WEEKLY INTAKE - 19. 2025

HBS SPEAKERS. AUCTION PERFORMANCE. CONTENT CREATORS AS CULTURAL AMBASSADORS. GEN Z ISN’T DRINKING THE COOL AID. COINBASE ENTERS S&P. UBER. AIRBNB. SAUDI TRIP. MAKING GOLD. SPACE HOTELS.

“Develop into a lifelong self-learner through voracious reading; cultivate curiosity and strive to become a little wiser every day.”

— Charlie Munger

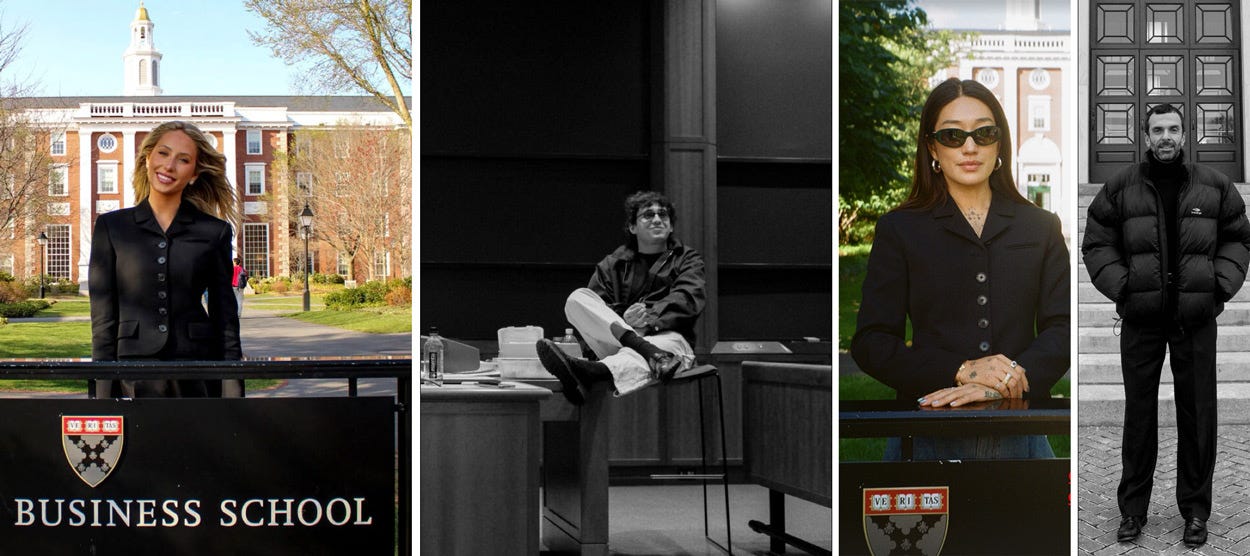

HBS SIGN PHOTO AS THE NEW BLUE CHECK MARK

Speaking at Harvard has long been an indicator of 'making it,' but mainly for the world of traditional business and academia.

Harvard has made a smart pivot, allowing its student leaders to choose who speaks and expanding the guest list to many who don't have degrees but have built amazing businesses through hustle or other nontraditional means.

Showing up at HBS has now become a coveted clout move among famous and high-profile entrepreneurs. See WSJ's 'Celebrities' Toughest Get: An Invitation to Harvard Business School'

It's smart, as many of today's most prominent businesses have been started by dropouts or people who never even went to school.

“Business school students are inherently risk-averse because we chose to get a second degree…

Hearing from people who have been courageous enough to take unconventional paths throughout their lives is very important for business school students to hear, to unshackle ourselves from what we’re supposed to be doing as opposed to what we want or could be doing.”

Nikole Naloy, 25, an M.B.A. student

Harvard's expanded aperture on invited speakers has included Marcello Hernández of "Saturday Night Live," who addressed the entertainment club. Alix Earle is a representative of influencers building business empires (one of her investments, Poppi, recently sold to Pepsi for $1.95 billion). Cédric Charbit of YSL and Lauren Hill.

Nightlife has had a strong presence, and Noah Tebberberg and the TAO group have been giving presentations on the business of nightlife for years. This year, Juriël Zeligman and the Gospel team also gave a presentation on their business, as did Rampa of Keinemusik.

“You can’t afford to exclude a significant and growing part of the business world just because these individuals arrived by a different route than a traditional M.B.A.,” said Tammy Smulders, who graduated from HBS in ’99 and now runs the creative agency Trends&Culture.

HBS is now trendy–maybe it always has been, but it's now drawing a celebrity crowd. Anita Elberse's "The Business of Entertainment, Media, and Sports" is a $12,000 short 4-day intensive class attended by CEOs, entertainment moguls, and A-list celebrities. Executive-level business school is as much about 'who else is in the room' as the lessons taught.

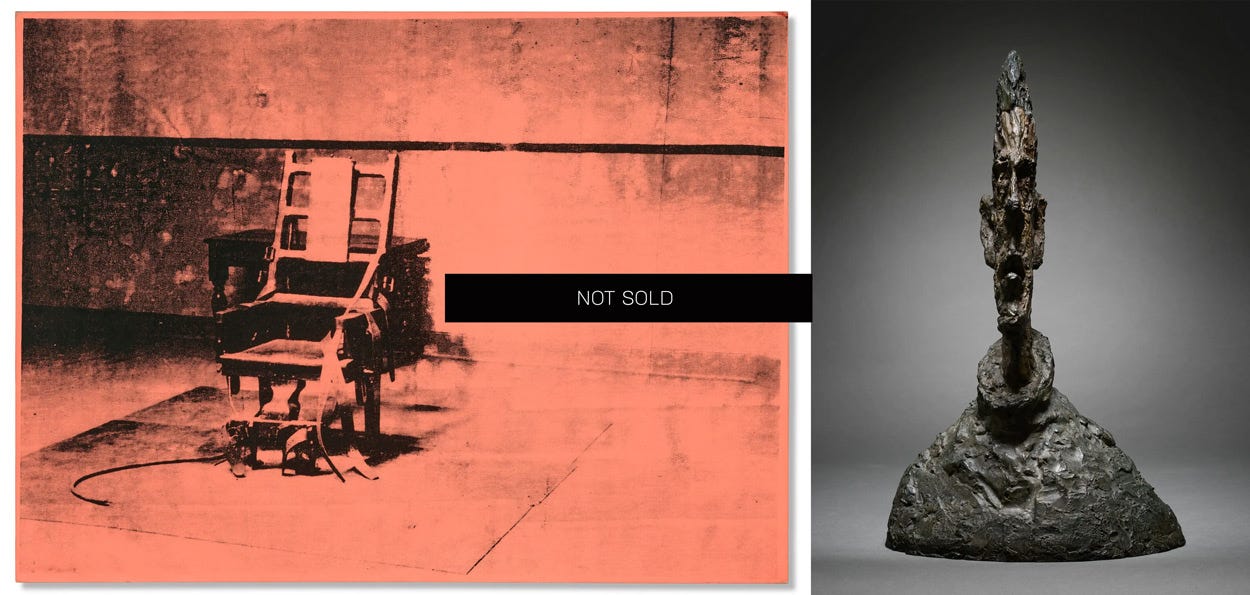

GRIM AUCTION PERFORMANCE

Last week was the Super Bowl for the art world: spring auction week.

This season fell short of its lowest targets; Christie's, Sotheby's, and Phillips all underperformed their own estimates. Blue Chip Art flopped and was actually pulled without selling. There were four minutes of awkward silence as nobody bid on a $70 million Giacometti bust, which failed to sell at Sotheby's. WSJ ran a whole podcast episode this week on the 'bust.' Christie's pulled a $30 million Warhol painting mid-sale when they realized nobody would pay its asking price.

Art sales at the highest level are a good indicator of a high net worth temperament. If there's a general austerity movement across America, the high net worth equivalent of belt-tightening is not bidding at auction.

There is also a disconnect between the attempted pricing by auction houses and what the market is willing to pay. During Frieze week, cultured wrote, 'Have the Prices for Art Gotten Too Damn High?' There are only a few hundred people globally who can purchase pieces north of $50 million, and those tend to be able to stomach market turbulence. These people have the money; they're just not valuing the product at the asking price.

“We saw estimates not reflecting where the market was, but reflecting what the auction house’s agreement was with the consignor.”

- Natasha Degen, the Chairwoman of Art Market Studies at the Fashion Institute of Technology

As results from the fairs come in, there is a softening and question over the return on investment for galleries to participate. At the high end, sales were slow for TEFAF, and the Chicago Expo fair was worse. A few galleries actually no-showed, as there were empty booths (Revolver Galería's).

What is selling is less expensive art, and a lot more of that is transacting. NADA and Entitled saw this. I like this; it means emerging artists and mid-level artists are getting love. Those sitting on old masters are stuck holding the bag. This is also an indication of taste: As younger collectors step into the market, old masters don't seem to be what catches their eye.

For a more unhinged but in-depth look at the art market, check out Kenny Schachter's "Flip Flop - a blow-by-blow recap of recent market mayhem.'

SCHNABEL’S SKATEBOARDS

It's not new, but I came across the film on them this week. In 2023, Schnabel revisited his iconic Big Girl / Blind Girl series by re-painting them as a series of triptychs on decks. These were then skated on by professional Eli Reed and his son, Scooter Schnabel. The tear and subsequent textures work; the idea is great in taking something so valued and defacing it but actually pushing the art further in the process.

The editions were sold through Taschen with a numbered copy of his book. While the boards are sold out, you can still get the book.

AARON STERN’S LONDON SHOW

My friend Aaron Stern continues his curatorial tour, this time in London with Webber Gallery, overlapping with the Photo London and Offprint book fairs.

This is the second time I've seen Ephemera presented in a week, the other being the Available Works Book fair this past weekend at WSA. I had a sliver of time this weekend and decided to use it for painting, but one of our designers went to the fair and gave it an A+ rating.

Aaron had a hard truth in his recent newsletter:

Often, artists make their best work when they’re young. Maybe they’re fearless. From judgment, failure, peers, legacy, heartbreak, and lifestyle creep. No distractions like a child, divorce, or a sick parent to take care of. Probably no mortgage, rent, or credit cards.

The verdict is out on this, but the battle for free time is real as responsibilities mount. This is a personal struggle for me, finding time for it all.

CONTENT CREATORS AS OUR CULTURAL AMBASSADORS

America's greatest export is entertainment.

The rest of the world may have a declining perspective on a lot else about us, but they love our content, movies, music, video games, and now our YouTube stars.

We've been at peak social media for, let's say, 5 years now, with COVID being the gasoline on the fire. 'Youtuber' has surpassed astronaut and movie star as the top job aspiration for Gen Alpha, with more than 30% of 12 to 15-year-olds surveyed listing it. It makes sense, as it's more conceptually attainable. Stars are close in age and the internet's endless obsession with niche can allow anyone to break out, even though the odds are stacked.

Take Ishowspeed, who began live-streaming video games on YouTube at the age of 12 nearly a decade ago. He now has over 80,000,000 fans and is a global powerhouse. Hasan Piker, a progressive streamer for the manosphere, who garnered 7.5 million views during election night coverage, labels speed as "America's greatest cultural ambassador."

Content creators are now making as much content as possible and producing content on the same level as movie and pop stars. (We'll leave OnlyFans out of this as that's societally depressing).

Kevin Hart and other 'old school' A-listers are taking note, and the smart ones are joining streams to promote and capture these massive audiences. Kevin has appeared on multiple Kai streams.

Justin Bieber recently released promotional imagery of Kai in a Serifa-esque aesthetic to promote his new brand, Skylrk.

What I've noticed recently (in the past six months) is that the production scale is on another level. It's UGC on steroids. Edglrd, Harmony Korine's experimental creative agency, has developed a whole revenue stream around high aesthetic, mind-blowing content for creator superstars.

ProdCO, a production company most associated with big multi-million dollar commercial budgets, has begun producing content for streamers at that level. This is NEW.

It seems to have started when Kai dropped movie trailer quality materials for his marathon streaming of the Batman Arkham video game series, which he recently 1-upped with his streamer academy announcement:

The business of all this is in the paid subscriptions, with 106,160 active paying subscribers on Twitch, and Kai is the No. 1 most-subscribed livestreamer. CNBC estimated that Kai's past subathons have generated $3.6 million from tier 1 ($4.99) subscriptions alone. Add in his 12 million YouTube subscribers, and you can see how the production value is paying off.

The trailer for Ishowspeed's Fatal Fury is another example of the extremely high production value and VFX-driven content that is now being released.

This represents a massive shift in how the next generations are consuming content. Big-budget, long-format films are struggling, while high-speed YouTube content of short duration is killing it. When I visited Syracuse, I remember being struck when students told me they don't have TVs in their apartments, they watch everything on tablets and phones. I've written extensively on YouTube's growth as a media platform, soon to surpass Disney as the number one streaming platform.

This, for the time being, is the future of content.

GEN Z ISN’T DRINKING THE COOL AID VS ‘EVERYONE’S REPLACEABLE’

An unstoppable force is meeting an immovable object.

There is a friction point coming to a head this year—a shift from employee to employer control, butting heads with a younger generation's sentiment on work-life balance.

Trade wars, job market softening, AI, and return to work have coalesced into a different environment than the 'quiet quitting' soft era coming out of COVID when we were at record-low unemployment. With jobs harder to find, there is less air for complaints.

"Everybody's Replaceable (WSJ)" is a noted sentiment shift across the executive landscape, a contrast from the talent wars of the aughts, which had companies hoarding talent, and literally providing free lunch.

Companies are facing headwinds from sales declines and an overall much more competitive marketplace across many industries. This is emboldening executive language to say a lot of the quiet part out loud:

“Work-life balance is your problem.”

Emma Grede, co-founder Skims

JP Morgan's CEO, Jamie Dimon, went viral with his hot-mic'd internal meeting, calling out everything from people's level of attention on Zoom calls to return-to-office resistance:

“I’ve been working seven days a week since Covid, and I come in, and…where is everybody else?”

- Jamie Dimon

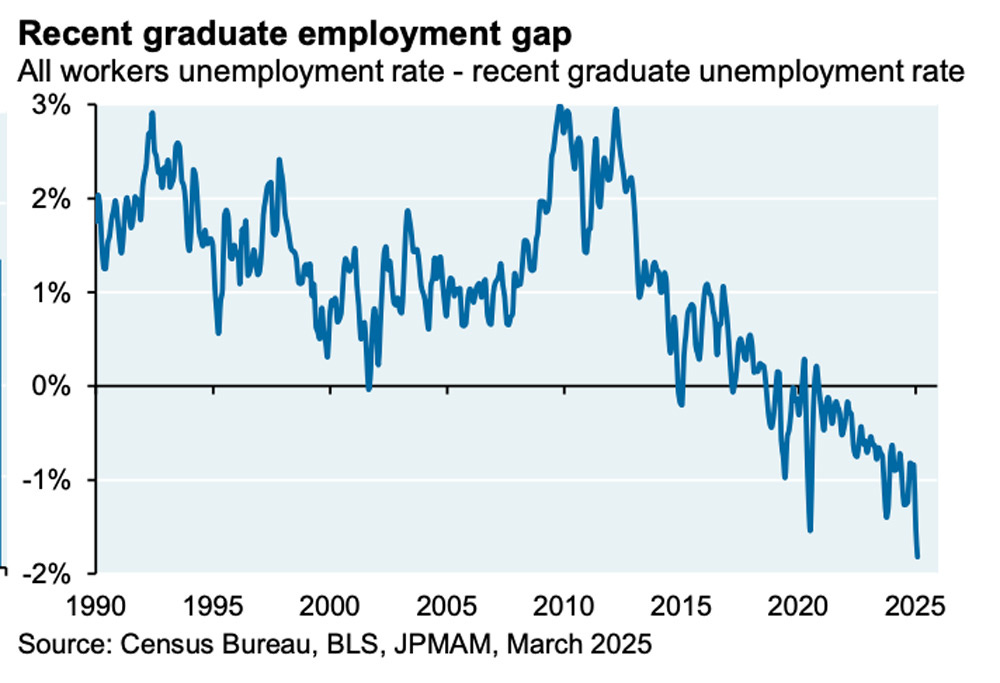

Much of this is coalescing around Gen-Z; they're having a hard time finding work (Atlantic), keeping jobs, adapting to professional expectations, and convincing business leaders they are not lazy. Michael Cembalest's most recent Eye On The Market for J.P. Morgan shows an alarming trend; for the last 30 years, the recent graduate unemployment rate was below the average rate, meaning it was easier for recent grads to get jobs, but it recently flipped.

There are many factors, but generative AI is playing a role in taking on routine grunt work that was going to junior-level employees. Entry-level white-collar tasks like reading, data analysis, producing reports, and building decks can now be done faster with AI. CEOs are assessing efficiency, which ultimately means pausing headcount or reducing staff.

A real-world example of this is J.P. Morgan's winding down of its hiring spree, recently telling managers to 'resist' hiring, and do more with less. Marianne Lake, the CEO of consumer and community banking, said advancements in AI would enable a reduced workforce, especially in fraud prevention, operations, and payment processing. 10% was a conservative estimate.

There has always been a pendulum, heavily tied to the unemployment number. A market turnaround and a tighter labor market could put power back in the employees' hands, but when there are 1,000 applications for a single tech job opening, that upper hand is gone.

Kate Whalen has a compelling article examining counterpoints to Gen-Z being 'lazy'. TLDR they're just not into the same career paths as previous generations. I find my experience somewhere in between here. I've seen wild expectations from young kids, and I've seen incredible dedication and work ethic. I'd imagine every generation had a similar range.

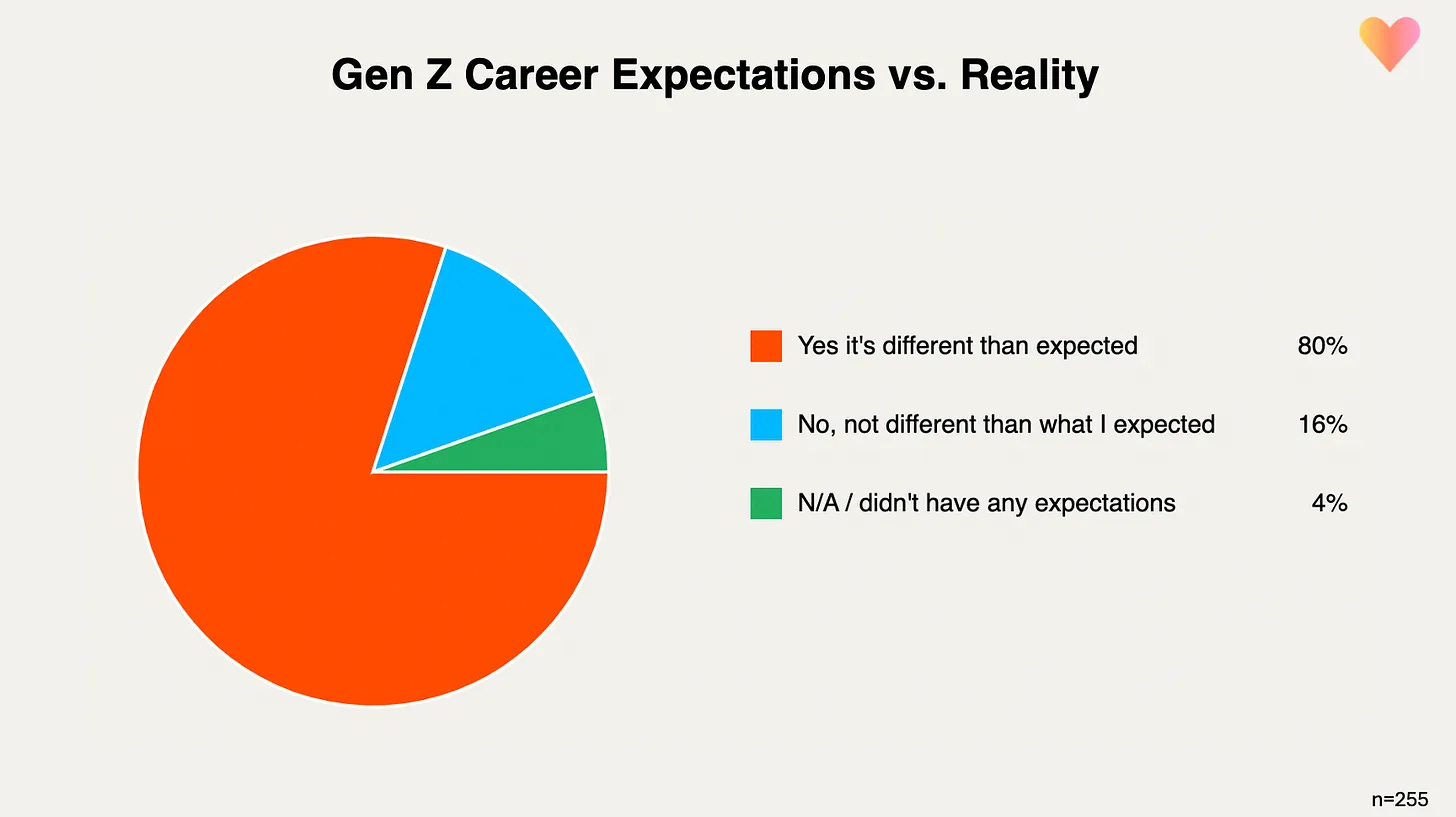

Starting with a survey, of a small sample size, with admirable global reach (28 industries and 21 countries) Kate brought some nice charts to the table.

A general theme seems to be a misalignment between expectations and reality.

QUE WEALTH GAP SUMMER

On the subject of expectations, reality, and the danger of trying to keep up, I-D's 'Wealth Gap Summer' exposes the dangerous time of year when overspending becomes most apparent: vacation. It's one thing to over extend over multiple nights out, dinners and drinks, it's another thing entirely when trips to the Maldives drive FOMO.

KreditKarma ran a survey in 23' - Gen Z and Millennials are losing friends over money:

88% of millennials and 80% of Gen Z have gone into debt after having spent time with a wealthier friend

31% of Gen Z and 32% of millennials had at least one friend who drove them to overspend.

47% of Gen Z and 36% of millennials had considered ending friendships due to their friends’ spending habits.

Transparency can be the most refreshing, it sounds trite, but at 42, I’m all about open conversations on money, vs when I was young, I felt really obligated to overspend to be at all the things. Looking back, I’d honestly rather have invested a significant amount of that money.

BUSINESS & MARKETS

The big items this week: America losing its Triple-A credit rating, Outcomes of the administration’s Saudi trip, BTC hits an all-time high, and a ‘Big, Beautiful, Tax Bill’.

Credit ratings grab headlines, but markets shrugged this one off after about five minutes. It's happened three times in the past twenty years, with this Moody's drop being the last of the three major assessors to remove our AAA status.

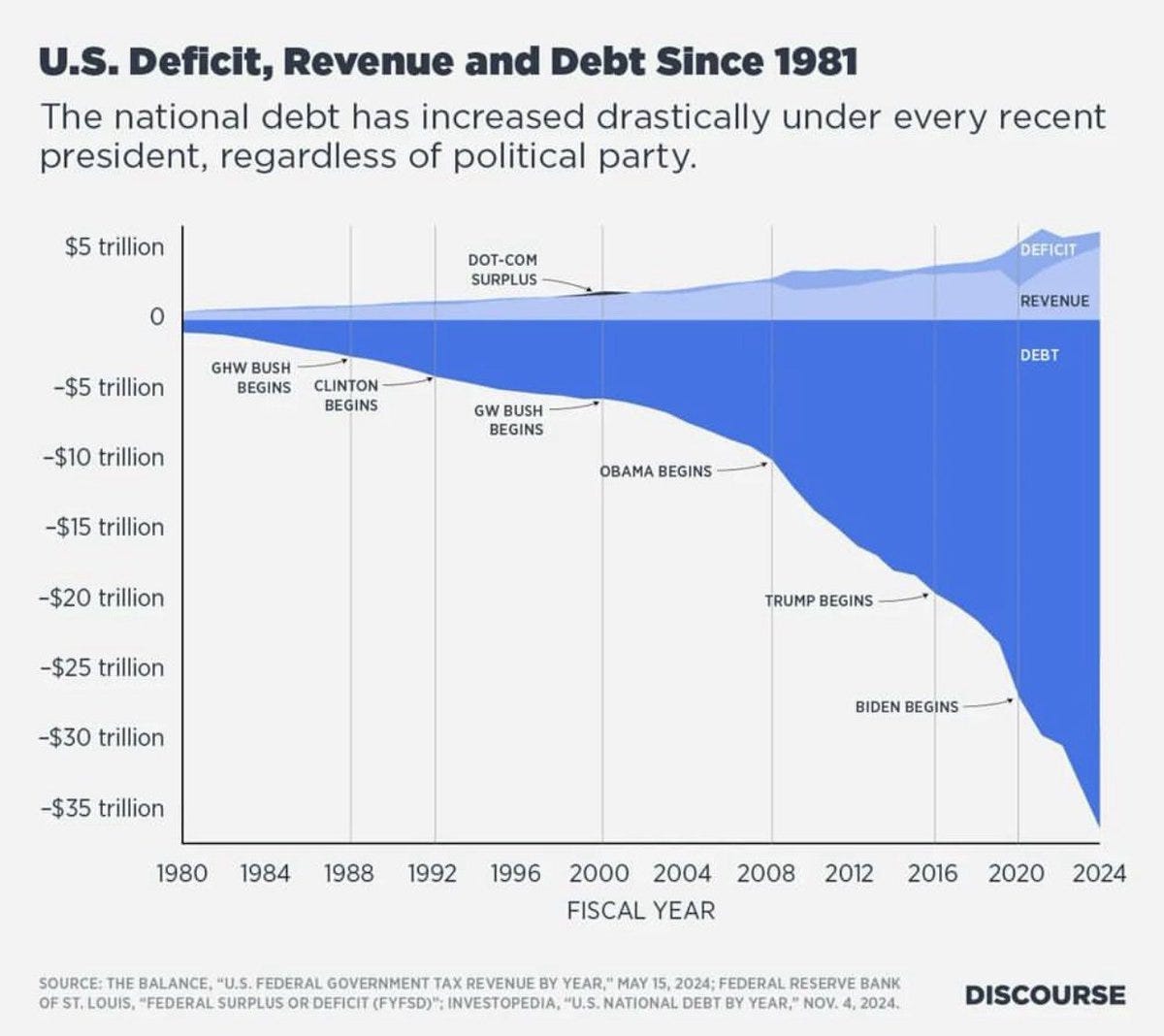

Citing an increase in debt for over a decade, and “interest payment ratios to levels that are significantly higher than similarly rated sovereigns”.

Standard & Poor's 2011 downgrade was a more meaningful one, being in the middle of a debt ceiling crisis, causing the S&P to fall over 6% in a day, being the FIRST U.S downgrade, and ultimately influencing the Budget Control Act.

Ramifications this time are in the form of continued upward pressure on treasury rates, meaning our mortgage, credit card, and other interest rates remain high (the 30-year mortgage jumped back over 7%).

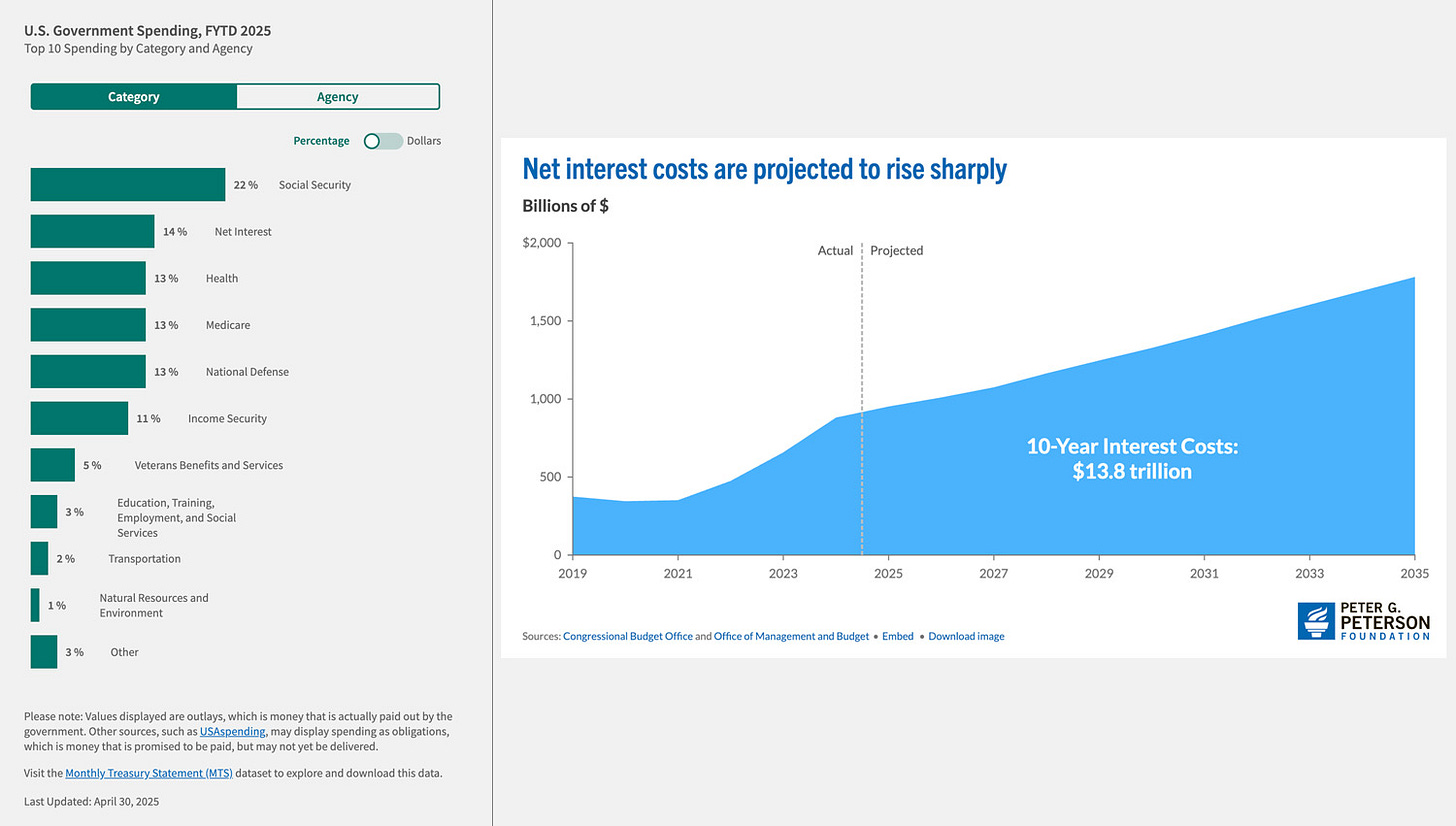

What's concerning is that the lower the rating, the more our deficit is increasing, which is driving interest payments to now be our second-largest spending item, YTD. In 2024, we spent $892 billion on interest. If we don't get our debt down, interest payments will grow exponentially.

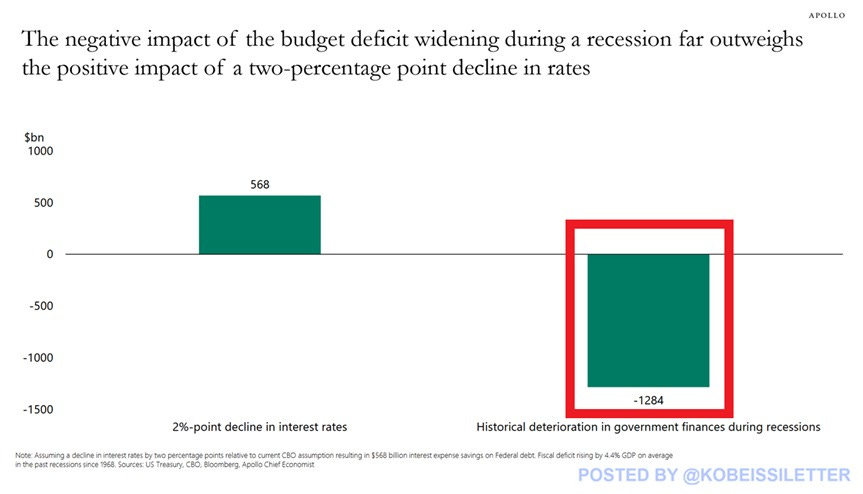

This is the ongoing sparring between the administration and the Fed. There has been much hypothesizing that Trump may actually WANT a recession.

The issue concerns the danger of deficit expansion during recessions, outweighing the positive impact of rate decline. Typically, the way governments navigate recessions is through massive spending programs. So what's worse, high interest rates, or an even larger deficit?

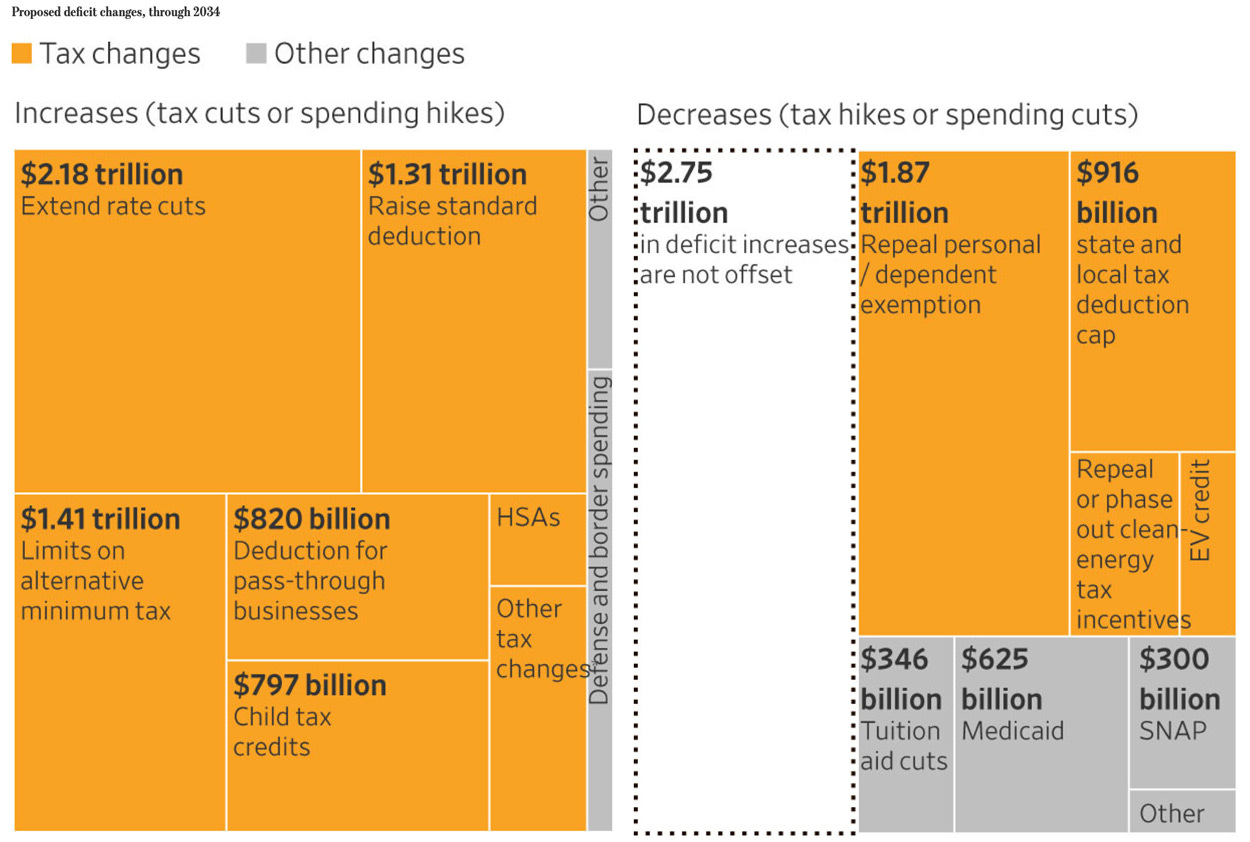

How bad is the debt? This chart gives a good look at the iceberg:

WHICH LEADS TO THE BIG BEAUTIFUL TAX BILL

Narrowly passing the house Thursday morning after last-minute changes, this bill divides his own party. Some conservative lawmakers withheld support, citing criticisms around the estimated $3.2 trillion to $3.8 trillion added to the federal deficit over 10 years, mainly due to insufficient spending reductions.

Trump is one of the largest deficit-spending presidents, with a first-term cumulative deficit of $8.33 trillion (second to Obama's $8.6 trillion). This new bill's expenditure may push him to #1.

Democrats' opposition centers around cuts to Medicaid and other programs supporting low-income households. A Multimillion-dollar advertising campaign is being readied for the midterms to paint the bill as a further giveaway to high earners and corporations.

RETAIL CONTINUES POURING CAPITAL INTO THE MARKETS

Through all of this turbulence, retail has held fast.

In fact, retail is breaking records. On May 19th, it accounted for 36% of trading volume, exceeding the previous record last month. Palantir and Tesla were the two biggest purchases during this period. Single stocks are also seeing more purchase flow than ETFs.

A few weeks ago, I wrote about this evolution of 'dumb money'. Anthony Pompliano's recent article points to the individual investor catching up to institutions as it pertains to intelligent investing and less emotional trading.

He cites examples such as retail beating institutional money to bitcoin (the best performing asset in 15 years), exploiting leveraged imbalance in Game Stop, buying the 2020 pandemic dip, and pretty much every single dip since then.

We have access to information and new tools. Robinhood changed the game; as a result, pretty much all platforms now offer free trading.

“Smart money” missed a lot of this rally. 38% of institutional investors were underweight US equities in early May, the lowest since May 2023, according to BofA.

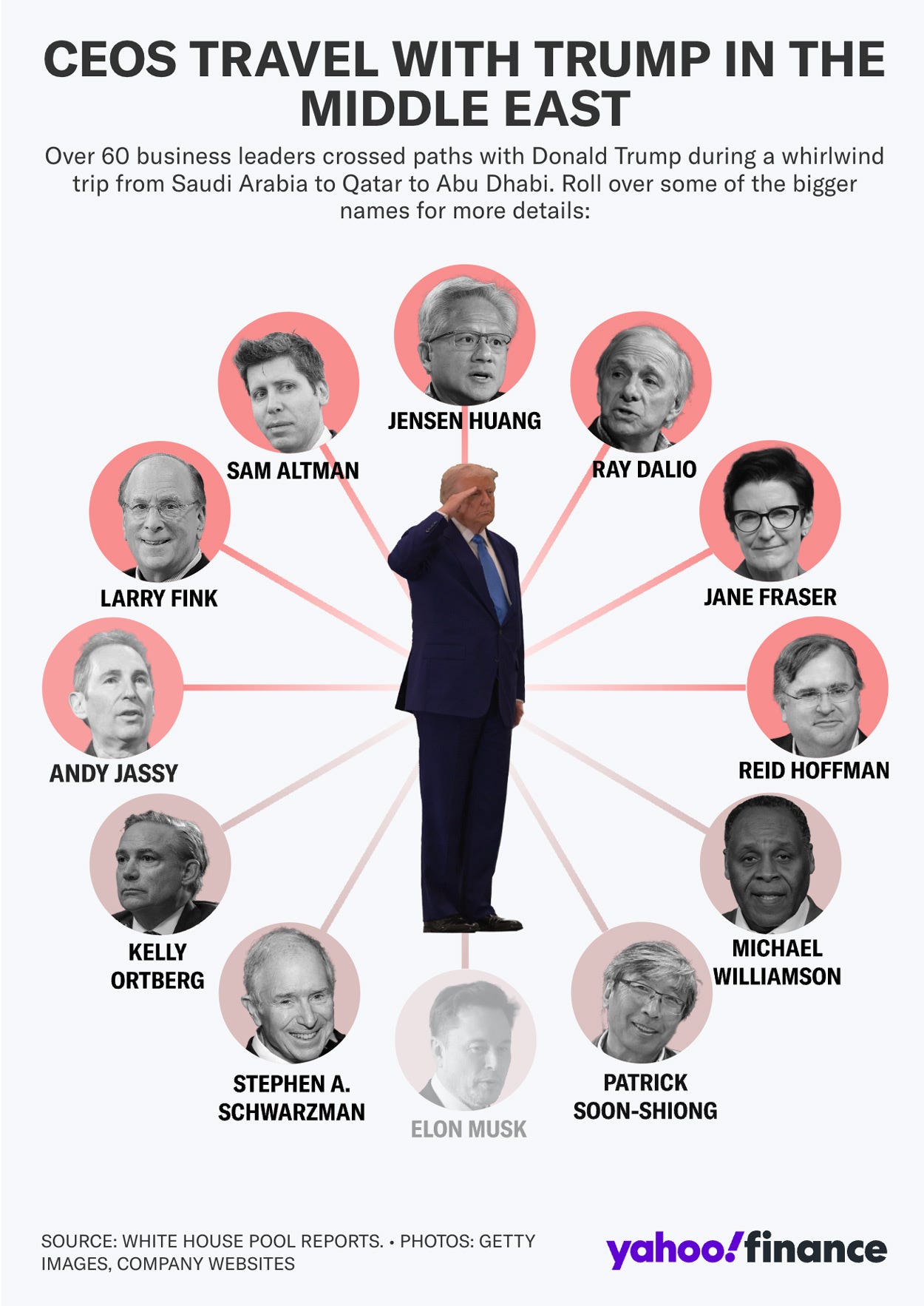

SAUDI TRIP

I've listened to and read a lot across many sides on this trip. The region is a minefield of political and humanitarian sentiment, but the scale of influence is monumental.

Four billion people live within 1,000 miles of Saudi Arabia.

America's visit to the region was a spectacle vastly different from Biden's three years ago, when he was not greeted at the airport by any of the kingdom's major leaders. Trump was given a fighter jet escort, 21 21-gun salute, and was met at the airport by Crown Prince Mohammed bin Salman.

Trump claimed that he was able to secure deals totaling more than $2 trillion from the trip.

While the numbers will be questioned until they materialize, it's substantial. Even the BBC acknowledged that "investments mark a continuation of the shift in the US-Gulf relationship away from oil-for-security to stronger economic partnerships rooted in bilateral investments."

The presence of NEW American companies and their CEO's, representative of tech, energy, aviation, and defense, was interesting. From Sam Altman to Elon Musk and many others present, it was clearly an indication of AI being a major theme. This played into the region's strategy to leverage today's oil money to build future industries, making them less reliant on the product.

Some examples:

Jensen Huang (NVIDIA): Secured a deal selling 18,000 Blackwell (GB300) AI chips to Humain, a Saudi-backed AI startup.

Andy Jassy, CEO (Amazon): Partnered with Humain to invest over $5 billion in an "AI Zone" in Saudi Arabia, including AWS AI capabilities and skills training for 100,000 Saudis.

Raytheon (RTX): Secured a $1 billion agreement for Qatar to acquire counter-drone capabilities (FS-LIDS), the first international sale of this system.

Elon Musk (SpaceX): Secured approval to provide Starlink satellite internet in Saudi Arabia. Neuralink announced a clinical trial deal with Abu Dhabi's health ministry for brain chip implants.

One of the biggest winners of the trip was Boeing, securing its most significant order ever for its widebody planes, with a $96 billion order from Qatar Airways.

THE QATARI PLANE GIFT WAS A MAJOR DISTRACTION

A lot of this was overshadowed by a gift from the Qatari royal family, a plane intended for the Air Force One fleet estimated to be worth $400m. Trump seems to continuously not be able to help himself with blatant personal advancement, whether it's meme coins or airbuses.

What's got many people upset is twofold. First, the plane will go into Trump's presidential library at the end of his term. Second, the cost to refurbish the plane to meet the security standards of a president, a process that could take years and cost close to $1bn.

There are massive security risks here as well. This plane is massive; hiding a small amount of explosives or thousands of listening devices is not a difficult feat. Allowing a somewhat nefarious foreign nation to build our president's plane is akin to when we allowed Russia to build our U.S. embassy at the height of the Cold War. In that instance, we found so many bugs inside the embassy that we had to abandon it and rebuild another from the ground up.

On May 21st, the Secretary of Defense confirmed it would accept the plane.

This is a shift from isolationism, which had been considered core to his 'America First' platform. More of an end to interventionism, which has been our approach to the Middle East for nearly 30 years. It is also a counterweight to China's influence in the region. Over the past decade, it's estimated that China has invested $200 billion to $270+/- 270+/-billion through its Belt and Road Initiative.

Trump has not brought up any of Saudi Arabia's human rights violations. He also skipped Israel on this trip.

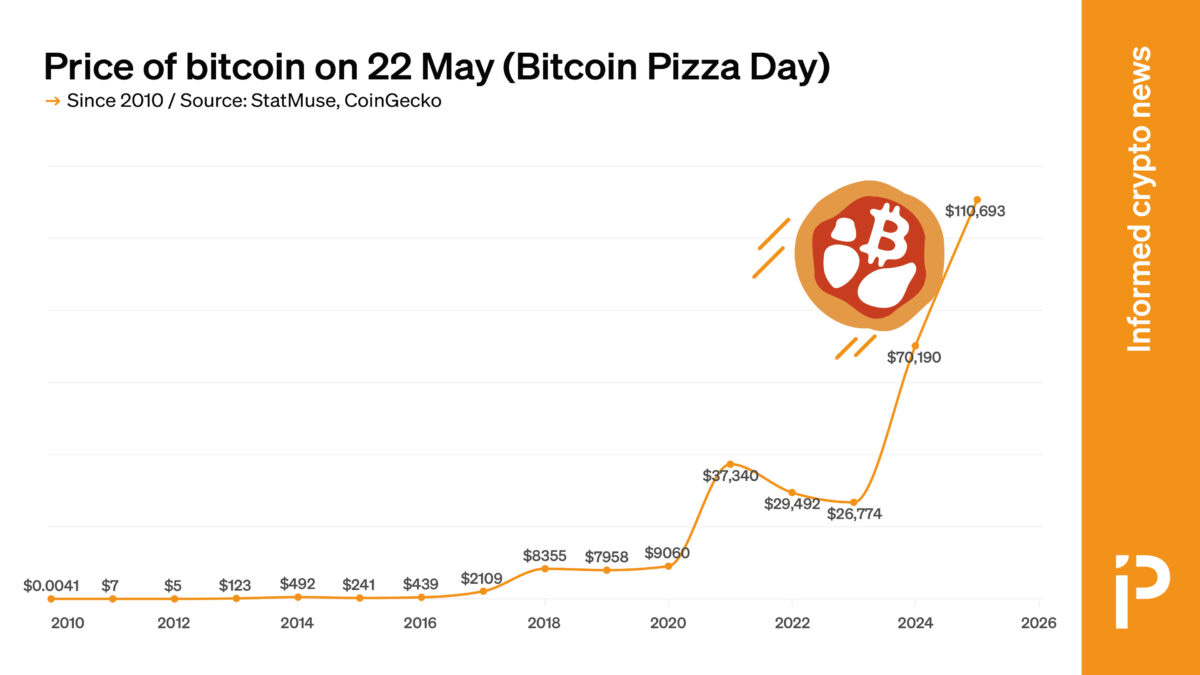

BTC ALL TIME HIGH INTO CRYPTO DINNERS

BTC hit an all-time high on Pizza day, which marks when Laszlo Hanyecz spent 10,000 BTC (worth $1.1 billion today) on two pizzas from Papa John's.

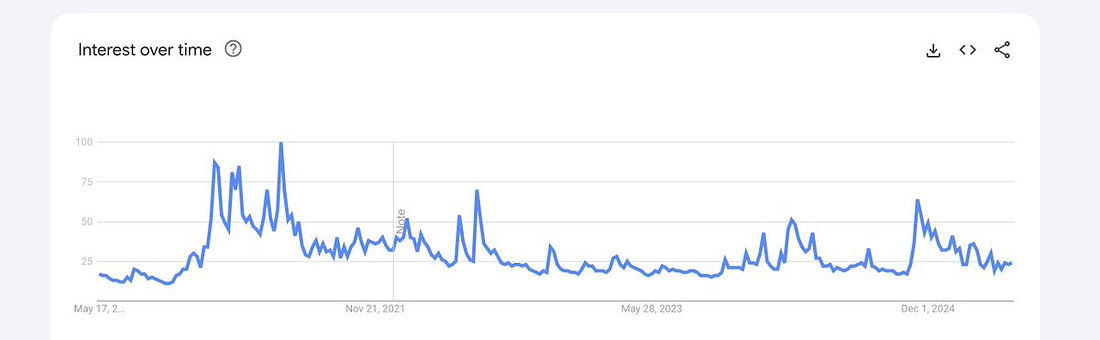

Something interesting about BTC's run this time is that it's almost entirely driven by institutions, who are steadily DCA'ing billions onto the chain. Through this massive rally since its fall to $75,000 a few weeks ago, Google search volumes are essentially flat:

Tonight, Trump will host his meme coin crypto dinner for top holders of his infamous coin. Investors spent an estimated $148 million on the $TRUMP coin to secure seats and a private tour of the White House.

Chain data is showing some pretty much expected things: the majority of dinner guests are not American (more than half bought the coin in foreign currency), and almost half have gotten rid of their holdings, whether by selling the coins or transferring them to different wallets immediately after last week's snapshot.

GD Culture Group, a Chinese company with no revenue owned by the same people that own TikTok, bought $300,000,000 worth of $TRUMP Coin.

Nothing to see here.

COINBASE ENTERS THE S&P AND PULLS NO PUNCHES

There is an irony in Coinbase replacing the tradfi Discover Financial as it enters the S&P. This is another point of legitimization for the asset class at large, another being BTC hitting a new all-time high this week.

If you own S&P, you now own Coinbase. That’s a lot of retirement accounts; Coinbase will be roughly 0.13% of that composition.

The same week, the company revealed a security breach that affected nearly 70,000 people. The event occurred on December 26, 2024, but was not discovered until May 11, 2025.

It wasn't a hack but rather the recruitment of customer-support agents to gain access to user data. The data included names, phone numbers, addresses, account balances, government documents, and transaction histories. All of that material can be used in social engineering campaigns for fraud and extortion.

The plot twist is that after receiving a $20mm ransom note, CEO Brian Armstrong took to social media to refuse to pay the ransom, instead offering the same amount to anyone with information leading to the arrest of the hackers—very FAFO.

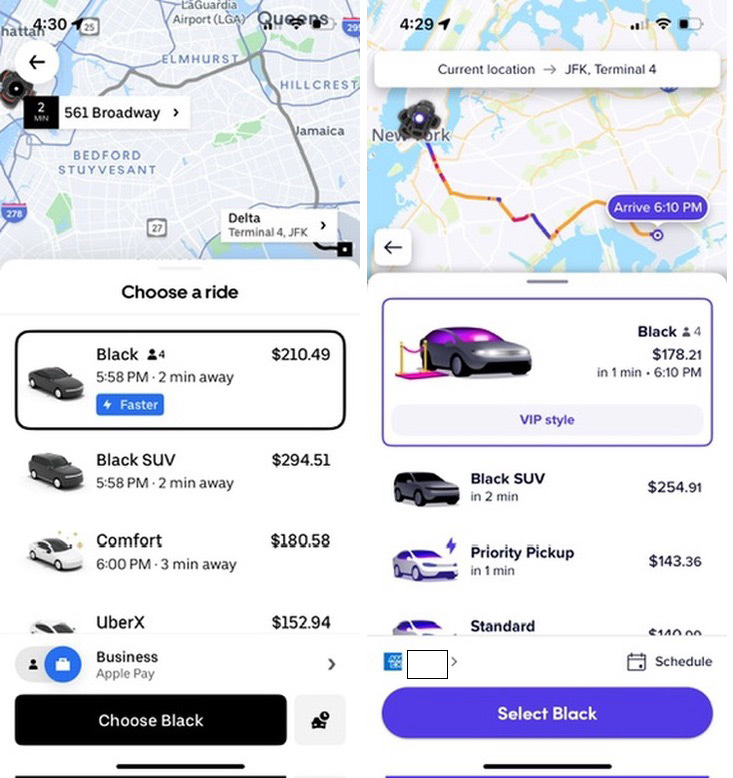

UBER

It's been a threat story for a long time now. From whether they could survive post-Travis to the implications of COVID, stay-at-home mandates, robotaxis, and tariffs. Uber continues defying the odds and innovating.

It sits at an all-time high, being one of the top five performing stocks in the S&P year to date (oscillating between 3 and 4). It's far more expensive than its competitors, and it's not going anywhere.

J.P. Morgan just gave it a positive target, speaking specifically about their partnership with Alphabet's Waymo and the impact self-driving can have on the business. 2025 seems to be the year autonomous driving becomes a reality. Waymo is No. 1 on the list of the World's 50 Most Innovative Companies of 2025.

![[Illustrations: <a href="http://www.tobyleigh.com/tobatron.html">Tobatron</a>] [Illustrations: <a href="http://www.tobyleigh.com/tobatron.html">Tobatron</a>]](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F6cf30900-2be4-4d92-8f32-541536ac17ad_3840x2160.webp)

I was amazed to see the number of Waymos in San Francisco recently, sitting outside at a restaurant, they come by in packs, it feels like they outnumber normal cars.

I don't find Uber to be a superior product; it's just a superior business and branding. A Delta partnership convinced me to switch to Lyft two years ago; it really racked up MQMs. Over that time, I found Lyft was pretty much always cheaper, not by a little, but by a lot.

Lyft cars are the same (often better), and the drivers drive for both, so how does Uber command an often 50%-1.5x price difference? Brand. Many people probably just default to it, have corporate accounts, and don't even bother to check Lyft. That's a superior brand in play.

That Lyft-Delta partnership just ended, with a new deal in place…with Uber.

In the last month, the stock has gained 25%

AIRBNB ENTERS THE EVERYTHING MARKET

Last Tuesday, Airbnb's Brian Chesky's keynote, followed by an interview with WSJ, provided a look into the future of the business as it expands into an 'everything app'.

The new app will expand services from professional chefs, local tour guides, celebrities, and experiences available through its platform. Airbnb has not just dominated its category; it has defined it. There was nothing like it before what has now become a verb.

This expansion is smart, but one hurdle is luring business travelers and people accustomed to hotel services, such as laundry, room service, and other amenities you don't currently get from the platform.

“It’s like, ‘I’d like an Airbnb, but at the hotel I can get room service, I can go to the spa, I can go to the gym, it’s that insight that tells us if we offer services, it fills up some of that gap.’”

Ellie Mertz, Airbnb’s chief financial officer

It also allows for continued expansion, as they have pretty much tapped the market for short-term rentals, opening up new revenue streams and ways to be sticky for their customers.

Planned amenities fall into three categories:

Services: such as spa treatments, personal training and hairstyling can be booked even if not staying in a property.

Experiences: tours, cooking classes, access to local artisanal crafts.

Airbnb Originals: Unique events with "the world's most interesting people," including celebrities and professional athletes.

This is a doubling down on the experience economy, something I’ve been writing a lot about. Airbnb sees experiences potential to add $1b in sales, their cut of those sales is between 15% and 20%

Chesky himself is an experience; he occasionally rents a room in his own home on Airbnb, providing freshly baked chocolate chip cookies for guests.

TECH AND SCIENCE

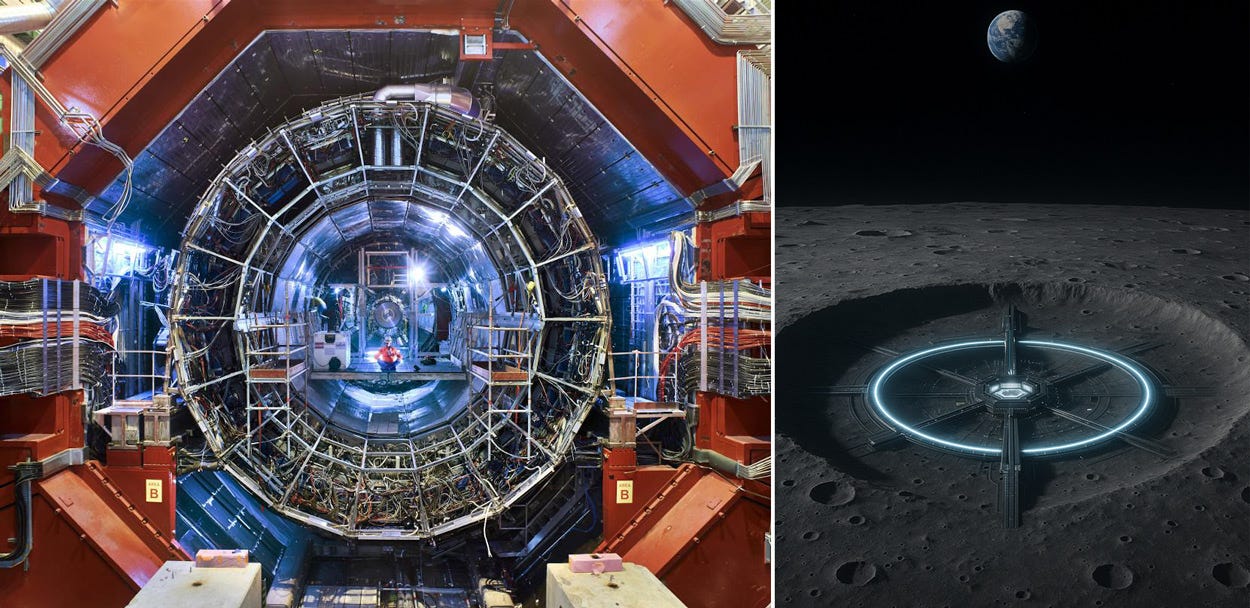

ALCHEMY

We made gold, alchemists rejoice.

What Isaac Newton believed possible, CERN has confirmed. As of May 2025, lead can be transformed into gold, not through mysticism, but through immense power, precision, and a lot of money.

Creation occurred at the ALICE experiment, a massive multinational project part of CERN. It is so large that it spans two countries (Switzerland and France). ALICE is also responsible for creating Antimatter.

While the amount produced was microscopic, the fact that it can be done opens immense possibilities. It's all about scale. As we get production costs down and build more colliders, this could allow the mass production of one of the rarest materials on earth. We dream big, with plans to build a particle accelerator on the moon that could reach 1,000 times the output of any on Earth.

GOOGLE PRODUCT SHOWCASE

At the annual I/O keynote, Google introduced some groundbreaking tech. Gemini apps now have more than 400 million active users. Deep Research will update to allow users to upload their own PDFs.

Live Translate has been integrated directly into video conferencing, allowing near real-time translation. It has some room for improvement, as there is lag and some inconsistencies, but when working properly, this will be a game-changer.

Veo 3 video, the first in the space, generates audio with text prompts, bringing us closer to bridging the uncanny valley. The lip sync and expressions are much more dynamic than anything I've seen yet.

TechCrunch has a full breakdown of all the announced products and updates.

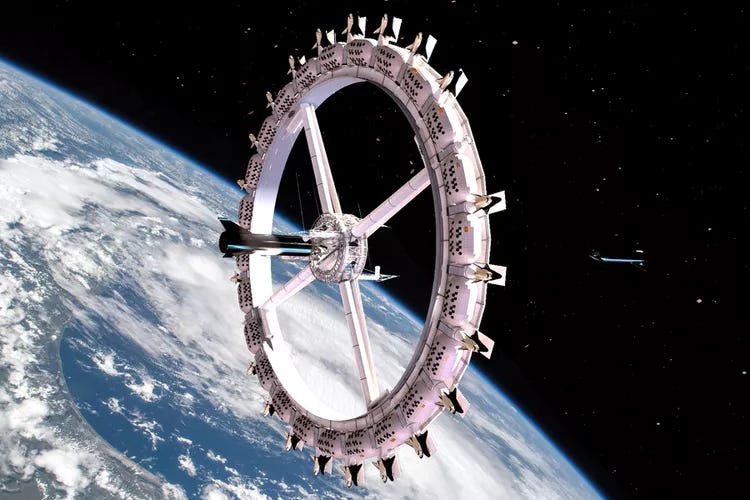

VOYAGER STATION

Concept art is becoming reality, and it is no longer on a far-out time horizon; this is real, and it's two years away.

Voyager Station, developed by Above: Space Development, is set to launch in 2027 as the world's first luxury space hotel in low Earth orbit.

Its rotating wheel design, spanning 125,000 square feet across 24 modules, will simulate lunar gravity, accommodating 400 guests and 112 crew. The station will feature luxury villas, restaurants, a cinema, a spa, and a gym, with construction starting in 2026. Backed by a NASA agreement and potential SpaceX collaboration, it aims to make space tourism accessible, with initial trip costs of around $5 million, decreasing over time.

BOOKS

The Everything War came to my attention from Dana Mattioli's guest appearance on The Compound and Friends. The book is a deep exploration of Amazon's ruthless growth quest, talking to hundreds of people to paint a picture on how they grew from books to everything.

- That’s it for this week.

Thanks for this Matt!