WEEKLY INTAKE 18

THE BUSINESS OF LARGE SPACES. SPRING IN NYC / ART WEEK. ROSE BAR TO RETURN. ZUCK IS RAW DOGGING LIFE. CERTAINTY RALLY? AI LANDSCAPE. FAA CRUMBLING. SPIKE LEE’S BACK.

THE BUSINESS OF LARGE SPACES

NY Magazine's feature on the creative repurposing of large commercial spaces post-COVID has breathed new life into vacant floors and archaic spaces.

Something I know intimately from our investment in HERO and everything I've learned across operating a 13,000-square-foot venue that used to be a post office. From modular, tech-enabled venues to artist studios, these spaces fill urban voids while landlords seek long-term tenants.

Silver Arts Projects, has transformed 28 floors at 4 World Trade Center into artist residences and studios, leveraging tax incentives like NYC's Cultural Space Subsidy Program. These are great temp space uses while landlords try to occupy the floors long term, as artist studios don't need much more than raw open space and a slop sink.

CoStar reports that experiential companies—think Meow Wolf, Mercer Labs, and HERO—leased a record amount of space in 2024, up 90% from 2023. This was fuelled by landlord incentives and urban revitalization efforts in areas like Seaport, Wall Street, and Midtown.

Other ventures started bringing different ways to look at vast spaces. Gyms got larger, and kids centers like Space Club and Cocoon have been expanding to multiple locations. Large footprints also allow optionality in business models. With more space to work with you can create ranging revenue streams. Hero, for example, is extremely modular, allowing us to do a mix of seasonal ticketed events that utilize the entire space while also converting to a flexible venue between seasons that can be used in various formats.

Then came Printemps, which opened a massive retail experience a few months back as a bold defiance to the struggle of department stores (rip Barney's). Abundance of space is core to this brand, with a restaurant, wild design in the retail, a raw bar, and a coffee shop all part of the experience.

This met a need at a time when landlords were not filling these spaces; as return-to-office trends pushed rent rates up 12% in Q1 2025, it will be interesting to see if these business models are sustained.

SPRING IN NYC / ART WEEK

New York's social and cultural landscape was at its peak last week and continues. Last Monday's Met Ball seems far in the rearview after a week packed with multiple fairs (over nine), events, and openings across the city. Frieze week has turned this city on. The overlap in programming and social activity created a beautiful spring kick-off for NYC.

The Met Ball is so overcovered, the only thing that really interested me this year was Tyler Mitchell’s 30-page catalog and accompanying essay. That felt like a real mark in history, where a lot of other stuff feels so overtly 'brand.'

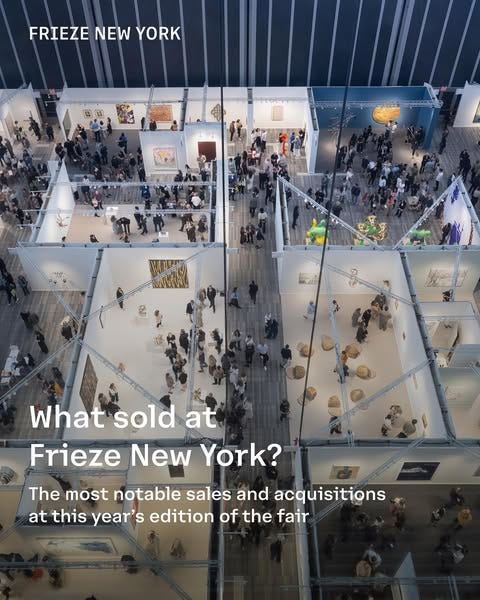

Recent art reports and news of the market's overall slump have put a lot of attention on the fairs. Pricing would have a lot to do with it, into the week Cultured ran an article on whether prices got too high.

At the highest price scale, TEFAF reported 'slow but steady' sales, with less of a feeding frenzy and more 'people taking their time'. There were fewer objects at the fair priced higher than $10 million, and several blue-chip galleries brought in some of the youngest artists on roster to appeal to a more youthful demographic. Gagosian, for example, brought works by their youngest represented artist, the painter Anna Weyant. Some pieces sold, but the gallery did not comment on the price.

Despite this, notable sales included Lisson Gallery's Sean Scully painting, Wall Tappan Deep Red (2025), selling for $500,000 and David Zwirner selling out a booth of Ruth Asawa's works.

Moderately priced works moved, and that's refreshing as it shows emerging artists getting attention and a share of the pie.

Frieze just posted a recap on their side of what moved:

The Independent fair benefitted from being 'priced right', with a third of the works ranging from $10-20k. This is a departure from last year, which had significantly higher prices; it worked as sales apparently did very well. Independent has become the alternate, hyper-curated (invite-only) alternative to the mega fairs, also showcasing a lot of artist solo debuts. Observer has good overarching coverage, as does the NY Times with their top choices of standout booths.

People seemed to appreciate NADA's new location in a larger space at the Starrett Lehigh building; it IS hard to get that far west in the rain, though.

Alongside the fairs, there were some amazing gallery openings, "Half Way Home" by Los-Angeles based Austyn Weiner being a must-see during its run at Lévy Gorvy Dayan, New York (Through June 21). I'm loving these paintings, the palettes especially.

We Are ONA brought the third and final installment of their partnership with Alexandre de Betak to WSA, overlapping the week. This iteration was with Chef Sho Miyashita of Paris's Haikara Izakaya. A lot of friends went; it looked artfully chic. This series will run through the 15th, so there is still a chance to go.

Available works - rare books will also return this week.

Art books, posters, ephemera, and more—presented by Something Special Studios.

Opening night:

Friday 16 May · 6–9PM

WSA, 180 Maiden Lane, Floor 39, NYC

ROSE BAR TO RETURN

Feedme with a bit of news that was new to me, and I can't seem to find anything else on: Rose Bar to be coming back.

Nur & Danny Meyer to bring it back. MCR Hotels acquired the property out of bankruptcy in 2023, taking a 99-year lease (Very Hong Kong style). There is VERY LITTLE online information on this; I'll dig around and report back.

Nur is a Legend. No better way to put it.

Hands down some of the most epic projects I was fortunate to work on in this city were the Rose Bar Sessions Nur did back in 2010-13. Guns N' Roses, The Cure, Black Keys, all performing in a living room with a 200-person capacity. NYC needs a venue like this again.

These pre-date social media, the energy was incredible, as a result, no one was on their phones.

Black Keys - Rose Bar Sessions

MARK ZUCKERBERG IS RAW DOGGING LIFE

Drinking coffee on vacation, recreationally.

Mark is a real wild Boi. His recent podcast with Theo Von proves his publicist has one of the hardest jobs out there, normalizing him.

His answer for the rise of loneliness? Replacing your friends with AI chatbots.

Citing that the average American has fewer than three friends but desires around 15 meaningful connections, Zuckerberg sees a massive and unmet demand for personalized companionship. AI companionship is normalizing, with over 10M people reported having "meaningful relationships" with AI in 2023. By 2025, that number jumped to 20M.

People are going to AI for therapy substitution, dream analysis, relationship coaching, medical and financial advice, and other deeply personal services.

The concern is just like social media, dependency, is more profitable than curing loneliness. These agents will be designed by corporations with teams of psychologists making them as 'perfect' as possible to increase interaction (aka profit). Attachment will = Value.

There are some good twitter threads digging into the use cases and watch outs.

Theo is part of the 'normalize' or reach a wider audience podcast circuit. Timothee Chalamet, Ben Affleck, and even Trump navigated his platform, coming out looking relatable on the other side. Zuckerberg, not so much, delivering awkward silences and bangers like:

“You want your car to have almost as much horsepower as your helicopter!”

When talking about his underground tunnel underneath his Hawaii compound, he made the important distinction that 'it's not the big of a tunnel.'

Rounding it all out with the iconic exchange between Zuck and Von, he is "Raw Dogging life."

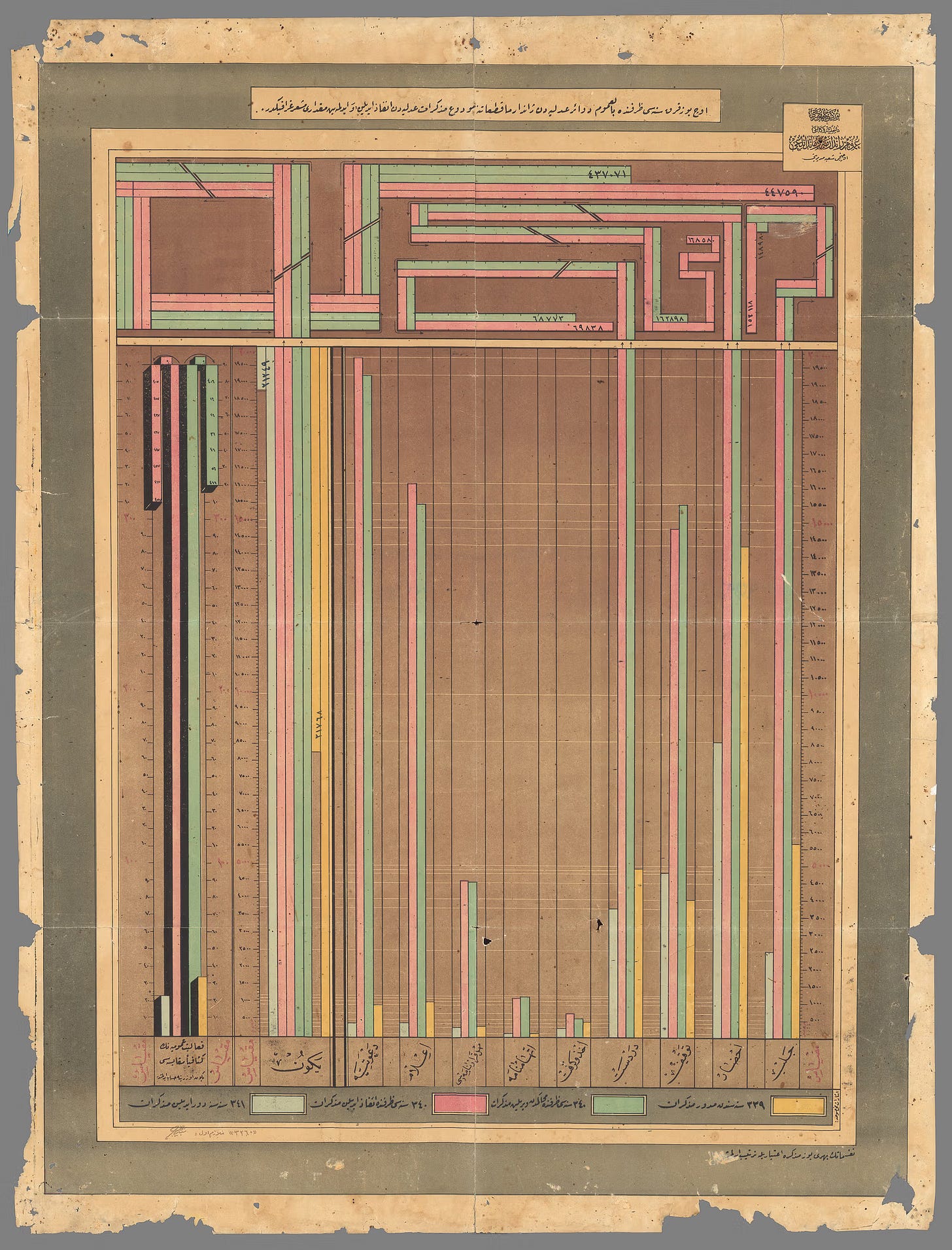

PRADA DIAGRAMS EXHIBITION

I love data visualization; it can and should be chic. I have books on the history of infographics. I loved Nicholas Felton's reports (until Google hired him in-house to make their reports). He later got a show at the MOMA.

Fondazione Prada’s latest exhibition with AMO/OMA - “DIAGRAMS”:

Seeks to foster dialogue and speculative reflection on the relationship between human intelligence, scientific and cultural phenomena, and the creation and dissemination of knowledge.

Pictures being worth thousands of words.

MARKETS AND BUSINESS

WILL CERTAINTY BRING A MASSIVE RALLY?

Markets recovered to pre-'Liberation Day' numbers earlier last week, prior to any trade announcements. Since the April 7th low, the S&P 500 is up 17%. Major announcements could set up a big rally with any positive news, and Risk Appetite is skyrocketing.

Concessions and deals on the trade front are starting. On Thursday, Trump announced a trade deal with the UK, followed with a softening stance on China tariffs:

I wrote this on Sunday evening, waking up to the positive news of trade negotiations with China over the weekend. Both countries have agreed to cut "reciprocal" tariffs by 115% for 90 days. Bringing U.S. tariffs on Chinese goods down to 30%. Chinese tariffs on U.S. imports will be at 10%.

Markets are responding extremely positively to this.

Crypto markets are running again. And so is the grift, FT found that a group of anonymous traders made $99.6 Million purchasing the coin hours before it was announced. To be exact, and blockchain data helps here: 24 separate wallets bought $2.6 million worth of $MELANIA two and a half minutes before it was publicly announced. Those wallets sold 81% of their coins in the first 12 hours after launch.

It's unfortunate this gets attached to the overall market, as it allows for a continued narrative around scams. Trump's family profits from crypto are estimated to be $2.9 billion due to crypto investments (about 40% of his net worth). This gave multiple senators reasons to vote against stable coin bills proposed last week, citing the administration's entanglements as reason for opposition to new legislation.

Trump's "Crypto & AI Innovators Dinner" is $1.5 million per plate and features President Donald Trump and venture capitalist David Sacks. Then there's his meme coin dinner, exclusive to top 222 holders of Trumpcoin, which pumped the coin 66%, coincidentally right before his lockup period ended. It's also made over $100 million in trading fees. Concern is around unanimous holders who can buy access or leverage over Trump, those could be foreign nationals or state-backed.

GOOGLE BEATEN UP. OVERSOLD?

Last Friday, Google saw a 9% drop after Eddie Que, Apple's SVP of Services, testified in court during Google's antitrust trial that searches on Google via Safari last month fell for the first time in 22 years. Google losing search to AI is the story here, with Apple exploring AI-powered search engines in Safari as an alternative to Google and a general shift in user behavior to AI queries.

Search makes up 56% of Google's overall revenue, but its profitability probably makes up for closer to 80-90%, as it's one of Alphabet's most lucrative revenue streams. AI is undeniably a threat to search, but I don't think it's an existential threat to Alphabet.

What will hurt, is if the $20b a year contract Google has with Apple to be the default search on all phones, becomes banned as a result of the antitrust trial.

Google has been beaten up, it's now sitting at a 17 price to earning, vs the S&P sitting at roughly 26. It's not like Google isn't heavily invested in AI either–last week they committed to roughly $75 billion in Capex this year, mostly in data centers and things adjacent to AI.

Yes, AI will cannibalize search revenue, but innovative product design can keep people within their ecosystem. AI integration into Google calendar and E-mail for example. Imagine being able to ask Gemini "Give me a list of everyone I've met with over the past 5 years but haven't spoken to in a while, where are they working now and what is their contact info'.

YouTube is another amazing place for AI integration. It could combine videos, create new clips that answer more complex questions, or abbreviate long forms to the most relevant parts. The use cases are deep for YouTube.

This is an innovator's dilemma: Successful companies can fail by focusing on sustaining innovations for existing customers, while disruptive innovations from new entrants capture emerging markets and eventually displace them.

Prof G Markets made a great point about the history of breakups; they often work well for shareholders.

The breakups of AT&T in 1984, Standard Oil in 1911, Hewlett-Packard in 2015, General Electric from 2021 to 2024, and Kellogg's in 2022–2023 significantly increased shareholder value by enabling focused business strategies, reducing inefficiencies, and unlocking undervalued assets in their respective successor companies.

AMAZON ROBOTICS AND KUIPER PROJECT

Some interesting developments in Amazon’s technological advancements surfaced over the past week.

First, they launched the first satellites for their Kuiper Project, a $10 billion investment and intended StarLink competitor. At 27 satellites, Amazon is miles behind StarLink, which has 7,400 operational satellites, but it is important that someone provides competition in this space. We don't want a single entity controlling 82% of the world's satellites.

Amazon could use 'Prime' as a Trojan horse into the race if they bundle internet service with existing Prime subscriptions. As of early 2024, 75% of American adults have a Prime subscription.

Amazon has also developed a robot with a sense of touch, Vulcan. Its primary use is product fulfillment in warehouses, where it can go into boxes and pick out specific items. The development is a milestone in overall robotics, providing delicacy in grip and a higher degree of control over object manipulation. Robot co-workers continue to be a major focus of Amazon, increasing concerns around automation and job displacement.

AI ACROSS BUSINESS LANDSCAPE

The general thesis right now is Adapt, Evolve or Get Left Behind.

Eric Schmidt has made some bold statements across several panels in the past month. In a conversation with Jeanne Meserve, host of the NatSec Tech podcast, some things stood out. AGI is closer than we thought:

“Within three to five years we’ll have what is called [artificial] general intelligence, AGI, which can be defined as a system that is as smart as the smartest mathematician, physicist, artist, writer, thinker, politician… you get the idea,”

Eric Schmidt

AI systems are becoming self-improving and capable of planning, raising significant implications for their autonomy. He warned that when systems reach a point of self-improvement, society must consider "unplugging" them to mitigate risks.

The stage after AGI is artificial superintelligence (ASI), this is when AI becomes smarter than all humans put together.

The technology isn't "overhyped" but rather "underhyped" because people largely don't understand the scale of change and the speed of change it will bring.

Concerns about China's rapid advancements in AI and biotech, noting their significant resource allocation and centralized approach. He stressed that the U.S. needs to act swiftly to counter this, advocating for increased research and development.

Automation of Rote work is coming for fintech.

Michael Batnick and Callie Cox talked this week about the declining need for financial analysis. There is time-consuming research that AI can absolutely augment, but humans who can find the connections and themes in that data are needed. So it won't be a full replacement, but we'll probably see firms not needing 50 analysts anymore. Five recent grads with ChatGPT can do the work that used to require 20.

Blackrock's Aladdin is an example of where this technology can go. It is a comprehensive investment management platform, risk analytics, and trading all in a single system that influences $21 trillion in assets (more than the GDP of the UK, Japan, and Germany combined).

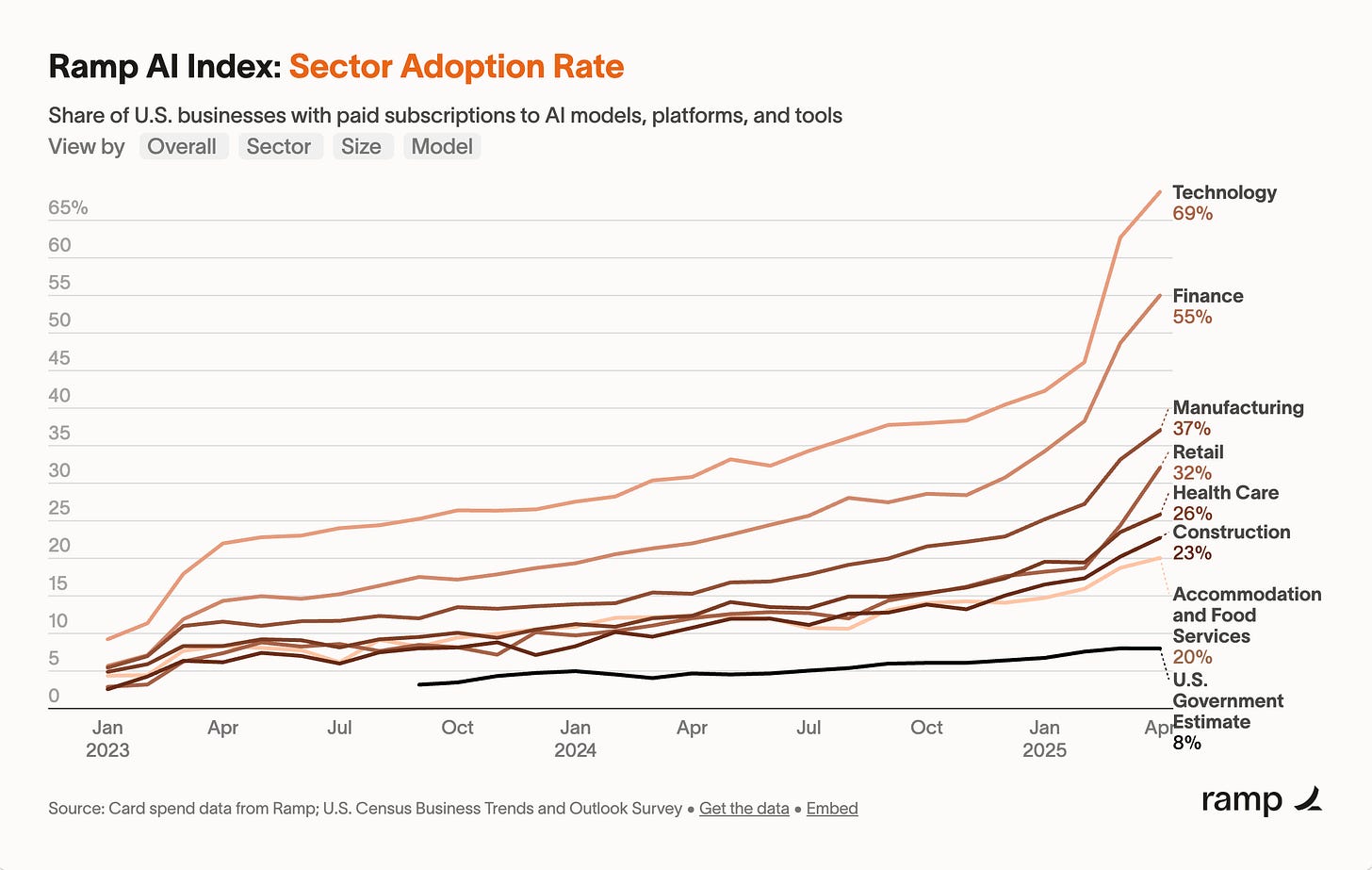

Adoption

Ramp's AI index has some interesting stats on adoption by sectors, size of business, and what models are most subscribed to. I found it interesting but not surprising how far behind the government is to AI adoption vs the overall landscape. The government is incredibly slow to adapt to new technology; New York's subway is running on 100-year-old analog systems and our Air traffic control is using floppy disks.

Rote process work is where the shift is happening first, vs. areas that require human-to-human skills (sales) or critical thinking. IBM is using AI agents to remove roles in HR and reinvesting that money to programmers and salespeople.

In the past few weeks several CEO's have tried to get ahead of internal memo leaking by taking to social media to openly address the necessity of AI adoption. In many instances, aligning adoption with hiring freezes, encouraging staff to learn tools before asking for more resources.

First, Shopify CEO Tobi Lütke published on X what was intended to be an internal memo on the necessity of employees adopting AI. He posted the lengthy directive on social media because "it was in the process of being leaked and (presumably) shown in bad faith."

“Using AI effectively is now a fundamental expectation of everyone at Shopify.”

Fiverr followed with slightly more alarmist statements; Micha Kaufman, CEO, said the quiet part out loud: "So here is the unpleasant truth: AI is coming for your jobs. Heck, it's coming for my job, too. This is a wake-up call."

“If you do not become an exceptional talent at what you do, a master, you will face the need for a career change in a matter of months. I am not trying to scare you. I am not talking about your job at Fiverr. I am talking about your ability to stay in your profession in the industry,”

Micha Kaufman, Fiverr CEO

EVERYONE IS CHEATING THEIR WAY THROUGH COLLEGE

What is the line between a new tool and cheating? Where does AI empower and where does it dumb us down? An entire generation of college students are grappling with this. NY Mag's intelligencer has a feature: "Everyone is Cheating Their Way Through College". Two months after OpenAI launched ChatGPT, a survey found 90% of 1,000 students were using it to help with homework assignments.

I just finished a college speaking tour this semester, and it was very interesting to see the various stances on AI across universities. Some are very weary, almost banning the tech, while others are embracing it so much it's actually a grading component of 'AI adoption and skill usage'

A good point arose in the article, what's the point of putting all the effort and money into getting into an Ivy League school just to cheat the whole way through? One students response: "It's the best place to meet your co-founder and your wife."

The irony is in the post-college landscape. If we're scrutinizing AI usage at the academic level, only to have kids enter the real world and be faced with CEOs expecting an AI-first approach to work, I lean toward the school of learning to use it and getting really good at it.

This is the future, but what kind of future is to be determined.

DEEPFAKES ARE REACHING A NEW LEVEL

Deep Live Cam's newest update, currently the top trending project on GitHub can do real-time face swapping with a single image:

FAA CRUMBLING

Corny to say, but the FAA had mostly flown under the radar for the past few decades. I can't remember it getting much attention outside Tin Cup until DOGE put a spotlight on it. Since then, the past two months have been harrowing. The attention has generated exposures from archaic technology (floppy disks), to lost radar and complete outages.

Newark airport is so dangerous that United and other airlines have canceled daily routes. Chaos seems to compound at this airport, in particular, with additional equipment outages and the FAA launching an emergency task force on safety as of yesterday. Recently, the control tower actually lost radar for 30 seconds, leaving them completely in the dark with no means of telling pilots where they were in relation to other planes.

I've always avoided Newark, but this is on another level.

SPIKE LEE’S BACK

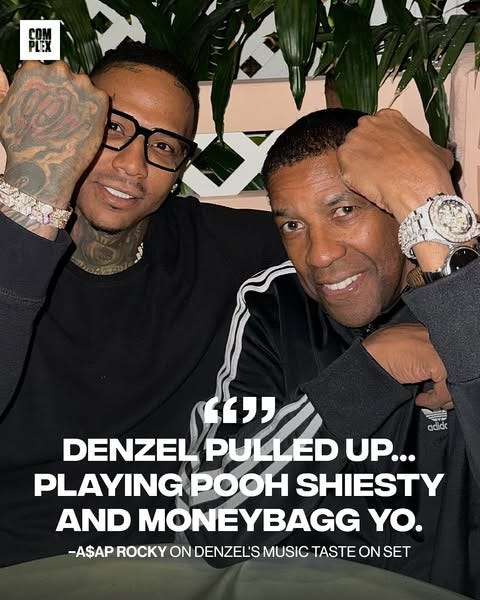

Oookaaaay Spike, A$ap, Denzel, NYC.

Scheduled to premiere at Cannes Film Festival on May 19. This is Lee's most recent film since Da 5 Bloods in 2012, a long time coming. I love spikes crime-esque films the most, Inside Man being one of my favorite movies. Highest to lowest feels 'in that world.' I'm also excited to see what Rocky does on the screen–his take on how Denzel rolled up to the set:

LIL WAYNE TO BRING THA CARTER V1 TO MSG

Another long time coming. Lil Wayne will bring The Carter VI to MSG on June 6

BOOKS

A fresh window for Spring at Mcnally Jackson in SoHo

What stands out, Experience: Revised and Expanded Edition (Hardcover). Olafur Eliasson.

One of the masters of experiential art. If you’re a designer I’d bet hard money you’ve put this in a mood board at some point in the past five years:

That’s it for this week.

Thanks you especially for the FAA inclusion — avoiding Newark now when I fly in for sure! Frightening stuff.