WEEKLY INTAKE 20. 2025

Starting a Creative Company in 2025. Scott Galloway's path with transparency. David Lynch Collection. The Goliath of David Bars. Labubu. Rhode. Industry Insights, Market Analysis, and Tech Innovation

“Problems are fuel, powerful fuel.”

- Nils Leonard

IT’S THE WORST TIME IN HUMAN HISTORY TO START A (CREATIVE) COMPANY, “SO START”.

D&AD’s festival at the end of May brought some heavyweight keynotes from the creative industry to the stage. One of my favorites was Nils Leonard (founder of Uncommon).

It’s a counterpoint to industry doomerism, particularly on LinkedIn, and a rally against creative apathy. Our industry is under constant change and threat vectors; most industries are, the coveted ones even more so.

Nils takes the stance that ‘Problems are fuel, powerful fuel.’ Recessions are innovation drivers; we know this from 2008 and other moments when things got tough and people got entrepreneurial. Creation during hard times forces grit while also providing factors like cheaper cost of labor and operating costs (see rents during COVID).

Disney was started during the great depression (1929), meeting a public need for cheaper entertainment.

More challenging times also force reflection on entrenched norms; the companies above weren’t slightly better versions of what existed; they shattered the status quo. Widespread employment retraction (Layoffs) also leads people to roll up their sleeves.

2007-10 brought us powerhouses:

Airbnb: Born from the recession’s impact on travel budgets and demand for affordable lodging alternatives.

Uber: Car services were rip-offs, and local taxis were horrid.

Venmo: Offering a low-cost digital payment solution.

Warby Parker: Founded in 2010, addressing the high cost of eyewear with affordable, stylish glasses and a home try-on program. Valued at $1.75 billion today.

A great point on not starting in service, start in something you wish existed. One of the worst parts of being in the service industry is that you are inherently ‘chasing someone else’s dream.’

The companies we revere were not better versions of something–they were complete paradigm shifts. Apple is the blue-chip example, but if you look at the missions of Mischf or A24 (now worth billions), the models sound like lunacy.

"What sets you apart is how close you can get to the edge."

- Es Devlin

To create vs. providing service is a key difference in our line of work. Our philosophy has been that the services side of our business is the engine that should be able to create bigger platforms and ideas. It allows us to pay all the incredibly smart people but ultimately never lose passion for creating something that is yours.

This is why we (MATTE) take bets on concerts, films, IP, and even operate our own venue. The last thing we want to be is a 'service business.'

He talks about staying close to the keys. I find this essential with the pace of innovation in my world. AI is scary unless you learn to turn it into a force; never stop learning. I loved his point: "The CCO that just uses his phone is death."

“The more you can do yourself, the closer you are to making your idea a reality.”

- Nils Leonard

Care deeply about your work. Sitting on the sidelines as a 'passenger' is dangerous. Build a business that you want to turn up for every day, find people who feel the same way about it, and find passion in what you do day to day. Life's too short to waste time.

SCOTT GALLOWAY'S CAREER PATH

On the subject of starting, or in Scott's instance, continually getting back up, I love how transparent he is in the story of his entire career.

He is one of the only examples I have found willing to speak openly about exactly how much he made (and lost) with each milestone along his career, offering a rare glimpse into entrepreneurial reality.

This episode of Prof G Markets breaks it all down. Starting with a point I wholeheartedly agree with across my own entrepreneurial experience, more than anything else, success comes from resilience. His story, and many other success stories, are more about how many times you can get back up.

His first real business, Prophet, a strategy consultancy (1992), touches on service-based companies being great tests of athleticism, requiring founders to learn how to present, establish relationships, sell, analyze analytics, and manage. The problem with service businesses is that 'the assets go home in the elevator'; it's hard on your lifestyle because you have to be there.

Similar to Nils's point above, and something many service-based founders gravitate towards, Scott started an incubator while running a profit, allowing him to take bets on products he could seed fund himself. His focus was E-comm.

Prophet sells, being his first 'hit', but after taxes and divorce, Scott only took 2-3 mil, which he poured all of into his next venture, Red Envelope. The lesson here is that if you're going to fail, it's a blessing if it happens fast. Red Envelope bled out over ten years, painfully wiping him out.

He touches on being young and aggressive at this stage in his career. He did not understand the difference between "Being right. And being effective," which got him kicked off the board of the company he started. This resonated heavily with my own experience; as the first agency I founded, I was voted out of my own company and spent a year litigating my buyout.

Scott ran an activist campaign, raising 10 million and spending the next few years kicking everyone off the board to regain control of his own company. Then, the credit crisis of '08 and a trifecta of catastrophes caused Red Envelope to go Chapter 11. Scott lost everything.

So many profiles focus on successes, but failures often teach you the most. Business is HARD, and the success rate is jarring. Approximately 20% of businesses fail within their first year, 38% by year three, and 49% by year five.

Only .5-1% of U.S businesses make it to $10m in revenue.

Red Envelope’s collapse led to academia, specifically NYU, which ultimately triggered the two most successful aspects of his career: public speaking/media and L2.

During this in-between period, he also founded Firebrand Partners, a now-defunct activist hedge fund that invested over $1 billion in U.S. consumer and media companies. I specifically liked this quote in regards to learnings from walking into boardrooms as an activist investor:

“When you come into a strange situation, assume you're not as smart as you think, and they’re not as dumb as you hoped.”

- Scott Galloway

L2 (2010) started as an academic research project to analyze the top 100 luxury brands. The original intention was academic publication for peer review, a necessary step to academic tenure. Realizing it was more of a commercial product than research, Scott ultimately published the list as a ranking analysis. Thirty or so of the companies called, "Who are you, and why are you doing this?"

This evolved into L2's Digital IQ Index results, a ranking across numerous dimensions, including e-commerce, social media, and digital marketing. Combining academic rigor and the aesthetics of an ad agency, L2 was born.

“The best time to start companies is in recessions.”

Office space and human capital are cheap.

Study exits. In Scott’s case, he mentions reading Deloitte reports. Outsize evaluations were tied to owning niches, recurring revenue, and international presence. The first thing he did with L2 was open a London office.

Ultimately, selling for 155m to Gartner at 8x revenue.

In 2020, Scott started Prof G Media and began building a strong presence across multiple shows (Pivot, Prof G Markets, Raging Moderates) and a weekly article titled ‘No mercy, No malice’.

Last month, Scott and Cara Swisher renegotiated their Vox Media deal, focusing entirely on performance over a flat fee. With no guaranteed payments, a 70-30 revenue split in their favor, and shared production costs, it is a disruptive example of betting on yourself. If it plays out, it could potentially earn them around $70 million over four years. The NY Times recently featured the deal with a feature on Swisher.

Scott’s weekly No Mercy post is actually a major inspiration for why I’m writing this. The challenge of holding yourself accountable to a weekly article while juggling running a business and having a family is hard to keep. It forces weekly contemplation on relevant topics, which has changed how I absorb information.

Closing remarks, some bars that stuck with me:

A key algorithm is to be rich but anonymous.

Entrepreneurship is rewarding but not advised. The greatest wealth generator in history is the U.S corporation.

The majority of people are not entrepreneurs.

Example: After receiving a 30m offer for L2, employees were offered options. A strategy that allows for future comp from acquisition to be taken as capital gains rather than ordinary income but requires writing a check to the company to purchase shares at the current evaluation. 0 people did it. When they sold, those same employees had to pay 40% + income tax on the gains.

People faced with the option of a bigger outcome are not willing to reach into their own pockets to fund a company. The difference is the irrational upside.

Starting a business takes a toll on relationships, mental health, and physical health. It’s a young person's game requiring 60-80 hours a week.

Ed brings up the intensity that L2 was known for in its heyday, pulling no punches. Scott mentions how he answered a question about management style on a recent panel. Rather than placate, he shocked the room with, “I’m all over everyone, all the fucking time.” This is what it takes if you want to sell a business for 8x revenue.

General Catalysts has backed everything he’s done for 10 years. His investor and mentor, Barry Rosen, explains life is about three buckets:

Things you have to do

Things you want to do

Things you should do

Economic security lets you eliminate the ‘Should’ bucket.

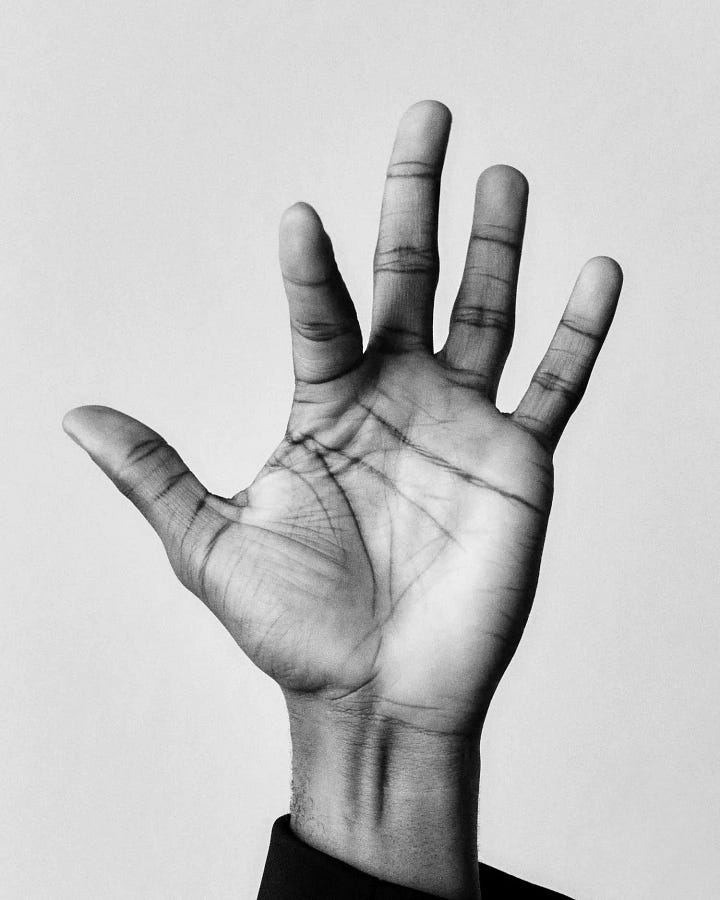

BOTTEGA VENETA CRAFT

Bottega’s newest campaign celebrating 50 years of Intrecciato (their iconic leather weave), struck me with its simplicity and impeccable casting. The execution marks the beginning of Louise Trotter at the helm as creative director. Jack Davidson and Lenio Kaklea executed it, and it is CLEAN.

While there are some iconic faces like Julianne Moore and Tyler The Creator, a lot of the casting is focused on the true makers, exceptional practitioners in art, music, literature, fashion, film, and sports.

Singer-producer Jack Antonoff, filmmaker and creative Dave Free, and conductor Lorenzo Viotti are examples of less obvious but spot-on casting.

Bottega has done a great job staying in the race, with its own subtle direction that frequently reminds you they have taste and cultural acumen. Examples include collaborating with Travis Scott for the brand’s digital publication ‘Issue’ or working with house legends Carl Craig and Moodyman.

One of my favorite live fashion films we produced was their garage show in Detroit for Salon 03 in 2022. The brand spent a month restoring the iconic Michigan Theatre, which had become a vacant car park. This is another example of the incredible effort behind the scenes to create understated beauty.

To me, the brand stands for speaking softly while going the distance.

DAVID LYNCH COLLECTION

450 items from the personal archive of one of the masters of cinema are going to auction this month. The collection includes everything from books to art supplies and tools from his home studio. Also included: a personal 35mm print of his groundbreaking debut feature film Eraserhead, Twin Peaks red curtain, and black-and-white zig-zag rug if you're feeling freaky.

VICTOR AND ALBERT’S NEW WAREHOUSE MUSEUM

The V&A East Storehouse has opened its doors to the public for the first time.

A re-imagination of museum archives and storage by Diller Scofidio + Renfro (High Line, The Shed, MOMA) that will bring 250,000 objects, 350,000 books, and 1,000 archives from the V&A’s collection to the public. Some of these objects are being seen for the first time in decades.

PEEL APART FILM IN ASIA

The first question: where are they getting all the film?!

China is seeing a rising trend of ”unfiltered“ portraits shot on vintage instant film. Studios offer portraits as a service at $55 a photo. The scarcity of film has driven prices up thirtyfold over the past decade. Fuji FP-100 was discontinued a decade ago, and the 2x2 old Polaroid cameras are even rarer.

THE GOLIATH OF DAVID

8 months old.

Younger than my newborn, DAVID is becoming a Goliath in very short order. The second act by Jared Smith and Peter Rahal, who founded RXbar, which was acquired by Kellogg for $600 million in 2017. David offers the highest protein-to-calorie ratio on the market, has a cult following, and is set to surpass $100 million in revenue in its first year.

Last week, news broke that the infamous (see expensive) protein bar had closed a $75M Series A, valuing the brand at $750M. What made this interesting enough for me to write about is the playbook they are running. Much of the money goes towards the acquisition of Epogee, the factory that supplies and owns the patent on their key ingredient, EPG. That ingredient reduces calories from fat by 92%, allowing fat to pass through your body without being absorbed.

“We will be taking all the supply,” Peter Rahal told Snaxshot in a follow-up interview about the deal. Their aggressive moat building is akin to Uber's early days. As the transaction developed, speculation developed on whether they would license the IP to existing Epogee clients or cut the supply off altogether.

Rahal pulled no punches. When asked what their plans are for existing brands supplied by Epogee, Rahal responded, “Given supply situation, cease supply.”

This leaves Nicks Ice Cream, Defiant Chocolate and many other brands in a tough position that could require reformulation.

"I am concerned what this acquisition means for our company Defiant Chocolate which uses EPG as a key ingredient."

McKay Fugal, Founder of Defiant Chocolate, a chocolate protein bar that sources from Epogee to Snaxshot

Rahal is also an early investor in prebiotic soda brand Olipop, and has spread around $50 million across about 100 other companies in the food space.

Also, kudos to Day Job Branding - for a really clean package. See the Die Line feature on it.

LABUBU

This cute little monster popped up out of nowhere and added $1.6 billion to CEO Wang Ning’s fortune in just one day.

Since 2019, Hong Kong-based artist Kasing Lung has collaborated with Chinese company Pop Mart. Prices range from hundreds of dollars for rare dolls to less than $30 for most smaller Labubu key chains.

Then Blackpink’s Lisa turns it into the Stanley tumbler of bag charms. It started in Central Asia but quickly broke out with celebrities, from Rihanna to Central Cee, styling the creature into streetwear and luxury fits.

UGC ramped up from here, with 1.5M+ posts and counting; stop-motion doll skits, songs featuring what sounds like a baby singing “Labubu” with over 11 million views on YouTube, and “what's in my bag” galore. More than 250,000 Instagram Reels are now using the song.

It's a charm, a desk buddy, an emotional support doll. In Southeast Asia, it's a full-blown frenzy with overnight lines and police being called to retail drops. Century City has seen people running around, acting crazy, and ultimately causing a cancellation of retail sales.

StockX resale prices have surged 600%.

Since mid-2024, Labubu has driven 188% net income growth for POP MART.

NOAH TEPPERBERG ON THE STANZA

The Stanza has been a primary source for me this year. Evolving from Instagram-based, sharp, quick hits a la StyleNotCom, the platform has added Substack and, recently, podcasts to its output.

The episodes have focused on business hospitality with Jamie Caring (ex-Soho House CMO, Anabelles), Gaetano Guarducci of Sant Ambroeus Hospitality Group, and most recently, my mentor Noah Tepperberg, co-founder of Tao Hospitality Group.

Noah’s conversation had some great points about the importance of good partners (his spanning 20+ years with Jason Strauss), longevity, and the ability to run the race at pace. He talks about building properties to ‘feel classic’ and to hold mass appeal.

I started my career as Noah’s Creative Director when it was still Strategic Group, with 11 employees. We had Marquee and Tao and were expanding to Vegas. It was 2005. Over the next 20 years, Noah would go on to build an empire, now operating over 85 properties globally.

Noah understands the business of hospitality more than anyone I’ve encountered. Professionalism in a stereotypically ‘unprofessional’ industry is a core part of his brand. Nightlife is populated with characters, driven by celebrity, spectacle, and plays in the realm of vices. The level of business acumen and professionalism with which TAO GROUP operates is rare in the space.

“One bad deal is more work than five good ones.”

- Noah Tepperberg

A great point is made on singular focus. He’s spent his career focused on being the best in a very difficult industry rather than managing DJs, dabbling in VC investments, real estate, or other distractions. You don’t get to the top in hospitality without that kind of focus.

E.L.F ACQUIRES RHODE FOR $1BN

E.l.f. announced last Wednesday that it had acquired Hailey Bieber’s Rhode for $1 billion. The sale is a masterclass in celebrity founder involvement, knowing one’s audience, investing in marketing, and having a TIGHT product offering without too many skews.

Rhode did $212 million in net sales with only 10 products in a market where celebrity-backed beauty brands have been in decline. Consumers have started to see through celebrity products, especially in the beauty space, being more skeptical of involvement or authentic interest in beauty.

This is not the case with Rhode. Hailey invests in and has been nailing marketing, pop-ups, $1MM vending machines, and the iconic iPhone case, which became a patented revenue stream.

Her husband is currently cheekily requesting permission to tweak it as a joint case.

Let's hope E.l.f. understands the ROI on this and doesn't gut the marketing budget post-acquisition. To their credit, the brand acts with agility despite being 20 years old and publicly traded. This acquisition is said to have happened in a matter of weeks.

Rachel Stugatz notes in her puck article both the speed and significance of this deal, rumored to bring Hailey $800 million at closing (a combination of cash and stock) with a potential earnout of $200 million based on Rhode’s performance over the next three years.

Stugatz also digs into the ongoing and upcoming rivalry with Selena Gomez’s Rare, which may have missed its exit window last year and is about to experience very real competition as Rhode enters Sephora.

BUSINESS AND MARKETS

"To do nothing at all is the most difficult thing in the world, the most difficult and the most intellectual."

- Oscar Wilde

Only three months after the chaos of Liberation Day, we are close to re-testing all-time highs. Closing out May, the S&P 500 officially posted its best month since November 2023, rising +6.2%.

Last week's court's reversal on tariffs helped the market look past the trade war uncertainty narrative. If investors feel the economic turbulence of ‘Liberation Day’ is in the rearview, it could spur further capital flow back into assets.

The Trump administration has also set a firm deadline of July 8th for negotiations, with tariff pauses ending in 36 days. Countries have been urged to submit their best offers by Wednesday. Trump is also set to resume conversations with China on Friday.

Gold and Commodities surged over the weekend and into the week, reacting to Ukraine’s unprecedented drone attack on Russian Air Force bases.

“Russia's Pearl Harbor," one of the most devastating attacks on Russia in history, is causing the markets to price out a peace deal that Trump had been working on for 3+ months. The U.S. didn’t even make an official statement of any kind for three days. It took until June 3rd for the White House to say President Trump was NOT informed of Ukraine's attack in advance.

The Fed continues to hold on to rate cuts. This week, Federal Reserve Bank of Atlanta President Raphael Bostic said Tuesday that he expects one interest rate cut this year and that inflation is still hot. A long pause on rate cuts continues.

HOUSING

More than $330 billion worth of listings have been sitting on the market for 60 days or longer, putting total unsold inventory at a record (close to 700bn). I’m seeing constant price reductions on my Zillow searches, but the mortgage rate is still TOO DAMN HIGH.

20% of mortgages in the US are higher than 6%, the highest share in 11 years. We're starting to see capitulation as people let go of their low-rate pandemic-era 3%’s. If this accelerates, we could see an increase in supply. We are currently at a 5-year high; Redfin shows there are currently 500,000 more sellers than buyers, the most on record.

Hopefully, we will see prices fall further soon.

EAST COAST SUMMER RENTALS SLOW

Robert Frank wrote about the icy summer rental market with Hamptons rentals down 30%. At the highest end, the rental business is down 50-70%

A reversal from how much the market heated up post-COVID.

TECH & SCIENCE

The most interesting thing about AI last week wasn’t the model or product development. It was the announcement of two partnerships with the leading creative minds of our time.

Jonny Ive’s partnership with Open AI & Rick Rubin’s collaboration with Anthropic.

Technology is meant to improve our lives. Ive accomplished this initially with the products that came out of his tenure at Apple (iPod and iPhone), a product of optimism around technology’s capabilities he feels Silicon Valley may have lost. Ive mentioned that he feels the burden of the negative effects of some of his products.

“When I first moved here, I came because it was characterized by people who genuinely saw that their purpose was in service to humanity, to inspire people and help people create. I don’t feel that way about this place right now,”

“Many of us would say we have an uneasy relationship with technology at the moment.”

-Jonny Ive

Let's hope Ive can bring a human perspective to the table. Last month, Ive sold his hardware startup, io, to OpenAI for $6.4bn. He’ll assume creative and design leadership across both businesses. It’s OpenAI’s biggest known acquisition yet, and brings them into the hardware game.

In the same timeframe, Rick Rubin and Anthropic launched "The Way of Code," a digital book with 81 Tao-inspired meditations and interactive AI art.

In April, I wrote about Rick’s conversation with Aravind Srinivas, CEO of Perplexity. Rick showed a genuine fascination with vibe coding, finding overlaps with his own creative process and asking genuinely deep questions to Perplexity’s LMM.

A master of cultural pulse, Ruben is riding the AI wave well, through a humanizing lens, democratizing and showing the potential for a much wider aperture of people to use the technology. Vibe coding perfectly suits Rick’s production approach, encouraging interaction with technology through intuition rather than technical know-how.

"I'm the record producer who doesn't know anything about music.

So the idea that there could be a coder who doesn't know anything about coding — that's vibe coding. It makes sense."

Rick Ruben

These were refreshing in the midst of a lot of AI doomerism.

The AI news cycle sees a constant barrage of gloom, from statements weekly on risks and job displacement to fun musings like "The phases of collapse in the age of AI."

Last week, Anthropic CEO Dario Amodei said AI could wipe out roughly 50% of all entry-level white-collar jobs within 5 years, causing unemployment to spike as high as 20%.

“Most of them are unaware that this is about to happen,

It sounds crazy, and people just don’t believe it… We, as the producers of this technology, have a duty and an obligation to be honest about what is coming.”

Dario Amodei

The counterpoint to job displacement is that it has happened before with every major advancement phase in human history. The difference is that this time, it’s happening orders of magnitude faster.

Before the industrial revolution, 60% of people worked in agriculture. Automation in factories, railroads, etc.; we have been here before, so it’s essential to weigh benefits alongside this. As an example, automation in food prep could reduce the cost of food by 50%

Other alarming AI developments:

Anthropic’s New Claud 4 Opus model results in blackmail to avoid replacement.

An advanced open AI model was caught sabotaging code intended to shut it down.

RADIENT MICRO REACTOR

Mars is hard. Out of the pursuit to colonize, we continue to uncover and create new problems to solve. Like how to refuel on a planet with no fuel, so ships can return home?

It’s possible. Vaporize water through a bunch of hardcore sciency stuff, eventually creating Methane. Compress it, put it in tanks, and you got fuel–but all that requires a ton of POWER. Solar’s out, you’d need multiple football fields, and the process of dusting them off non-stop and the technicalities of setting them all up make it impractical in the short term.

Enter Doug Bernauer, CEO of Radiant Nuclear, an eleven-year SpaceX veteran who left to solve this problem. He’s building a mobile nuclear reactor from scratch that is the first NEW U.S. reactor design in over 50 years. It is designed to power our efforts on Mars, among other things.

Radiant just received a $165 million Series C funding round and was one of five companies in the United States to receive high-assay, low-enriched uranium (HALEU) fuel for testing.

Trump's recent nuclear Executive Orders are another major catalyst for the company and the nuclear industry at large.

If you're into the nerdy shit Notboring has a great DEEP DIVE.

STARSHIP’S NINTH FLIGHT TEST

Starship Heavy saw its 9th flight test last week, achieving a milestone of the reflight of a Super Heavy booster. I still vividly remember watching the first time Space X landed a Falcon 9, changing space flight forever by proving the possibility of reusable rockets.

Overall, the mission did not fully succeed, ending in “rapid unscheduled disassembly” of what was supposed to be a controlled "hard splashdown" in the Gulf of Mexico.

It’s also important to admire the feat in the sheer scale of this rocket. The starship is 6-9 times larger than a Falcon and has 33 Raptor engines. Humans are barely even visible in photos shown for scale. The fact that we have figured out how to launch that thing into space, then CATCH it on the return and re-use it, is incredible.

Musk is so volatile and disliked across the media spectrum that the launch gets mired in politics. So, a lot of media positions it as a failure, but it was the most successful burn to date. Rockets are hard. Commercial flight also operates on a ‘fail fast’ model that is very unlike NASA’s past 75 years.

Despite this, SpaceX has a lower failure rate (~0.41% for 490 launches) compared to NASA’s historical 5–10% rate, though NASA’s missions often involve more complex objectives.

Another fun watch: SpaceX’s newest multiplanetary video

STUDIO

A look at the process this week, I’m working on a larger format continuation of my floral series. This is the largest one yet.

This is the path it’s on, the original smaller work which inspired this series.

More of my Life & Process of painting here.

- That’s it for this week.