WEEKLY INTAKE - 16. 2025

KENDRICK X CHANEL. HENRY TAYLOR. GOLD. THE BUFFET INDICATOR. GLOBAL TRAVEL: A REDIRECTION NARRATIVE. FACEBOOK ANTITRUST TRIAL. AUGUSTA’S PRICING STRATEGY. FIGMA IPO FILING. SINNERS. LUNAR BASE RACE.

KENDRICK X CHANEL

This had been a slow burn for those paying attention, but was announced officially with a BOF exclusive.

Last year, Chanel entrusted Dave Free, Kendrick’s manager and creative partner at PG Lang, and long time director with a short film ‘the button’ which launched alongside their haute couture show.

Kendrick has been sitting front row in custom Chanel for several shows over the past years, and wore head to toe at the Met ball the year of the Lagerfeld theme (skipping red carpet). Other codes could be a stretch, but his pre-super bowl interview with Timothée Chalamet who is the face of Chanel’s men’s fragrance.

“Tying up with Chanel—one the world’s most carefully controlled, risk-averse brands - could signal that Lamar is opening a new chapter and putting a year of controversy behind him,”

BOF’s Luxury Editor, Robert Williams

Kendrick will play Metlife Stadium May 8th & 9th

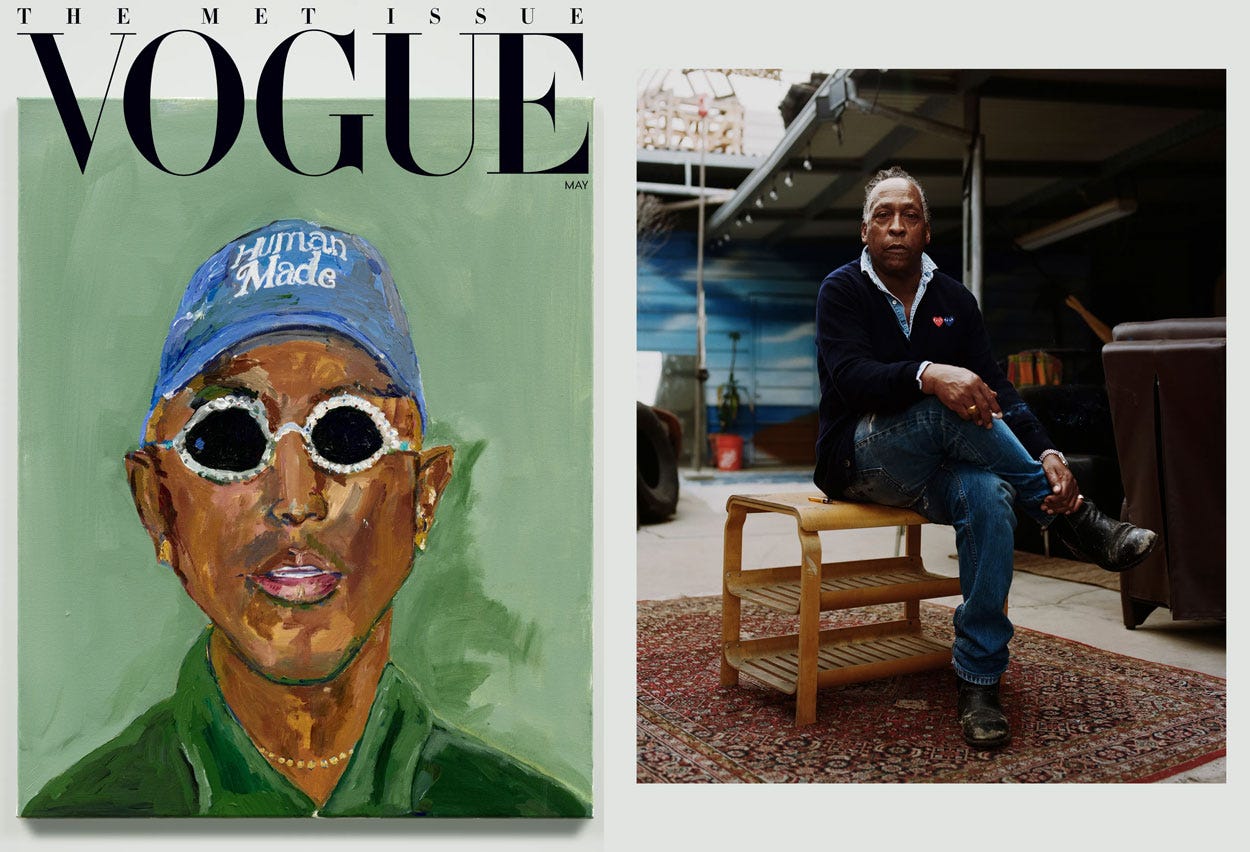

VOGUE HENRY TAYLOR

Vogue continues its ongoing commissioning of artists for covers with Henry Taylor’s painting of Pharrell Williams. Their 5th commissioned painting in the past decade.

Taylor has existing connectivity to Pharrell, mini versions of his portraits were embroidered on his suits and accessories for his debut Luis Vuitton show. This is where they met and without time for a portrait setting he worked from that memory.

Vogue’s article on how he went about it. This is smart long term, as it also builds a collection of icons by blue chip artists with the additional cultural impact of the painting itself being a vogue cover, I’d imagine those appreciate.

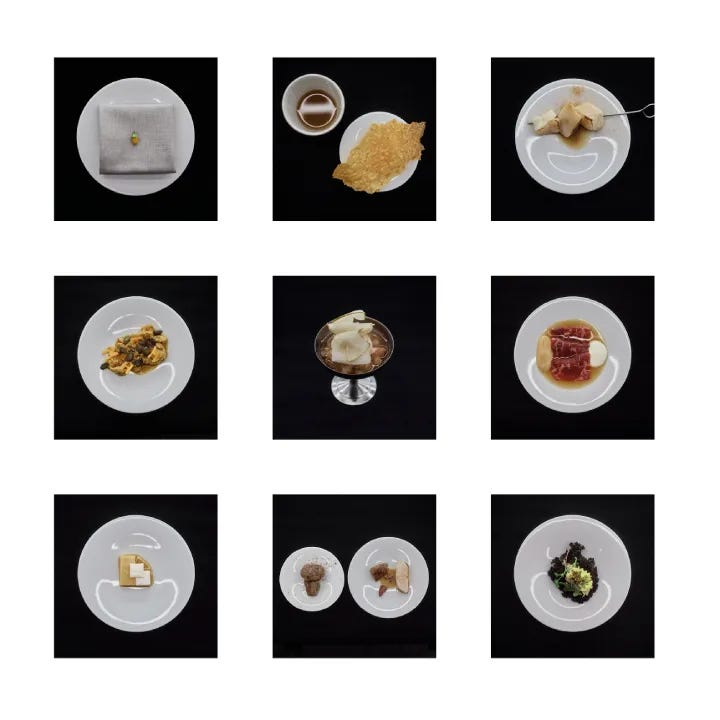

BON APPÉTIT’S FIRST ANNUAL DESIGN ISSUE

Releasing its first-ever Art & Design issue, Bon Appétit’ May issue will explore how culinary culture intersects with creative fields such as fashion, design and fine art. In Luxury daily’s interview with Bon Appétit’s editor in chief Jamila Robinson, she speaks to her goal of expanding the magazines voice for a design conscious audience.

It’s well timed, capitalizing on “the camera eats first” era were in. Food has always played well as a creative experience, WeAraOna’s recent success is another example of this, Wallpapers feature on the collective explores a potential future of fine dining as experiential.

BUSINESS & MARKETS THIS WEEK

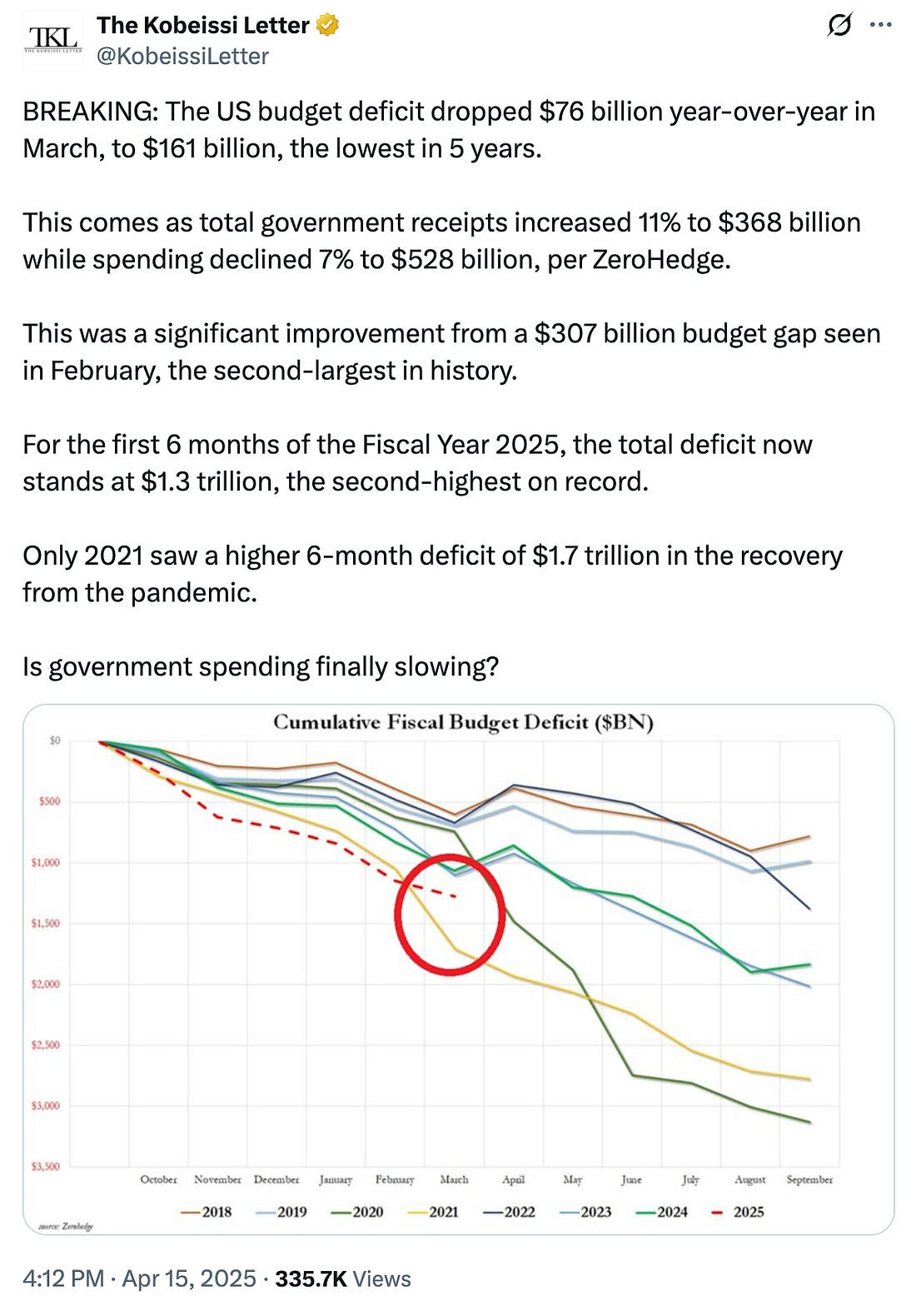

The roller coaster continues. We’re starting to normalize 3% swings in the S&P which is by no means normal. This week Trump called “Mr. too late” Jerome Powell a “major looser” Then reversed course that evening saying he’s not looking to fire him.

Were in a period of peak political market impact. Each day this week was peppered with conflicting statements such as:

Trump: We are talking to China "every day."

China: “China and the US have not held any trade discussions, all such reports are false.”

Our volatility index is through the roof, with daily drops, followed by rebounds. Traders are loving this, but its shaking the one thing markets want more than anything else; certainty.

A three minute pull from a Bloomberg terminal looks like this:

Such uncertainty is causing an exodus of American treasuries, equity and dollars.

We’re starting to see major business and finance personalities speak out. Citadel’s ken griffin, a major trump supporter, mega-doner and founder of one of the largest hedge funds in the world, spoke at the Semafor World Economy Summit in Washington on the damage to the American brand:

“If you think of your behavior as a consumer, how many times do you buy a product with a brand on it because you trust that brand?” Griffin said. “In the financial markets, no brand compares to the brand of the US Treasuries — the strength of the US dollar and the strength and creditworthiness of US Treasuries. No brand came close.

We put that brand at risk.”

Ken Griffin

Jamie Dimon, wrote in his annual shareholder letter this month; “America First is fine, as long as it doesn’t end up being America alone,”

“If the Western world’s military and economic alliances were to fragment, America itself would inevitably weaken over time.”

Foreign investors hold 30% of US treasuries, and their reduced purchases could raise yields. While they may not actively sell (self sabotage), most central bank holdings are 2-5 year maturity. They can let them mature and not buy again. They have options, from gold to land to other countries treasuries.

International and emerging markets are outperforming:

Brazil IBOVESPA: +11.90%

Germany DAX: ~+12.3%

China Hang Seng: +12.019%

While US markets struggle:

S&P 500: -6.45%

NASDAQ: -10.43%

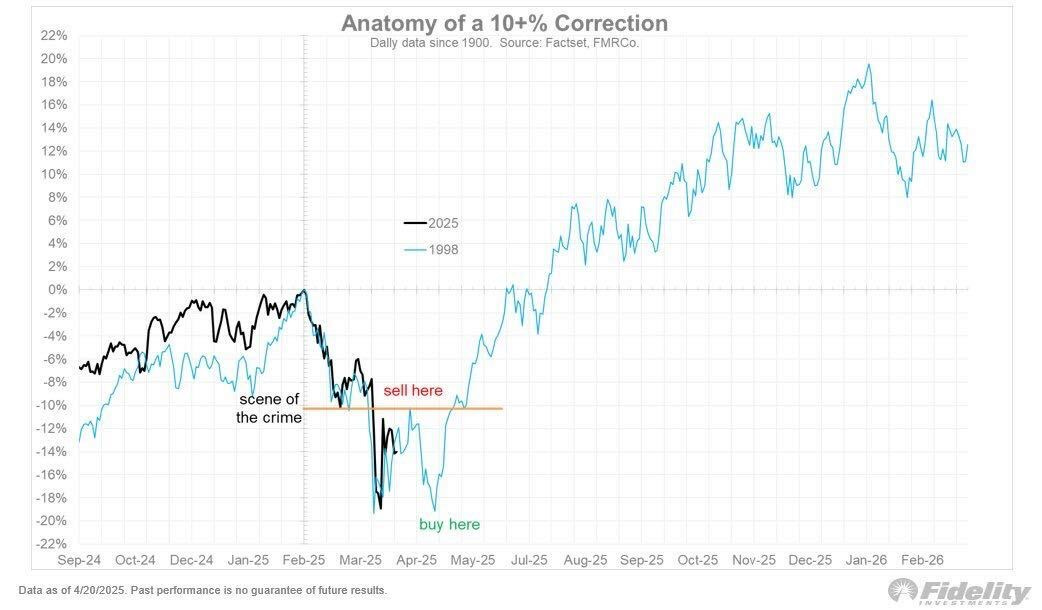

Someone is always able to find a chart that shows some sort of correlation with a past event, history doesn’t repeat but it rhymes. You can use data to form any side of an argument, but this is worth looking at:

I don’t fully buy the ‘end of American exceptionalism’ narrative on a long term scale. Right now were looking sloppy, nor is it wise to ‘fight the world at once’ with tariffs (see norm Macdonald’s great take on the last country to do that from 2 years ago).

Fighting the whole world at once on trade is causing new coalescences to form.

I do agree with compound and friends this week - Long term, America just has BETTER COMPANIES. Over half the time, in global drawdowns, the US outperforms on the return.

IS THE FED PLAYING POLITICS?

65% of companies reporting so far are missing on top line. That can’t be blamed on tariffs it’s reflective of soft economy prior to that. The fed’s job is to react. The Jobs reports last quarter didn’t even reflect government layoffs so expect a high unemployment print top of may.

The past 2 years have seen criticism of feds inaction, slowness or the infamous ‘transitory’ inflation assessment. I try to look at all sides on this, its complex and unfortunately each side is extremely entrenched. prof g markets will have a 180 take from compound and friends as example.

GOLD AT RECORD HIGHS

Gold is saying we’re at a full “absence of certainty” says Danielle de Martino, on last weeks Risk Reversal Podcast. This trade started last year and those who pivoted to gold early are reaping benefits, its not just a safe haven, its an outperforming asset right now.

This is central bank diversification, followed by retail investors crowding in.

Our dollar is tanking, hitting the lowest its been in 3 years this week, that may be partially by design. With $38 trillion in debt, devaluing the dollar could be beneficial for debt management while maintaining gold reserves.

Why? Devalue our currency which is what the debt sits in, while we still hold a lot of gold as a potential asset to sell into repayment.

Donald Trump posted on Truth Social, "THE GOLDEN RULE OF NEGOTIATING AND SUCCESS: HE WHO HAS THE GOLD MAKES THE RULES," which coincided with a surge in gold prices.

The statement, posted on April 20, 2025

The gold trade is however CROWDED. When we get market clarity, gold could fall hard.

What motivates most gold purchasers is their belief that the ranks of the fearful will grow. During the past decade that belief has proved correct. Beyond that, the rising price has on its own generated additional buying enthusiasm, attracting purchasers who see the rise as validating an investment thesis.

As “bandwagon” investors join any party, they create their own truth – for a while.

Warren Buffett - Letter to shareholders 2011

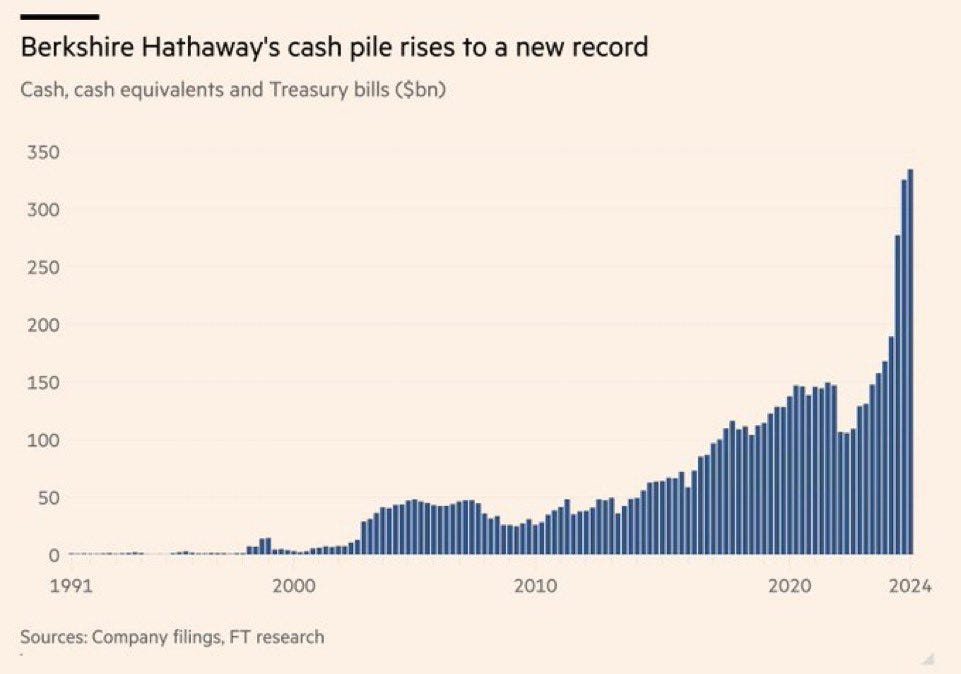

THE BUFFET INDICATOR

The man has plays left in him at 94, if only I’d watched the Buffet Indicator back in November / December. He calls tops. Berkshire is now in a position with enough cash to buy buy 476 companies in the S&P 500.

Is the chaos working?

EMERGING AND INTERNATIONAL MARKETS

Argentina is thriving. Javier Milei, famous for taking a chainsaw to red tape and bureaucracy, has reduced monthly inflation from 25% to 2.2% and is now seeing economic activity expand at the fastest pace in two years. Poverty is also lower than when he took office. It’s too bad his crypto grift left a stain on his credibility.

On Compound and Friends this week, Rebecca Patterson, Senior Fellow at the Council on Foreign Relations and former Chief Investment Strategist at Bridgewater Associates breaks down how Brazil is going to win both ways on the trade war. Their tariff is only 10%, they have a large population with a cheep labor market and existing manufacturing pipelines.

They’ll get market share from China and Vietnam on shoes, and market share from America on agriculture. For example, prior to the last trade war in 2018, the U.S was the largest Soybean supplier to china, Brazil swept in and took that, never giving it back up.

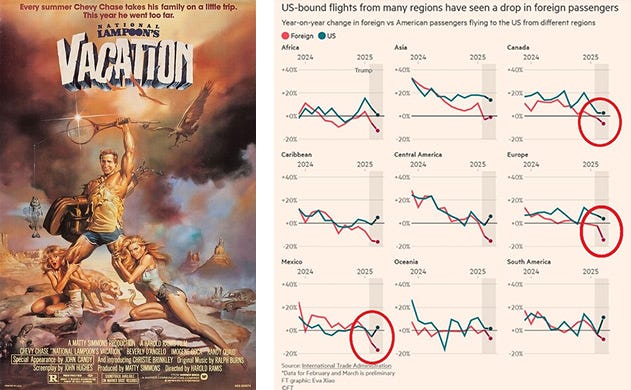

GLOBAL TRAVEL IN 2025: REDIRECTION, NOT DECLINE

The data suggests a global redirection rather than a universal decline.

As global tourism pivots in 2025, the U.S. faces its steepest travel downturn in years, this isn’t a retreat from travel, it’s a reshuffling of the global tourism map.

Travelers aren't staying home, they're just redrawing their itineraries, with profound implications for destinations, hospitality brands, retailers, and the broader travel sector.

U.S TOURISM TAKES A HIT

Will this be a ‘staycation summer’?

The U.S. tourism industry is experiencing a significant contraction in 2025. International tourist visits dropped 11.6% in March compared to the same period in 2024, according to the National Travel and Tourism Office. This was before liberation day.

Our trade war has sparked boycotts and American travel hesitation. Canada leads this decline with visitors down 31.9% by land and 13.5% by air in March, while German and British visitors each decreased by approximately 29%. Looking ahead, summer 2025 bookings indicate this trend may persist, with European reservations to the U.S. projected to fall 25% year-over-year, according to Accor SA.

This downturn could cost the American economy dearly, Goldman Sachs estimates potential losses of $90 billion (equivalent to 0.3% of GDP). Domestically, Bank of America reports a 2.5% decline in credit card spending on lodging and a 6% drop in air travel expenditures through Q1 (Skift)

Major carriers are feeling the pressure (Business Times):

Delta Air Lines (18% market share)

Cut first-quarter profit estimates by 40–50 cents per share.

American Airlines, (21% market share)

Reported a first-quarter net loss of $473 million.

United Airlines (16% market share)

Saw a 50% decline in government bookings.

JetBlue Airways (4.7% market share)

Adjusted to a 4% first-quarter loss and eliminated several international routes.

RETAIL IMPACT

Tourism decline is impacting U.S. luxury retail, with (tourist) spending at U.S. malls and shopping districts falling 16% in Q1. LVMH's recent quarterly earnings call noted a 17% decline in North American same-store sales, partially attributed to reduced tourist traffic.

"International tourists traditionally spend four to five times more per day than domestic travelers," explains Heather Blacker, retail analyst at Morgan Stanley. "Their absence is particularly acute in luxury flagship districts like Fifth Avenue, Rodeo Drive, and Miami's Design District."

Brands are pulling out tactics learned during covid when travel ground to a halt (BOF), shifting marketing from international tourist campaigns to local customer retention and emphasizing programming and events. Many are also leaning into food and beverage partnerships as places like Bal Harbour Shops’ see dining tenants growing to around 50% in the coming years.

A last effort will be rent relief and other concessions similar to 2020 if there isn’t a reversal. The last thing the major landlords want is empty space, giving temporary relief to ensure brand partners succeed is a much better alternative.

GLOBAL TRAVEL: A REDIRECTION NARRATIVE

The global picture tells a more nuanced story. Travel is (99%) back to pre-pandemic levels, slowing down slightly, but that's coming off of double-digit increases over recent years.

We're not seeing a global retreat from travel, but rather a reallocation of destination preferences,"

Explains Sandra Carvão, Director of Market Intelligence at the UN World Tourism Organization.

"Travelers are making different choices, often influenced by geopolitical considerations and changing perceptions of value."

Social media analytics reveal changing preferences in real-time, becoming a leading indicator of travel intention. Instagram engagement rates for #StaycationSummer increased 43% year-over-year, per Later Media analytics.

TikTok videos featuring domestic hidden gems receive 2.3x higher engagement than international destination content, according to Hootsuite's Social Media Trends Q2 report.

"Social sentiment has become a leading indicator of travel intention," explains Talkwalker CEO Tod Nielsen. "We're seeing significantly higher positive sentiment for domestic and non-U.S. international destinations compared to previous years."

WHERE ARE PEOPLE GOING?

If internationals opt out of America, I’m interested in what places are trending:

The Asia-Pacific region. Sabre's Global Travel Demand report indicates a 34% year-on-year increase in bookings.

Thailand - The "White Lotus Effect" drove a 312% rise in January 2025 bookings through Fora, with Koh Samui hotel bookings up 65% for Songkran

Japan has been seeing so much tourism they had to make adjustments to limit it next year, including a tourist tax.

They had one of the best ski seasons in 40 years, a generational winter with record snowfall. A weak yen also was a major driver, giving some of the best exchange rates in decades. The Japan National Tourism Organization reported a 35% increase in international visitors compared to Q1 2024.

Twitter/X conversation analysis from Talkwalker shows Japan as the most positively discussed international destination among North American users, with 24% of travel destination conversations mentioning Japanese locations.

Türkiye emerges as a value-focused alternative, and also has a booming medical tourism industry (It’s the hair transplant capital of the world). 28% year-over-year increase in international arrivals through February 2025.

Canada - the irony. Tourism receipts rose 14% with particular strength in British Columbia and Quebec. The Fairmont Pacific Rim in Vancouver saw bookings up 18%

Norway and other Nordic countries - Have created a ‘Coolcation’ trend as many European hotspots were simply TOO HOT last year. Visit Norway data shows advance bookings up 22%

The U.S. Travel Association forecasts potential revenue losses of $18 billion if current trends persist through 2025. Travel patterns eventually normalize and new york is still the greatest city on earth (sorry). "We've seen regional shifts in travel preferences before," notes Deloitte's Travel & Hospitality lead Eileen Crowley.

FACEBOOK ANTITRUST TRIAL

META faces a landmark antitrust trial that began this month, in Washington, D.C., as the FTC seeks to dismantle its acquisitions of Instagram and WhatsApp.

WSJ breaks down Mark’s failed Negotiations. The FTC wanted $30 billion to drop its case, Zuckerberg countered with $450 million, 1.5% of the initial demand and a fraction of the value of Instagram and WhatsApp. Zuckerberg was confident that President Trump would back him up with the FTC, after donating $1m to his campaign, settling a $25m lawsuit and making policy shifts more aligned with the new administration. Mark Eventually countered with $1b and a frenzied lobbying effort to trump. It didn’t pay off (yet).

The trial has revealed troubling insights into the tech giant's business practices, including Mark Zuckerberg's infamous 2008 statement that "It is better to buy than to compete." Critics have argued that competitors like Pinterest and Snapchat have only been allowed to survive to create the illusion of a competitive market for Meta.

The trial has exposed Meta's aggressive acquisition strategy that systematically eliminated potential rivals before they could become genuine threats.

This has put Mark Zuckerberg, back in the witness stand, out of the sceeny clothes, gold chains, and once again into a suit. Meta’s next strategy will be to drag this out in court, as they have the money to spend. People familiar with latest negotiations say the paltry initial offer was reflective of how strong Meta thinks it’s case is.

Meta wields tremendous power with ownership across Instagram and WhatsApp. They are very much in position to control narratives. Regardless of the way thats done, I don’t think its healthy in any direction.

It would be best for society at large to see these platforms broken up.

KERING Q1 REVENUES FALL. ZEGNA UP.

Kering reported Wednesday that Q1 revenue fell 14%, largely driven by Gucci which continues to weigh on the group, with sales dropping 25%. This will put even more pressure on Demna’s new appointment as creative director.

“ What I can share with you is that after the nomination of Demna, I never received so many CVs of creative people and designers who want to join the team.”

Kering CEO Francesca Bellettini

Bottega Veneta is carrying, with sales up 4% along with beauty and eyeware divisions holding the line.

Not all reporting is in across the luxury sector, but so far Kering is lagging the rest of the luxury groups.

A general luxury slump Its not all one directional. Some Brands are winning. I spoke about Hermes last week surpassing LVMH. This week Zegna Group reported Sales Rose in Q1, Boosted by the Americas, and a strong Direct-to-consumer Business.

FIGMA IPO FILING

Figma has confidentially filed for an IPO a short 16 months after the $20 Billion acquisition by adobe unraveled after UK regulatory pressure. They received a $1 Billon breakup fee from adobe in that deal, giving them runway into this move.

This could be one of the biggest IPO’s of the first half of the year which has been much more subdued in comparison to expectations last year. Experts were hoping for lower interest rates and perceived lower odds of a recession, things did not play out as expected.

Hopes are that this could set a tone and usher in more companies stepping off the sidelines into the IPO market.

Adobe was a big looser in this deal. I talk to a lot of people in the creative space and the general sentiment is Adobe is NOT keeping up.

We put a lot of effort in shifting our presentation format completely to Figma over the last year. Its simply a better product for multimedia. In 2025, sending pdf’s or 2.5 gig keynotes is not a vibe, Figma lets us send a clean dynamic live links with video and dynamic content.

Adobe is also behind on AI, their integrated products are no where near as powerful as dedicated platforms, such as Midjourney or Runway, with new competitors emerging weekly. They seem to be acting like blockbuster in the 90’s, they have so much competitive edge, with a large subscriber base, a ton of data, and entrenched benchmark tools. If they continue to move this slow or lack innovation, could it could be an irrelevant product in 2 years?

AUGUSTA’S PRICING STRATEGY

There are a few lessons to learn in brand from Augusta, one of the most tightly controlled and secretive golf clubs in the world. Annually the Masters opens it up to public view, while the rest of the year only the chairman, Fred Ridley, speaks on its behalf. It’s Membership is so secretive that the surrounding city and FAA actually redact the private charter traffic to the club.

They do not allow cell phones, causing finance bros to miss market insanity this year.

But most importantly, their prices on-course harken to the 1950’s. It builds on the mythology, being so highly coveted a ticket, so inaccessible, to then provide $1.50 pimento cheese and $3.00 BBQ. This shows their connection to members and people shelling out to be here, it subtly states ‘You’re here, were not going to bang you out further.’

That rewards loyalty and creates a lore around the brand.

MEDIA & ENTERTAINMENT

SINNERS

Ryan Coogler is back in the spotlight with Sinners, his take on a southern ‘7 samurai’. The film made history with a near perfect rotten tomatoes of 98% and an A rating on CinemaScore (the first ever horror film to rate that high).

It’s rich for analysis, with codes and depth giving the online and critic communities lots to dig into. It’s a slow burn, providing a big flip and course correction in a way reminiscent of From Dusk Til Dawn. Its also a testament of the power of his long term collaboration and friendship with Michael B Jordan.

Jordan has starred or appeared in all of Coogler’s films, including the “Black Panther” movies and “Creed.”

Shout out to Ara Barzingi for bringing this one to my attention:

Its also a business story, bucking the trend of original script flops I wrote about last week and disrupting the current studio model. It’s seen back to back $40+ Million weekends which puts it nearly profitable with lots of room to run.

The larger story is on how he cut his deal, giving him the rights to the movie after 25 years. The director also got final cut, and a percentage of box-office revenue as soon as the movie hit theaters rather than after reaching profitability. All in all an amazing deal for the young actor, only 38, he’ll see profit from this with ample runway to enjoy it.

Thats a big change for the studio model, as Directors don’t typically obtain ownership of their films.

A24 & DEATH STRANDING

Kojima productions and A24 subtly dropped a hint to a feature fim adaptation of the iconic video game back in December. Production progresses with the announcement that ‘A Quiet Place: Day One’ director Michael Sarnoski will take the helm.

The game itself is perhaps one of the most cinematic games in history. It is not yet clear if the film will be a completely different re-write within the universe built.

TECH & INNOVATION

FACIAL RECONSTRUCTION FROM CIGARETTE BUTTS & GUM

Artist / Biohacker Dewey-Hagborg. This is not actually a NEW story, but something I only saw now that really got me thinking. In 2013 the artist collected DNA from discarded objects to create 3D portraits of strangers. I can only imagine how much more detailed this could be now.

LUNAR BASE RACE HEATS UP

At a presentation in Shanghai on Wednesday, China gave updates to their joint International Lunar Research Station (ILRS), with Russia. The Chief Engineer for its 2028 mission, Pei Zhaoyu, said that China is considering building a nuclear plant on the moon to power the base.

"An important question for the ILRS is power supply, and in this Russia has a natural advantage, when it comes to nuclear power plants, especially sending them into space, it leads the world, it is ahead of the United States," Wu Weiren, chief designer of China’s lunar exploration program, told Reuters on the sidelines of the conference.

The space race is real, people mocked ‘space force’ when it deployed in the first trump administration, but the truth is space will be one of the critical theaters of conflict in the future (if it isn’t already).

NASA’s Clearest image ever of Jupiter’s Moon IO is stunning:

MOST AMAZING KEYBOARD

I love these keyboards from Serine Industries. Machined from a single blocks of aluminum, magnetic switches for smooth, analog precision and LED lit keys. These are beautiful:

BOOKS

Keith is a wild boy, extremely outspoken and resultantly polarizing over the past few years. However one feels about his social media antics, he has undeniably contributed to the soul of downtown manhattan. Odeon, Minetta Tavern, and Balthazar are Iconic institutions that should be protected with Landmark status.

I’m excited to read his memoir: I REGRET ALMOST EVERYTHING

As a father of daughters, I found his post on his daughter moving ou as a grown 20 year old a foreshadowing of my future. Admirably she is one of the most in-demand new faces on the fashion scene and manages to have no social media presence. See the feature on her in SSENSE.

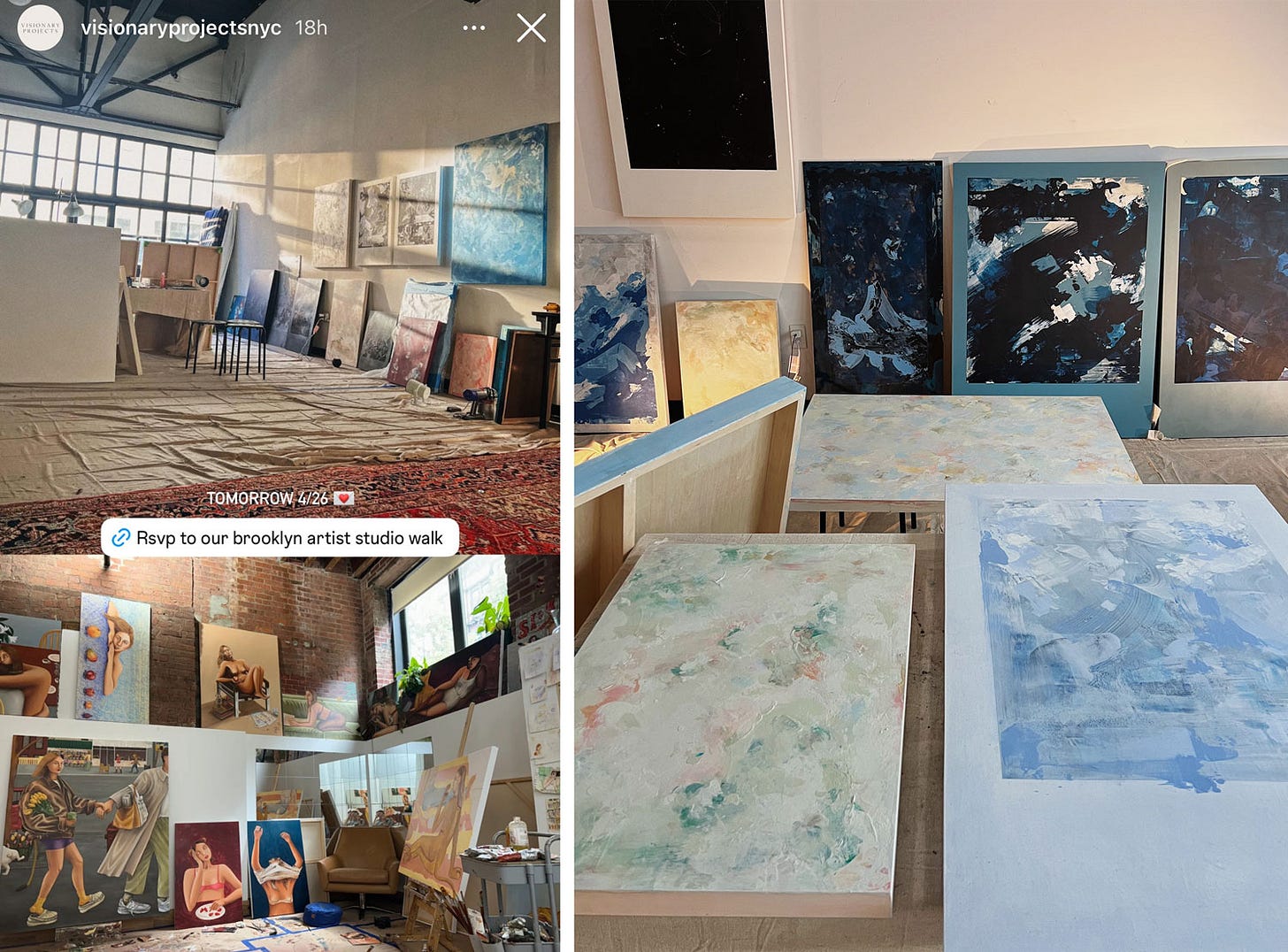

MY ART THIS WEEK. A STUDIO VISIT WITH VISIONARY PROJECTS.

I had my first studio tour this weekend, much thanks to Visionary Projects for bringing a great group through.

More of my life and process here.

- Thats it for this week.