12 years. While it looks nice, early user feedback is that it’s a UX misstep, greatly degrading readability.

Software engineering chief Craig Federighi and marketing chief Greg Joswiak have been on a press tour trying to explain the lack of progress in AI.

WSJ’s Joanna Stern pressed them both hard on the lack of progress:

Apple hasn’t felt ‘innovative’ since Sir Jony Ive left the company in 2019, and his recent partnership with OpenAI to create a ‘new companion device’ is a real threat to Apple. Sam Altman has stated their goal “to ship 100 million units faster than any company has ever shipped 100 million of something new before.”

Mark Zuckerberg commented openly about Apple’s lack of innovation when he went on Joe Rogan back in January.

Trump’s made in America push is another challenge. In May, Apple was targeted with demands that the company make iPhones in the US. Easier said than done. A U.S.-made iPhone could cost close to $3,500. It would take over three years and $30 billion just for Apple to move 10% of its supply chain to the U.S.

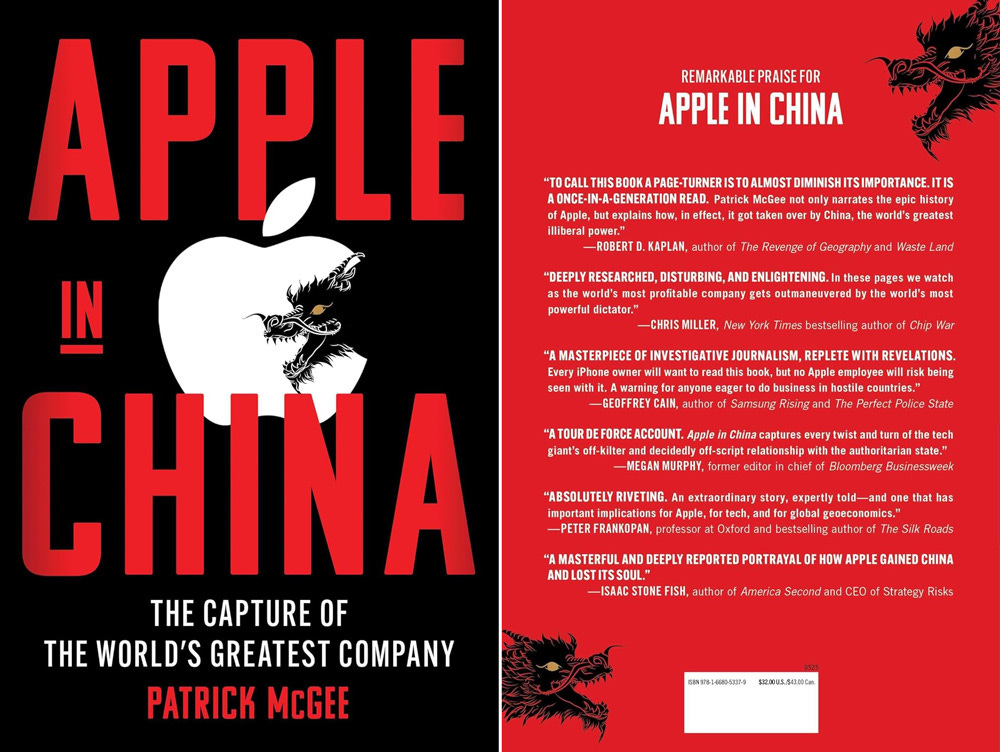

A new book, Apple in China, by Patrick McGee, tells the story of how the company ended up being lured by an inexhaustible supply of cheap labor. It wasn’t an explicit intention, and they may now be too embedded with a regime that ‘increasingly controls its fate’.

Steve Eisman (The real-life character played by Steve Carell in ‘The Big Short’) sat with Patrick on his last podcast:

I started divesting from Apple at the start of the year.

AI GUIDES - A READING LIST

Google, OpenAI, and Anthropic have all released prompting guides and quality reading materials. A short list of some of the best reads with direct downloads:

A Practical Guide to Building Agents

OpenAI’s guide for product teams and how to build your first agent.

AI in the Enterprise: Lessons from seven frontier companies.

Seven case studies on global companies using AI for operational automation and workplace performance. Morgan Stanley, Klarna, and Lowes are among the studies.

GPT-4.1 Prompting Guide

Clear instructions, workflows, and planning for optimal use of the newest model.

Similar guides for Google’s platform:

Gemini for Google Workspace Prompting Guide 101

601 real-world generative AI use cases from industry leaders

Anthropic’s Building Effective AI Agents & Prompt Engineering Overview.

And last but not least: AI Tools For Marketing: Your Go-to Guide For Top Marketing Tools And Techniques

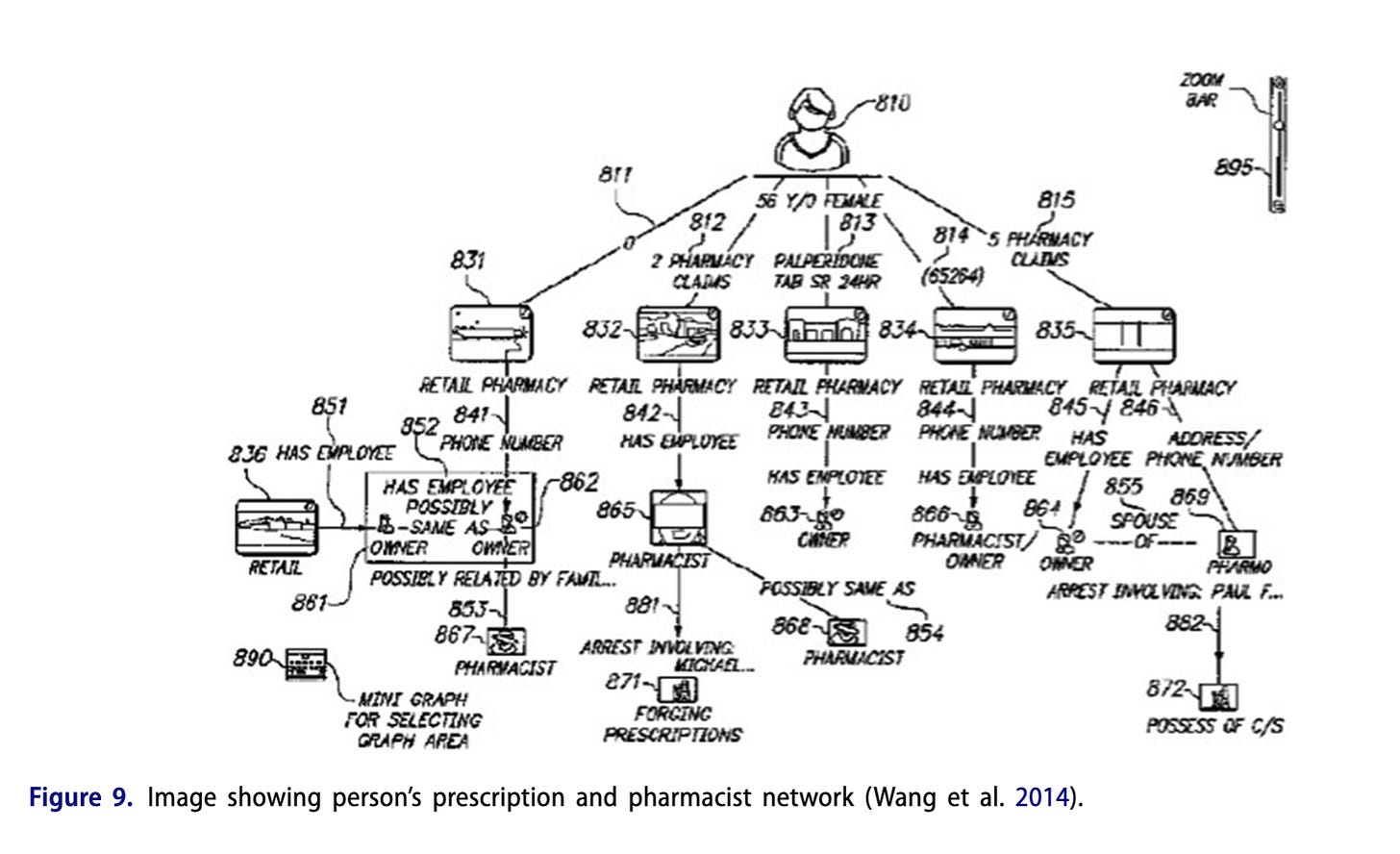

PALANTIR’S DATABASE

People are starting to piece together Palantir’s expanded government contracts and data organization efforts with Foundry. Even trump supporters are alarmed as this is very much the ‘Deep State’ he ran against. Drawing criticism from privacy advocates within his core base.

A recent NYT article threads a series of executive orders from March removing barriers to data collection, to contracts with the U.S government to create profiles of America across taxes, health, finance, and social listening (Semafor). Representatives of Palantir are attempting to buy technology and data from the Social Security Administration and the Internal Revenue Service.

Foundry data collection has been embedded into at least four government agencies such as D.H.S. and the Health and Human Services Department.

The Trump administration has already sought access to hundreds of data points on citizens and others through government databases, including their bank account numbers, the amount of their student debt, their medical claims and any disability status (NYT).

The larger issue is how shrouded in secrecy this work really is. Trump has spoken little on the orders, and most of Palantir’s work is confidential.

There is a comparison here to China’s social credit score. Data collection is the first step. It’s dark, but Palantir kill lists do exist (Project Lavender).

AI VIDEO

Kalshi dropped a completely unhinged commercial during the NBA finals, made in TWO DAYS, completely with AI. This is a watershed moment for advertising. The creator, PJ ACE, provides a complete breakdown of how he made it.

This took around 300–400 generations to get 15 usable clips. One person, two days.

That’s a 95% cost reduction compared to traditional advertising.

The mockumentary ‘BTS video’ is equally funny:

The Dor Brothers dropped another AI madhouse film that’s incredibly catchy. They must be running their model to create these:

TIMBALAND’S AI ARTIST

Timbaland announced signing the first 'AI artist’ known as “Ta Ta” and has spent the following week defending himself from fan and industry backlash.

“I’m not just producing tracks anymore,” Timbaland said in a statement to Billboard. “I’m producing systems, stories, and stars from scratch."

The ensuing debate on his live chat between him and Guru is driving an industry conversation around the implications of this:

FROM MY ARCHIVE

This is one of the original Koi Paintings, in a larger format.

Koi Large #4

Acrylic on wood panel.

36 x 48

More of my Life & Process of painting here.

- That’s it for this week.

So good, always the most engaging and comprehensive weekly updates.