WEEKLY INTAKE - 17. 2025

NICHE PUBLICATION RESURGENCE. CULT100. FEAR & GREED NEUTRAL. BUFFET RETIRES. PORTS. FRIEZE NEW YORK. YOUTH LOVES AN OFFICE. SLATE AUTO LAUNCH. LORDE & LABRINTH RETURN. HUMAN VERIFICATION.

THE RISE OF NICHE PRINT PUBLICATION

It is a great moment for niche, new, small, tailored, and often times print-focused media. In an era of digital overload, these publications are carving out a vital space.

A byproduct of the past 4 years seems to be a curtain pull back on large media, and a fatigue of social, across news and cultural reporting there is a beautiful shift to new. There is also a luxury in sitting with a high-quality print item and taking the time to read it front to back. The New York Times is paying attention with a feature on some of the rising print stars. Substack's rise is also evidence of people searching for new voices and content of substance.

Family Style, Cultured, Semafor, and Outlander are examples of independents having moments. People are looking elsewhere for their reporting, and that's awesome. Hopefully, it will move us away from the homogeneity and agenda-based messaging of legacy media.

CULTURED 100 GALA’S NICHE TRANSCENDENCE

Last Thursday's CULT100 Gala at the Guggenheim showed the scale and growth of a publication beloved by the creative and artistic community. It felt three times the size of last year, as did the talent on this year's list.

The hosts were great, with coordination and a bit of an ‘act’ with each speaker. From Sarah Jessica Parker to Walton Goggins’s Speedo gift to Chloe Fineman, the speeches kept the crowd.

Recognition doesn’t come quickly. You have to do really good work, For a very long time.

- Sarah Harrelson

Cultured's footprint is carrying weight. I remember being introduced to Sarah Harrelson and the potential of what she was creating three years ago, being told at the time that this would become the 'next Vogue'. It's something else entirely, with a wider aperture than fashion. Receiving a copy a few years back, I was struck by how many people were within the pages of that issue I had never heard of. I marked that instantly as something important. The magazine has become a key R&D source for me.

Sarah has supported several dinners with us, from Frieze to a Salon with Tavares Strachan, Ferg, and Alexander Grant, each time bringing an amazing selection of guests.

NICHE NEWS. SEMAFOR.

Semafor, founded three years ago by Justin Smith and Ben Smith, has been one of my go-to platforms for news that reads as news. It's evolved from a news source to an events platform, attempting to build something of a new take on Davos around the week of the White House Correspondents Dinner with their 'World Economic Summit.' Bloomberg is doing something similar with his Bloomberg New Economy Forum (sharing a flair for originality in naming).

In year one of the World Economy Summit, Semafor hosted five Fortune 500 CEOS; in year two, it was 20; and this year, more than 200.

The morning Flagship newsletter, at 100 words or less, is a great global news briefing.

In terms of news and market consumption, balanced, objective reporting is near impossible in 25'. My best approach is to read both ends of the spectrum, knowing the biases, but that's extremely time-consuming. The closest things to the middle seem to be FT and Puck & Semafor.

Semafor's scoops, like Trump's potential Crimea concession (confirmed by Bloomberg), underscore its legitimacy.

A new news platform in 2025 is refreshing and surprising in its willingness to explore a business model that is dying by most accounts. The New Yorker takes a deep dive into the current landscape of media and how it is fighting to survive.

MARKETS

An eight-day rally has the S&P almost back to where it was on Liberation Day and only 8% off a record high if momentum continues.

Friday's Jobs report showed better-than-expected gains, and earnings season has shown resilience, especially in big tech. Microsoft beat earnings expectations, bringing the stock past Apple to become the largest in the U.S. by market capitalization on Friday. Software and cloud services tech is a bit more insulated from tariffs than Apple, which is still heavily reliant on hardware sales. Microsoft's Azure cloud service, for example, increased 33% over the past year, giving the company a record quarter.

"Cloud and AI are the essential inputs for every business to expand output, reduce costs, and accelerate growth."

- Satya Nadella, Microsoft's CEO

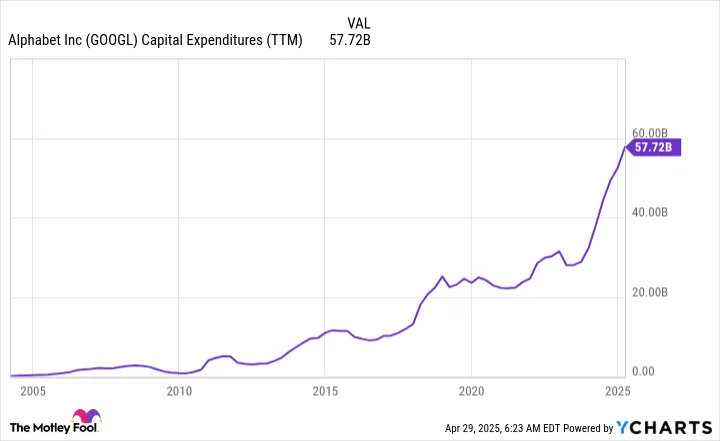

Alphabet (Google) also showed strong earnings, with ad revenue up 10%. YouTube is raking in money for them, something I've been writing about a lot recently. This strength is good news for NVDA and data centers, as they are sticking to their $75 million in capital expenditure plans this year.

Subscription tech and digital ad stacks could become the new defensive stocks. When cuts are made, you're not going to pull your office suite. Digital advertising has acquired such a death grip on marketing because it's measurable and constantly improving to scary levels of effectiveness. When brands look at their marketing budgets, digital ads will probably be the LAST thing to get cut.

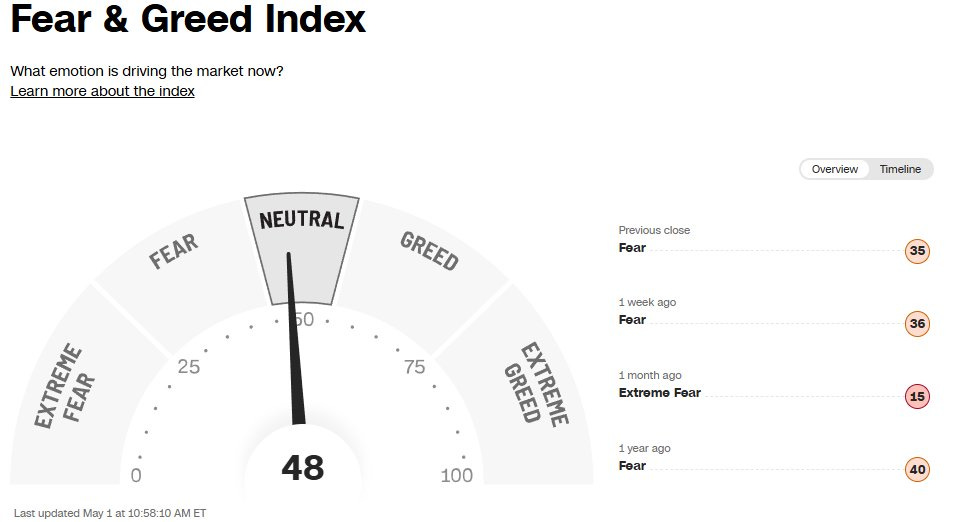

Are we leaving peak uncertainty, or is this a head fake? The fear and greed index has shifted back to neutral, up 44 points. It seems the market is shrugging off the trade war, anticipating rollbacks or considering damage baked in.

Skeptics might view this as a bear market rally within a longer decline pattern. The 2000 dot-com crash featured multiple rallies during a prolonged descent, ultimately losing over 50% from peak values, with a six-year recovery timeline.

What matters next is executing the plan. Landing trade deals is key. This morning, the White House indicated that trade deals could be announced as early as this week.

Ray Dalio has been prophesying doom for so long now he may actually be rooting for it. His article last week maps why he thinks it is 'too late'

Through all of this, retail has kept buying while institutional money has been selling. April saw the largest inflow in the 15-year history of VOO, which tracks the entire S&P.

Who's playing this right? Retail is typically referred to as 'Dumb money', prone to more emotional reactions to fear and greed, but they've acted differently this time. Perhaps it's something to do with a recession, a year being predicted for the last 10 years, never materializing.

Some say don't watch the markets; watch the shipping containers. The market may be rebounding, but that's not the only indicator of an economy. Data from America's busiest port (the Port of Los Angeles) shows Weekly volumes fell 36% from April 27 to May 3.

Logistics and international shipping also move slowly, and complex supply chains are involved. They cannot easily adjust to the speed of change in current policies.

The trip from China to California is typically two or more weeks, making a fast reaction difficult. Larger entities like Amazon can absorb, lobby, or pull from existing inventory in storage. See Amazon CEO Andy Jassy's statements on their ability to weather this storm. General Motors can lobby for concessions, but small purveyors cannot. Smaller businesses will have the hardest time navigating this, and many are going bust.

This will have a rippling impact.

“Essentially all shipments out of China for major retailers and manufacturers have ceased, and cargo coming out of Southeast Asia locations is much softer than normal…"

"If you're a trucker and you're hauling four or five containers today, you may haul two or three in the future. If you're a dock worker who's been getting OT... or getting a full workweek, that may be dialed back as well," he said, with casual workers being hit the hardest.

-Los Angeles Board of Harbor Commissioners Executive Director Gene Seroka

We'll start to see correlations with all of this, "Less cargo volume, less jobs. That's the rule here," according to Mario Cordero, CEO of the Port of Long Beach.

Starbucks is struggling. McDonald's just reported its worst quarter since COVID. Consumers are getting nervous, with both low-income and middle-income consumers pulling back. Their breakfast is softening, and that's an early indicator.

Earnings reports reflect data pre-liberation day, so tariff impacts aren't baked into these numbers.

BUFFETT RETIRES

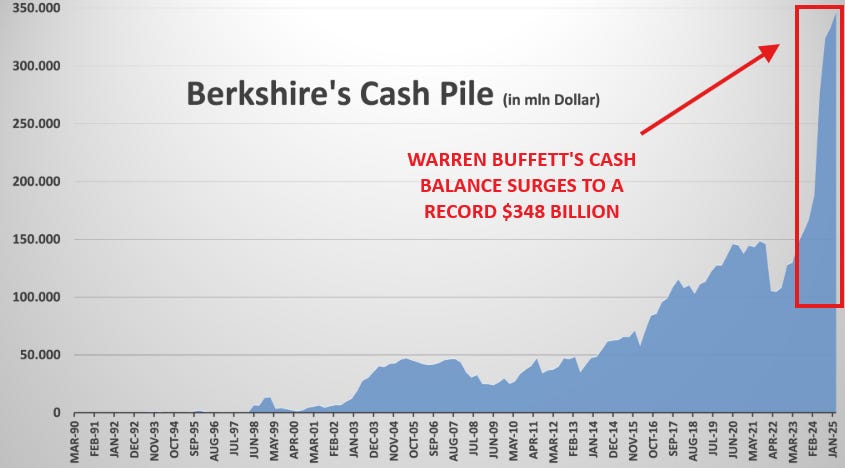

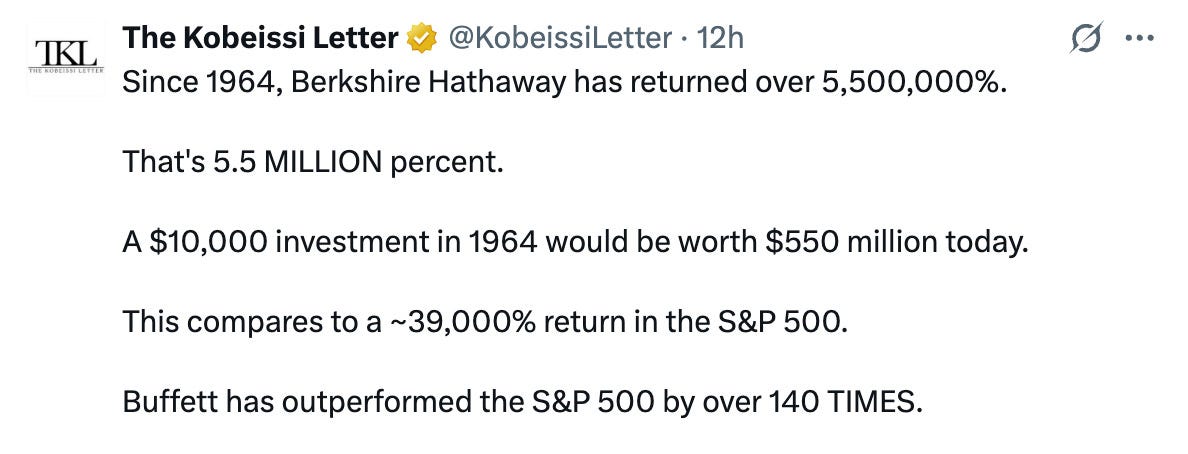

We were waiting for Buffett to weigh in. Through all this turbulence, he's been relatively silent in the press, mainly speaking with actions through continued moves to cash ($348 billion as of Saturday's remarks). To put that cash pile in perspective, the U.S. Federal Reserve currently holds $195.3 billion in treasury bills, while Berkshire Hathaway's T-bill balance is ~56% HIGHER.

At Saturday's annual meeting, Buffett made some of his most direct statements yet on tariffs, praised Apple's Tim Cook for making Berkshire more money than he did, and downplayed last month's volatility, among other profound statements.

Trade and tariffs “can be an act of war,”

“And I think it’s led to bad things. Just the attitudes it’s brought out. In the United States, I mean, we should be looking to trade with the rest of the world and we should do what we do best and they should do what they do best.”

- Warren Buffett

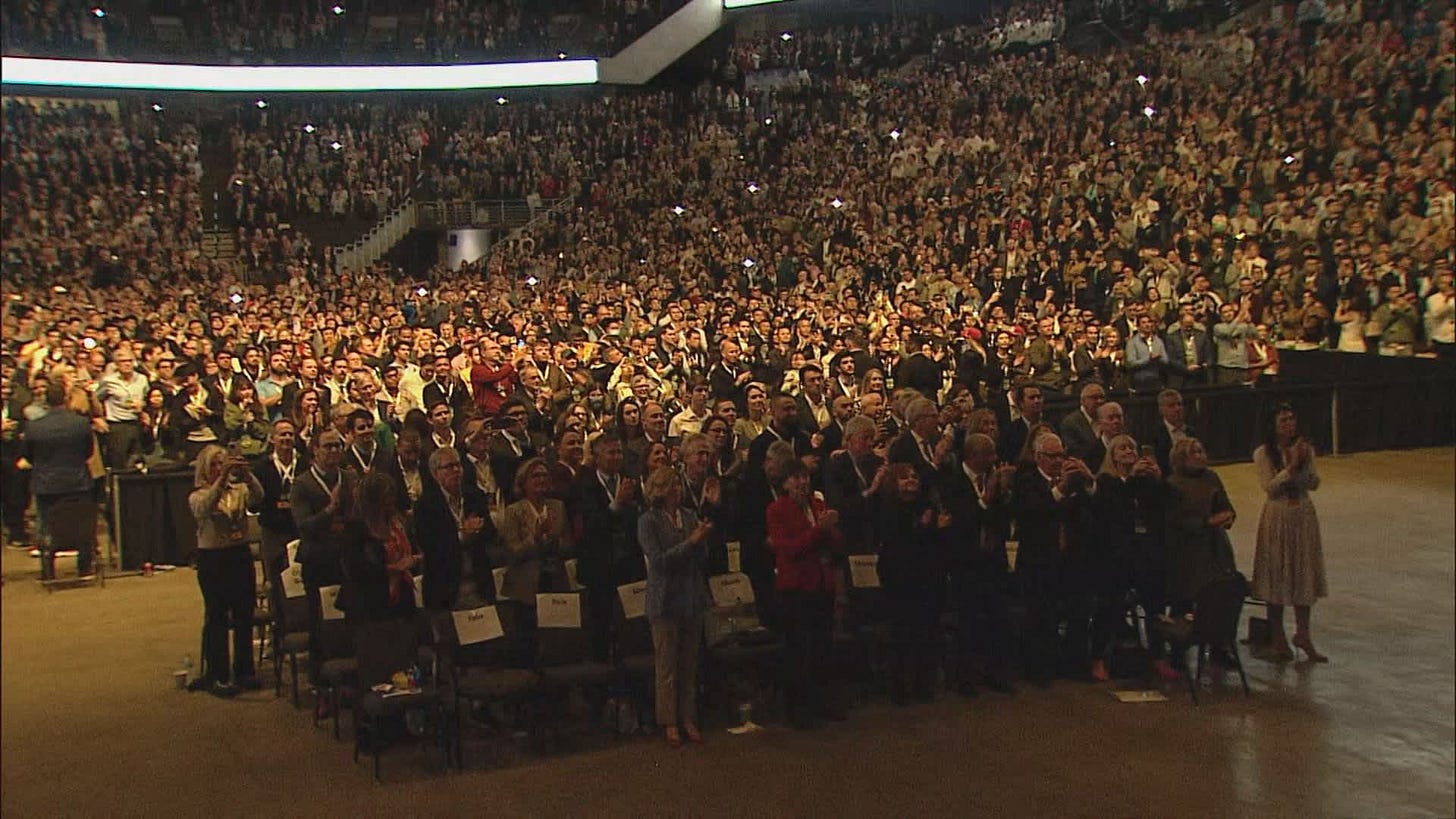

The biggest news of this year's Berkshire Hathaway annual meeting was the complete end of an era. On Saturday, Buffett finally announced he would step down as CEO at the end of the year, with Greg Abel taking over. This came after five hours of questions to a packed house of 40,000 people, who gave him a standing ovation.

While Buffett expressed disagreements with trade wars, he resisted the idea of ending American exceptionalism.

There will never be another Buffett. He is leaving on a high, as many fail to do. The man became a sort of mythology; his simple life, profound statements, intellect, and sharpness at 94 were akin to a human form of artificial intelligence. A $10,000 investment in 1964 would be worth $550 million today. Since 1964, Berkshire has returned over 5,500,000% or 5.5 million percent.

Buffett left with a great remark:

"We've gone through great recessions, we've gone through world wars, we've gone through the development of an atomic bomb that we never dreamt of at the time I was born, so I would not get discouraged about the fact that it doesn't look like we've solved every problem that's come along."

"We're always in the process of change. We'll always find all kinds of things to criticize in the country, but the luckiest day in my life is the day I was born [because] I was born in the United States.

- Warren Buffett

FRIEZE NEW YORK

Frieze comes to NY next week, anchored at The Shed from 7th to 11th. See here for a great map of the surrounding exhibits. With 67 galleries officially exhibiting and many more off-site events, it will be an important indicator as the global art market struggles with a downturn. White Cube will show works from Tracey Emin, Sara Flores, Antony Gormley, Park Seo-Bo, and Ilana Savdie.

Last week, news broke that Endeavor Holdings had sold Frieze back to its one-time CEO, Ari Emanuel, bringing it into a new, yet unnamed, roll-up company focused on events and experiences. Frieze has grown to seven fairs, including Frieze Los Angeles, EXPO Chicago, the Armory Show in New York, and Frieze Seoul. The Financial Times puts the value of Frieze at nearly $200 million with this transaction.

NADA will parallel the fair, focusing on contemporary and new dealers.

NYCxDESIGN runs the week following Frieze, with some great exhibits that are more focused on interior design. Deezen has a great round-up of the events calendar for the week. One to see for sure is CHROMA, a multi-sensory design installation presented by the Consulate General of Switzerland:

On Tuesday, MATTE will be having a dinner and party at Ella Funt.

ROBER RYMAN AT ZWIRNER

The story of Robert Ryman is incredibly inspiring. He taught himself to paint while working as a guard at the MOMA, consumed and observed modern masters, and then evolved into one himself.

His work heavily inspires my paintings, especially in terms of palette and ability to work with tonal ranges of muted palettes. I have a whole muted series that I've been working on for years that draws from this.

This exhibit will be one of the most extensive looks at 1961–1964, when he started gaining recognition.

“Ryman’s daily scrutiny of paintings by Mark Rothko, Henri Matisse, Franz Kline, and others at his job as a guard at MoMA is one of two major formative experiences in the 1950s that remain visible in his work.”

- Art historian Vittorio Colaizzi

YOUTH LOVES AN OFFICE BUT NOT ONCE COVETED JOBS

A recent survey of 12,000 workers worldwide by property group JLL found that Gen Z sees the most value in in-person work. It's just not the same work that was coveted by previous generations. This is in stark contrast with how many millennials prefer remote work. JLL's report showed workers aged 35-54 reported the lowest satisfaction with being in the office.

Those under 24 are the most likely to be in the office, averaging 3 days a week. We went to 4 days a week about 9 months ago, and it's honestly been the best thing for camaraderie and mentorship. The debate on doing it was more arduous than pulling the band-aid; we spent a year deliberating.

Once we got everyone back, the advantages were clear. We could walk over and have a conversation rather than trying to navigate a packed Zoom calendar. People started hanging out outside of work and getting to know each other, and new hires actually met people off-screen. Keeping at 4 is essential, though, as the fifth hybrid day allows time for thinking and work that requires focus over interaction.

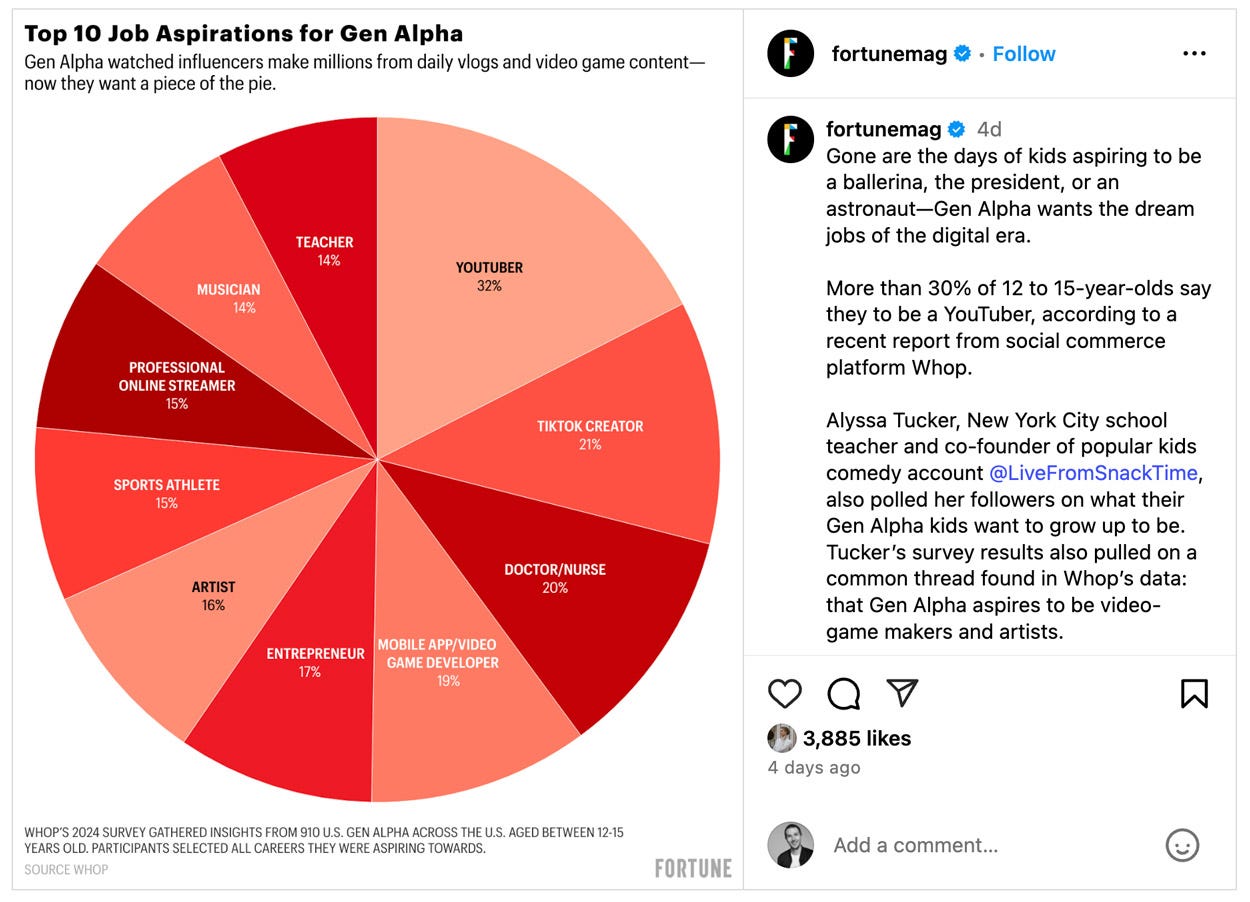

Fortune's look at Gen Alpha's career aspirations shows ballerina's on decline. The shift in coveted jobs makes sense, as the majority of these jobs weren't even options for older generations, but its interesting to see the classics like president and astronaut on decline.

I do find social media aspirations depressing. Let's be honest, we're not going to change the world and innovate if most of our youth want to be a YouTuber or TikToker (sitting at 53% combined). It's understandable, as they see people their age, if not slightly older, making millions off vlogs and video game content, which also feels more accessible than movies or sports. This also leads to the wealth dysmorphia I wrote about several weeks back.

It IS nice to see ‘Artist’ sitting right next to ‘Entrepreneur’ at 16%.

RALPH LAUREN’S SOHO PURCHASE

$132m is what it took for Ralph Lauren to hold onto its Soho flagship, ending a long bidding war against the deep pockets of LVMH. He bought the entire building (109 Prince Street) to keep the iconic corner location.

The sale shows the power of long-term holdings in Manhattan real estate. Jean-Pierre Lehmann originally bought the building on the corner of Prince and Greene Streets in 1991 for $3 million, making almost 130 million in profit on the sale.

LOUWE TOPPING THE LIST INDEX

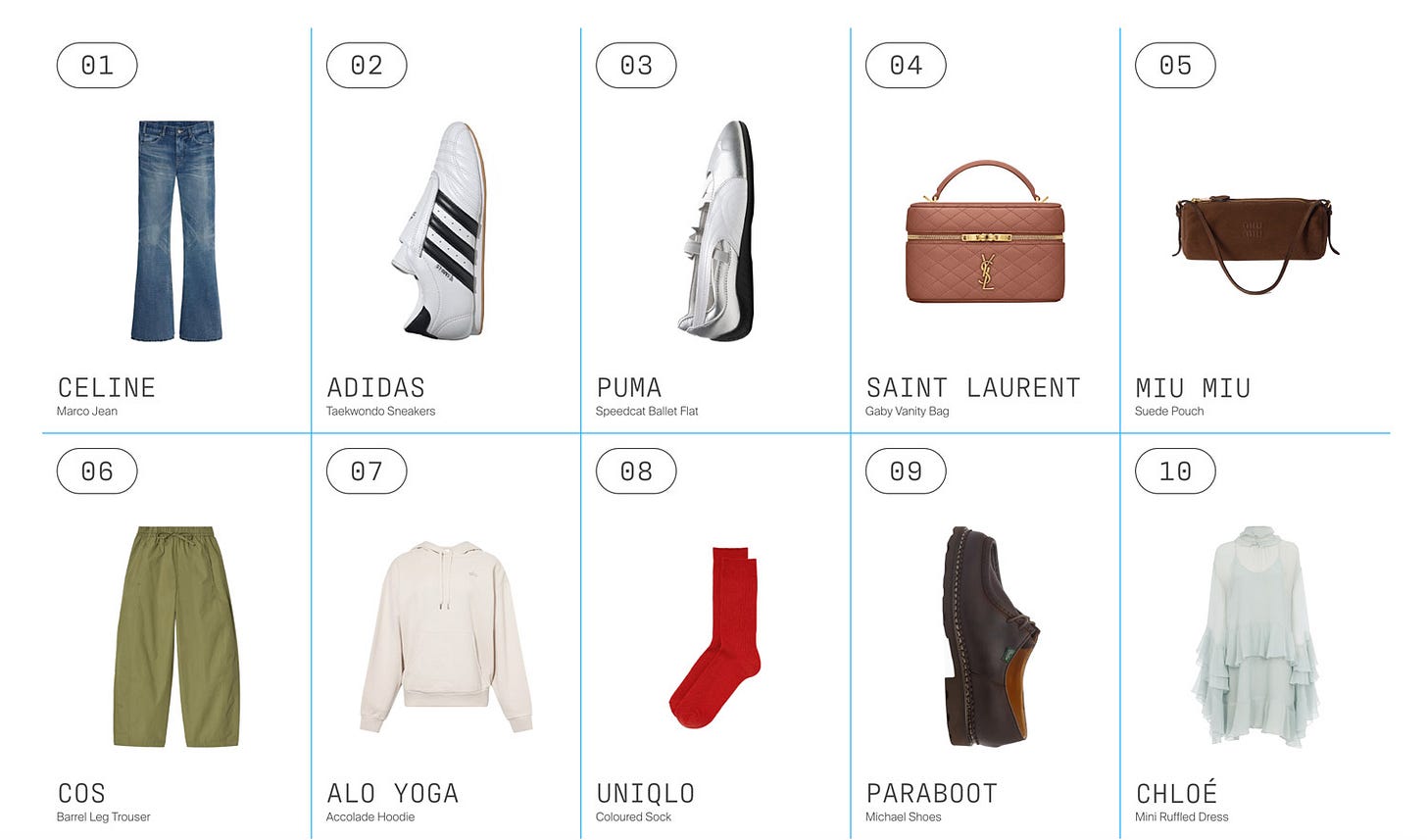

This could partially be due to Jonathan Anderson's departure spiking search trends. Lyst's hottest brands ranking for the first quarter of 2025 saw Loewe overtaking Miu Miu. Other brands like Versace and Balenciaga announced new creative directors during this quarter and did not see the same spike.

One enters Lyst for the first time. Collaborations with talent like Zendaya and FKA Twigs and luxury brand partnerships like the one with Loewe show the brand's ambitions beyond activewear.

Levis is also on the rise, showing a 35% increase in demand this quarter.

SLATE AUTO LAUNCH

A very different launch for Slate drove a ton of attention.

The Jeff Bezos-backed, affordable EV auto company launched through a series of hilarious fake companies. In some instances, they were parked on the road as if they were real. These fake companies actually ground the product in. How many people would use this vehicle, or do they have a flower shop? Imagine how it would look:

I was then surprised to find one of my close college friends, Ben Whitla, behind much of it as Slate's new head of brand.

The connection was customizable and affordable, but it was storytelling for the win. Taxidermyfamily.com (which drives to the Slate official site) premiered during SNL and felt like an actual sketch.

LORDE RETURNS

Lorde's re-build into her upcoming album, Virgin (June 27), sees the artist return after four years. A lot of Charli XCX codes with some crossover in play, the artist mentioned how working together 'kicked her into opening up'.

She teased a pop-up performance in Washington Square Park with a TikTok video, to return that evening to cause a ruckus and debut her new single with an impromptu performance.

LABRINTH DROPS

Labrinth (famous for scoring euphoria, among other things) is also teasing new music.

Dropping a new music video for the single S.W.M.F. on Monday:

ONE & ONLY HUDSON VALLEY

Hudson Valley continues to draw major hospitality players. While the Soho farmhouse in Rhinebeck is starting to feel like a mirage, we've seen Auberge build an incredible property with Wildflower, and now the One & Only is set to open its second U.S. property in the region.

The property, set for 2028 on the Culinary Institute of America campus in Hyde Park, will be within a 90-minute drive from NYC.

Private residences will also be a part of the development.

TECH & INNOVATION

HUMAN VERIFICATION

The rise of deepfakes and AI has created a need for something dystopian, and of course, it's backed by Sam Altman. World.org—Human Verification, in the form of an Orb that scans your face and retina, creates a unique digital ID stored on the blockchain.

Future uses involve proving it's really you on Zoom or in content, a rising concern as deepfake quality gets nearly imperceptible.

If you read about eye-scanning crypto orbs being a thing in the New York Times ten years ago… I guess we never expected to see UFOs on the cover either.

PERSONAL NOTES ON ART AND LIFE THIS WEEK

I didn't get any studio time this week, as I was traveling to SCAD for a fantastic experience of working intensely with students on a workshop MATTE facilitated.

We visited the fashion and accessories school's graduating seniors, reviewed the final presentations of real products the students developed, and chose the top 5 products to help them build 360-brand worlds around.

These students were then paired with others from the Photography, Graphic Design, Advertising, and Strategy schools. On Friday at 5 p.m., we briefed these groups on how MATTE typically builds 360-degree campaigns. We walked through go-to-market plans ranging from key imagery to social assets, world building, and experiential.

By 9 a.m. the next morning, these kids had produced incredible output. Product shoots, models cast, and design thinking were all in play. We worked with these groups through the following day as these brands came to life, with a final presentation coming back to us in two weeks.

Several of these students met for the first time on this project.

I was amazed at the output, raw talent, and passion these students brought.

In light of this, here is an archival painting vs studio update:

DEEP BLUE #02.

Acrylic on wooden board

18” x 24”

2.5” Depth