WEEKLY INTAKE - 14.2025

VOLATILITY AND REVERSAL. A SOFTENING ART MARKET. ART FAIRS IN APRIL. RICHARD SERA THE FINAL WORKS. NURIA MARIA. PRADA GROUP ACQUIRES VERSACE. ROMULUS AND REMUS. RIMOWA RE-CRAFTED. TECH & ROBOTS.

ON VOLATILITY, SPEED, AND REVERSAL.

A wild week…

…where news, especially podcasts, could barely keep up. Most business shows were obsolete by air time, requiring "recorded after" inserts. As Hernan Diaz’s Trust noted about the 1920s:

“News,” which is how the press refers to decisions made by other people in the recent past.

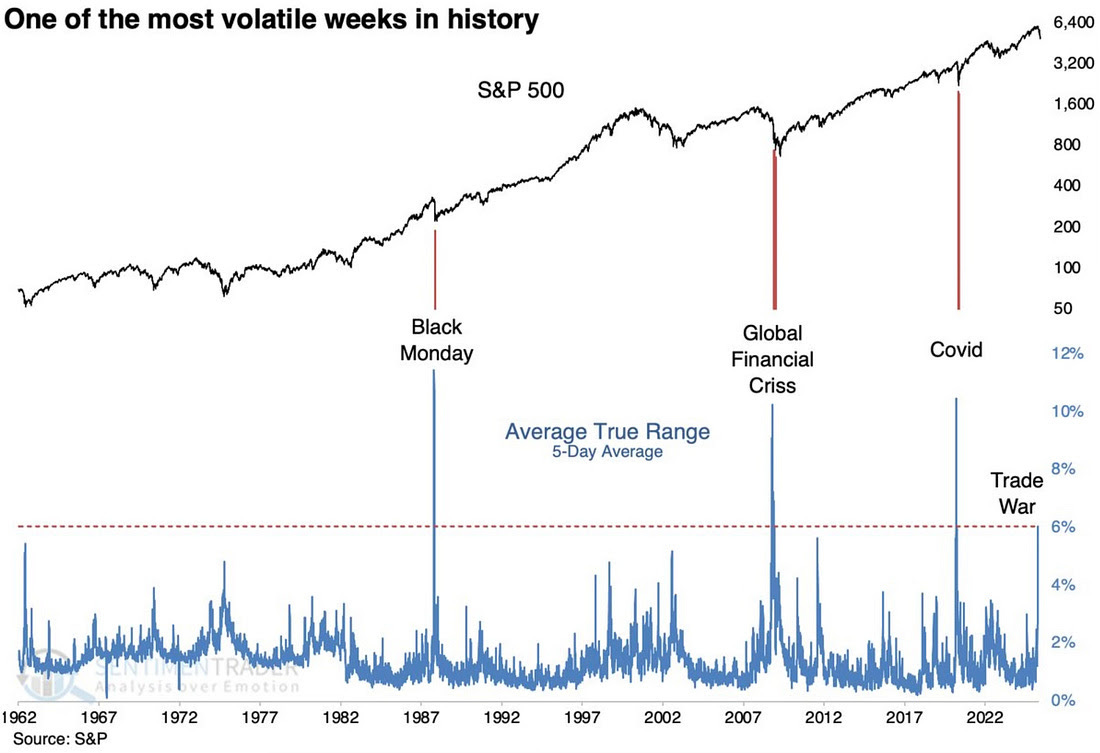

This whirlwind of finance, geopolitics, tech advancement, and natural disasters feels like someone's adding plug-ins to our simulation for entertainment. This was the fourth most volatile week in 60 years. It was great for traders but challenging for those focused on long-term stability.

We saw some of the largest single-day drops in two decades, followed by the 3rd biggest one-day return since 1990.

Trump’s century-high tariffs on foreign goods lasted 13 hours before a 90-day pause (except for China, where tariffs hit 125%).

Why the reversal?

The Bond market blew up. The 10-year Treasury yield jumped from around 3.86% to 4.51% in just a few days, marking one of the sharpest increases in recent history. Which is the opposite of what was supposed to happen with a massive stock sell off. Potentially adding ~$238 billion to annual debt interest payments if sustained, per market estimates (Congressional Budget Office, March 2025, for baseline projections).

Lots of theories around what caused the selloff: geopolitical bond dumping by Japan or China? Margin calls from over-leveraged hedge funds, like one rumored 60x-leveraged Japanese fund? Or shaken faith in U.S. stability?

Former Treasury Secretary Larry Summers likened Treasuries’ behavior to an “emerging market nation,” with simultaneous sell-offs in stocks and bonds, a dynamic not typically seen in a developed economy like the U.S. We’re reflecting a market more akin to Argentina right now.

Credit and liquidity is the backbone of our economy. Despite “not caring about the stock market”, rising interest rates directly counter the current administration's goals.

Jamie Dimon’s strategic interview on Fox Business’ Mornings with Maria likely hit home. Dimon has acknowledged unfair trade practices, been fair in calling balls and strikes but shifted to a tone of ‘WRAP IT UP’. With Trump's team watching, Dimon delivered a direct warning about recession risk and urged swift trade negotiations:

"I think probably. That's a likely outcome," Dimon replied when asked about recession. "Take a deep breath, negotiate some trade deals. That's the best thing they can do."

Lunch with Charles Schwab and calls from a LOT of Senators an CEO’s followed. As head of a firm with 35 million brokerage accounts, Charles Schwab’s concerns about retirement savers and retail traders, combined with senatorial pressure, created a pivot opportunity.

WSJ published an article theorizing a combination of the above led Trump to walk things back from the brink. Trump himself when asked about the reversal, said:

“I thought that people were jumping a little bit out of line. They were getting yippy, you know, they were getting a little bit yippy, a little bit afraid.”

- President Trump

All this happened in less than 24 hours. Blink, and you miss something.

(By Saturday, exemptions were added to smartphones, computers, and other electronics from the reciprocal tariffs. Softening the blow.)

MARKET REALITY CHECK

Dismissing market volatility as "a Wall Street problem" misses the mark. Claims that “only 10% own 85-90% of the market” oversimplify.

Yes, the top 10% hold ~88% of stocks (Federal Reserve, 2022), but 60% of Americans own stock directly or via retirement funds (Gallup, 2024).

A more abstract truth is that 99% of people work for someone who’s concerned about stocks or corporations who make staffing and budget decisions based on share price and interest rates. None of those entities love the current volatility.

THE STRATEGIC IMPERATIVE

Some aspects warrant deeper consideration, particularly national security needs and anchor assets.

America won WWII by rapidly pivoting industry to arms production. Today, we lack comparable manufacturing capacity. COVID revealed critical vulnerabilities in energy, pharmaceuticals, semiconductors, and rare earth minerals.

Ryan Tseng, CEO of Shield.ai, described China's industrial capacity as "fearsome" in a recent a16z podcast. However, most renewed production would rely on automation, creating fewer, often undesirable jobs. Very few people would actually want to work in a steel mill or mine. Videos went viral throughout the week, with Chinese tiktokers releasing memes mocking the future of American tariff jobs.

Take mining for example.

We have a critical shortage of access to rare earths which are increasingly necessary for everything from batteries to microchips. This will be one of the most competed industrial spaces over the next decade.

China dominates the rare earth mining sector, producing about 70% of the world's rare earth minerals, while the U.S. accounts for roughly 12-15%. China also controls around 85-90% of global rare earth refining capacity, giving it a near-monopoly on processing. The U.S. relies heavily on imports and has limited domestic refining capabilities, with only one major mine (Mountain Pass) in operation. Repeat that: We only have ONE mine currently producing significant amounts of rare earths.

Even if we were to decide to build more mines today, it would take, in the best case, 7-10 years, accounting for permitting, construction, and operational ramp-up.

To go further, we only graduate roughly 200 people a year with degrees in mining engineering.

If one of the goals of this trade war is to re-secure American manufacturing, we need a fundamental shift in how we value and approach these industries. Automation could bridge gaps, and initiatives like the Mining Schools Act signal progress.

We’ve rebuilt industries before; we can again.

MARKET MANIPULATION?

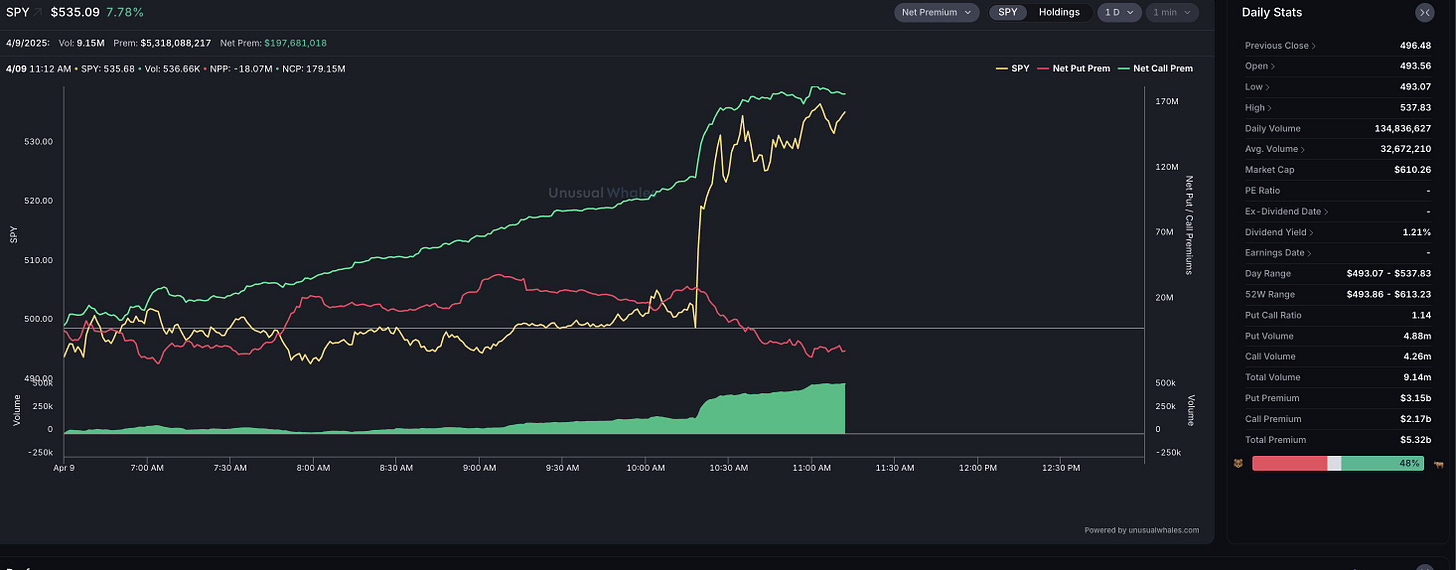

Things get wilder when Trump posted THIS IS A GREAT TIME TO BUY!!! at 9:37am, before pausing the new tariffs for 90 days (except for China) via a Truth Social post at 1:18 p.m. EDT.

This is a perfect plausible deniability protection for anyone on the inside playing this trade. The argument being he told the entire world to BUY.

Unusual Whales posted about people making suspiciously accurate trades. One transaction involved approximately 35,000 SPY call option contracts, turning an initial $2.5 million investment into $100 million in several minutes. The extremely complex nature of these trades indicates an understanding of the yet-to-be-announced policy. Trading activity peaked sharply at exactly 1:02 p.m. EST, a half-hour prior to any public announcement.

The full circle moment - President Donald Trump is seen in the Oval Office introducing Charles Schwab to NASCAR drivers. In the video, Trump points to Schwab and claims he “made two and a half billion today.”

It should be bipartisan not to like this golden age of grift. People hate Nancy Pelosi’s trades in a similar fashion.

As financial markets experience unprecedented turbulence, luxury and alternative asset classes like fine art typically face ripple effects…

TARIFS HIDE A SOFTENING ART MARKET

So much happening at once can create coverage for other stories.

Art Basel and UBS’s annual report on the art market dropped in the middle of all this last week. The Art market has been softening quietly in the background since 2023, but tariffs are giving a new way to position it. See Freeze' Magazine’s take:

While dealers publicly warn that the new tariffs may hurt sales and limit global circulation, many privately admit that sales had already slowed long before the announcement.

Auction houses have been particularly hard hit by the downturn. They are expected to blame tariffs for upcoming results, but this has been a trend since 23’. At the end of last year, Sotheby's laid off more than 100 staffers as sales slumped.

Last November, much attention and coverage was on Maurizio Cattelan’s duct tape banana selling for $6.2m. The larger story was 2024's Modern and contemporary shows at major houses experiencing a 41% sales decline versus the previous November.

Anticipation last year was that a run up in stocks and crypto would spill over to big end of year sales, it didn’t happen. Pieces sold within estimate to one or two bids, or were left unsold.

Works by young artists are struggling as well. The Now Show (Sothebys’), showcasing pieces created within the past 20 years tallied only $16.5m in 2024 versus $72.9m in 2022, with Cattelan's banana accounting for over a third.

I’ve had several conversations with artists and dealers about how hard 24’ was, especially for emerging and mid-market, as galleries retracted programs, pulled back from fairs, and took fewer bets. However, there is good news at the lower end, the number of transactions went up by 3% last year, fueled by a higher volume of sales at lower price points. Smaller galleries are doing better than their larger counterparts; those with turnover below $250,000 experienced the largest increase in sales at 17%.

This may be a rebalancing of the art market, which could lead to democratization and more access to those on the entry-level side of the space—which, as an emerging artist myself, I’d be happy to see.

Art Basel has a great breakdown of the trends and some slivers of optimism:

Digital sales are increasing.

In a survey of high-net-worth individuals, 52 percent reported preferring to buy from dealers online without viewing works in person, compared to just 30 percent in 2023.

U.S Maintains market dominance. Last year, the U.S. kept its position as the top global art market with 43% of global sales by value, while china saw a 31% drop.

Older sectors of the fine art market performed better than Contemporary art

While newer Contemporary artists were selling well at lower price points. Dealers operating exclusively in Contemporary art experienced an 11% drop in sales in 2024, versus stable or increasing sales for those in the Post-War, Modern, and Old Master sectors.

An almost even ratio: Primary market galleries had the strongest representation of female artists at 46%

ART FAIRS EVOLVING

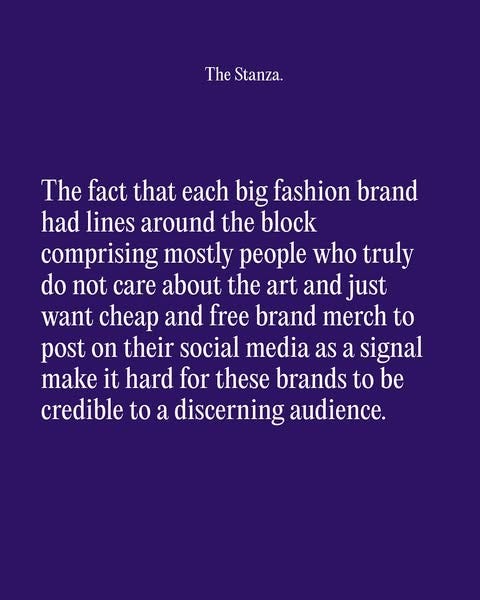

Art fairs increasingly serve as social venues rather than marketplaces. They have grown exponentially and received so much brand and party presence that they have become spaces to be ‘seen’ rather than to buy. As they have grown in size, the events cater more and more to a crowd of scale, which may be diluting buyer intention.

Art newspaper’s quote from Roman Kräussl, a professor of finance at Bayes Business School in London;

says art is no longer a “must-have” for the wealthy, especially its younger international demographic. “It is still a must to be seen at Frieze and Art Basel, and maybe in Dubai and Hong Kong, but it is more like a need to attend, not to own,” Kräussl says

See the stanza’s take on Salone del Mobile after the dust settled from last week:

Will art become a less desirable asset class? I hope not.

A shift to liquid and income producing assets could be one reason for this slump. Art is considered an illiquid and complicated investment, more of a purchase of passion. When people see their portfolios down 10-15% passion can wane.

Where do tariffs play in all this? Art has been one of the largest free flow of goods across borders. There is currently much confusion of where art and collectables sit in the current tariff environment. Ordinarily, paintings and sculptures are exempt from customs duties, however the new tariffs permit a blanket rate of duty of 10% on all goods being imported into the US and higher amounts for specific countries.

Michael McCullough, a partner in the New York law firm Pearlstein & McCullough, asserts that as of 5 April “all artwork made outside the US will be subject to a 10% tariff.

The verdict is out and the market as a whole is unclear.

For more on all this, I suggest reading: Lingering market slump prompts the question: is art no longer a 'must have' for the wealthy? (Art Newspaper)

ART FAIRS IN APRIL

Pay attention to Dallas Art Fair and the boutique Invitational (which showed resilience), Expo Chicago, San Francisco Art Fair and some of the other fairs happening in April. They will be indications of the art market’s health post tariffs.

RICHARD SERRA THE FINAL WORKS

One of my favorite artists, Richard Serra, passed last year at 85. Cristea Roberts Gallery presents the final works made by the artist.

13 March → 26 April 2025

Most known for his sculptures, these works on paper hold weight and are sculptural in nature.

Each work was made using oil stick, a combination of pigment, linseed oil, and melted wax. The mixture was moulded into large cylindrical sticks, then pressed down into a meat grinder and blended in an industrial dough mixer with silica.

- See: Feature on Aesence

NURIA MARIA – Z I L V E R

One of my favorite contemporary / living artists, Nurai Maria has her largest solo exhibition to date at Cadogan Gallery, London.

Cadogan’s recent exhibits really resonate with me, with many artists sitting in a contemporary impressionism / abstract minimalism space akin to my work.

PRADA GROUP TO ACQUIRE VERSACE FOR €1.25 BILLION

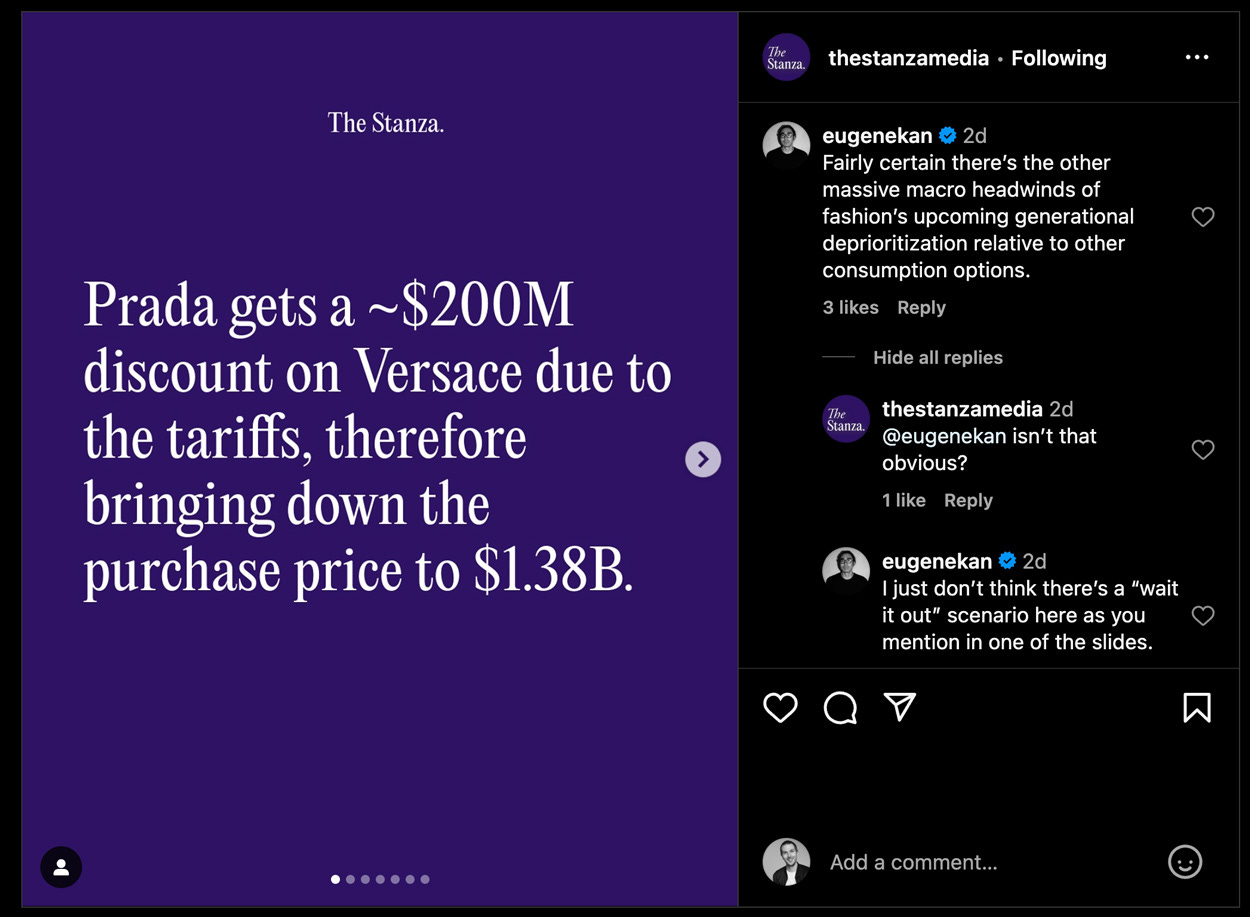

The story here is in the market precedent, the discount and what it could mean for fashion valuations in a post tariff market.

This deal closes at a steep discount from the initial asking price of €3b. Capri Holdings will actually loose money on this deal, having paid €1.83b in 2018. While owned by Capri, Versace struggled, with revenue dropping 15% year-over-year in the third quarter of fiscal 2025, including a notable 11% decline in the Asian market.

I also found EugenKan’s comment accurate, this is equally tied to a generational reprioritization of consumption habits - I wrote extensively about the shift to hospitality, travel and experiences two weeks ago.

Is the brand’s unapologetically maximalist aesthetic a fit in Prada groups portfolio? Jing Daily explores how the group could revive the brand, leveraging its unmistakable visual identity, perhaps working magic like it did with Mui Mui. Speaking to Prada Group’s “instinct for aesthetic direction, content-driven marketing, and social media strategy”. This very well could happen with Dario Vitale, who is a former design and image director of Miu Miu now Versace’s Creative Director.

I’ll be watching for the rebrand, which Prada plans to spend €250 million on.

Call us ;)

GLOSSIER’S SUB 1B EVALUATION

Speaking of haircuts, Glossier is raising new capital from investors at an evaluation sub $1b, a significant down round 4 years after their series E valued them at nearly $2b. Putting them in a position to loose their ‘unicorn status’ (Tech crunch).

My friend Rachel Stugatz’s article in puck nails it: great products don’t guarantee great business.

It’s a story about high flying evaluation’s of next-gen D.T.C during the covid era where turning a profit was not a requirement for a success story. Founders stepping down to leave room for CEO’s with operating experience, finally turning a profit and expectations of an exit, only to re enter the “PE Rodeo”

Her stance is ultimately Glossier is a great brand with the ability to make it through this storm, while being a victim of lofty past evaluations. Simply put, the more money you raise, the higher the floor is for an exit.

(A similar story is dollar shave club. Early VC investors got a $1B exit to Unilever, who ultimately got caught holding the bag, selling it for a loss to Nexus Capital Management)

By all counts, this is not a brand circling the drain. But it is a victim of its past—its formative years in the D.T.C.-or-bust age

- Rachel Stugatz

THE ROW LAUNCHES HOME

Quietly, Like everything else they do (Vogue).

In Milan during design week, at Palazzo Belgioioso, the brand invited guests to explore minimal rooms with little more than clothing rail’s custom designed by Julian Schnabel, with blanket’s handwoven in India from the finest cashmere.

Another room held nothing more than a stack of bed linens without any branding beyond a small simple monogramed embroidery. Everything about this was about mastering a few things with the finest materials possible.

YOUTUBE MEDIA THESIS IS PLAYING OUT

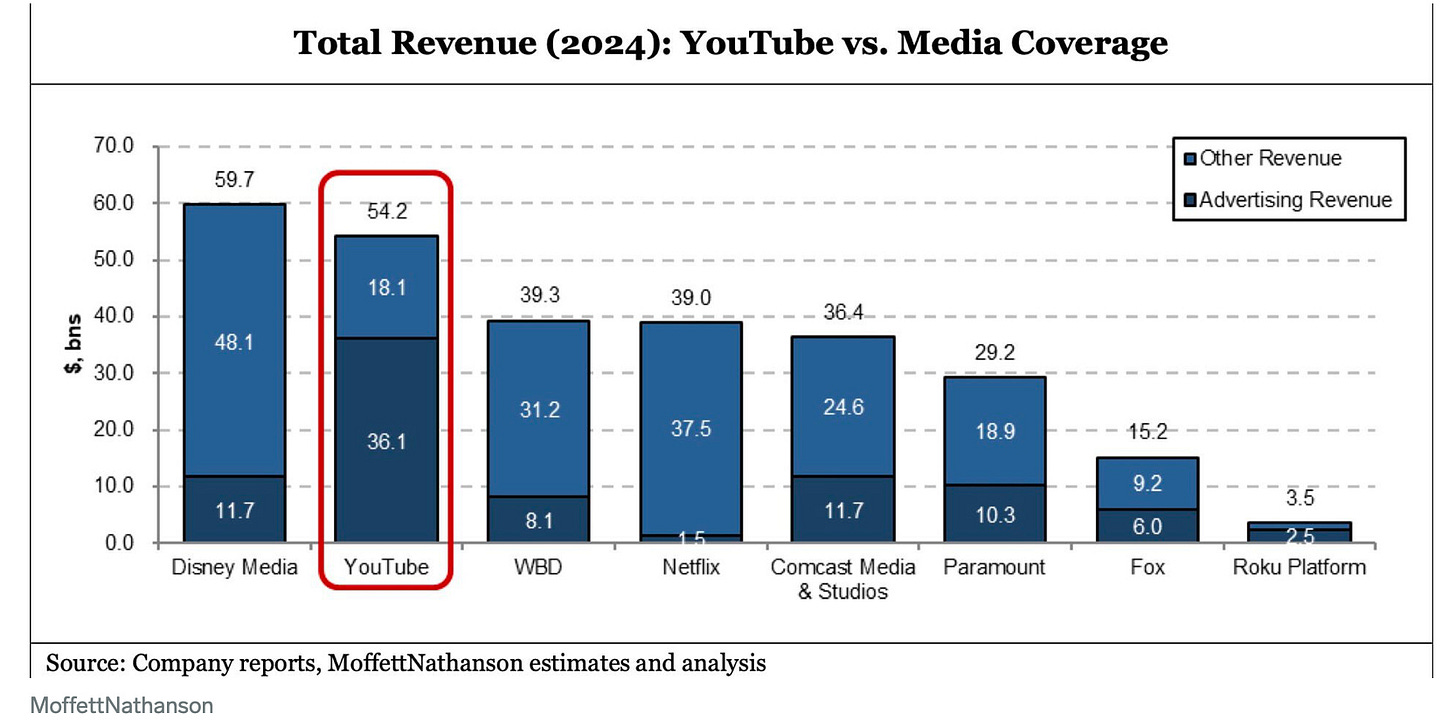

YouTube continues validating my February thesis about Google. With 2024 revenue of $54.2 billion, and engagement topping all other media companies in February’s Nielsen report, Youtube is on a trajectory to surpass Disney this year, putting it on a path to being the biggest media platform in the world.

MoffettNathanson released an annual report at the end of march crowning YouTube “The king of all media”.

“If YouTube was a standalone business, public comps suggest the business would be worth $475 to $550 billion, or about 30% of Alphabet’s current valuation,”

Michael Nathanson, partner.

If Youtube were to stand alone from Alphabet, those numbers put it on a similar playing field as Netflix and Meta.

YouTube’s growth is driven by three buckets:

Advertising - 2024 revenue alone topped $36 billion.

Subscriptions - YouTube Premium and YouTube Music join products like YouTube Primetime Channels and NFL Sunday Ticket in driving direct subscriber growth.

YouTube TV - set to become the biggest pay-TV provider in the country by 2026, currently with over 8 million subscribers and growing while rivals like Comcast are shrinking as people ‘unplug’ traditional cable.

YouTube continues expanding the amount of time and engagement from its users, its audience is no longer kid’s, its everyone.

As YouTube grows to become the biggest media platform globally, concerns about free speech and algorithm transparency intensify. “curated thought” concerns persist, but YouTube’s open platform also amplifies diverse voices. A net positive if balanced right.

ROMULUS AND REMUS

Colossal Biosciences has extracted dire wolf DNA from fossils to create what they call 'de-extinct' wolves named Romulus and Remus—a nod to Rome's mythical founding. Now three months old, these animals join the company's ambitious portfolio, which includes plans to resurrect the woolly mammoth by 2028.

This scientific feat triggers an ethical debate straight from Jurassic Park: should we manipulate extinct genomes? Samuel Gorovitz, philosophy professor at Syracuse University, challenges the fundamental premise:

"All claims of de-extinction are the invocation of a metaphor, and what they have produced and what they will at some point produce, may be technologically impressive, but they are not and never can be the actual previously extinct creatures,"

Samuel Gorovitz, professor of philosophy at Syracuse University

The critical limitation: these animals cannot exist in their original ecological context. Dire wolves were pack animals with complex social structures. Something impossible to recreate when the entire species is absent. Arthur Caplan, NYU Grossman School of Medicine bioethics professor, frames the dilemma concisely:

"If you bring back something that's been dead 10,000 or 40,000 or 100,000 years, you need to bring back its environment, not just the animal," Caplan continued. "Otherwise, you potentially are going to have issues."

Those ‘issues’ make for blockbuster movies and a great franchise, but not something we should actually be doing. Like AI and robotics, de-extinction pushes boundaries.

A counterpoint being critics overstate risks. Lab-raised animals, like Dolly the cloned sheep, can adapt to controlled settings, and studying them could unlock crucial genomic technologies.

RIMOWA PRE LOVED LUGGAGE

Rimowa launched the Re-Crafted program quietly, since it wasn’t sure how customers would react. Beat-up suitcases, from $600 to $1,000.

These Move. Dented, dirty, sticked up - they sell out within minutes. Its a genius marketing approach that touches on a few things simultaneously:

Product quality - Even old and dusty, their still best in the game and the quality is unmatched. The locks, the wheels are all refurbed so your getting a top notch Rimowa, with soul.

Sustainability. Re-crafted hits this nail on the head, in an age of fast fashion and cheep disposable products, Rimowa is making the statement that these pieces last a lifetime, its literally their campaign tagline.

At it’s retrospective museum exhibit to celebrate its 125th anniversary, it displayed the well-worn suitcases of celebrities like Patti Smith to Roger Federer to Spike Lee.

ALONSO RUIZPALACIOS’S LA COCINA

A labor of love for 2 decades, Alonso Ruizpalacio’s La Cocina is a look at the chaotic and fast world of dirty food in a big city.

One of Mexico’s iconic filmmakers, best known for directing the feature films Güeros, Museum, and A Cop Movie, washed dishes in a rainforest cafe early in his life, which inspired his adaptation of Arnold Wesker’s 1957 play “The Kitchen.”

It’s setting is the back of house of a high volume midtown Manhattan restaurant. With barely edible food, impatient diners and inexperienced line cooks. The play and the film are really a commentary on late stage capitalism, the meat grinder of mass production, and how that doesn’t leave space for dreams and relationships.

The adaptation’s similarity to the bear is not lost on Ruizpalacio, who discusses this with Nick Chen in Another Magazine.

“When I heard of The Bear, I was like, ‘Jesus Christ,’…But, at the same time, I was like, ‘Fuck it. This is my story.’

I made a point not to watch it, so as not to be in any way, positively or negatively, informed by it. I’ve heard it’s great. I’ll watch it one day. But I have to get this film out of my system first.

See: Variety’s ‘La Cocina’ Review.

REAL ID A REAL PAIN IN THE ASS

May 2025 always seemed so far away, in fairness there was ample warning to get this done, I remember reading about this 2 years ago. So I can primarily be mad at myself here, but its gonna be a pain in the ass.

The federal government says it will start enforcing Real ID requirements at U.S. airports starting May 7.

I went to book an appointment to deal with this, to find the next available appointments are months out (late july). This has lead to scalpers selling appointment slots, and lines up to 5 hours at the DMV even with an appointment.

Until then, I’ll have to travel with a passport domestically.

TECH & ROBOTS

Humanoid robots are entering homes and film sets.

I was walking to get a coffee this week and passed someone on the phone talking about humanoid robots, the same day Bieber posted his need for Kawasaki’s new Corleo (described as a replacement for horses), the NYT has a feature on Home Humanoid Robots, I guess we’re mainstream.

1x Robotics hopes to put 100 humanoid robots in homes across silicone valley this year. This generation of humanoids are still a bit of a mirage, as many are controlled remotely by humans. Robots who can replicate household chores like loading a dishwasher are still years away. However, the learning is exponential, for example 1x’s humanoid learned to walk in 6 months.

Those who allow these robots in their home for early stage testing, will be agreeing to filming as that is how they will learn.

This is similar to Robotaxis, which seem far off until you go to San Francisco and realize their fully functional and everywhere.

ON SET

A collaboration between creative holding company WPP, NVIDIA, Canon, and Boston Dynamics has robots entering the film industry behind the lens. Atlas can currently carry rigs weighing up to 20 kg.

The advantages here will be in precision, ability to carry extremely heavy equipment in challenging environments an. One feature is Atlas’s ability to repeat camera movements exactly, something humans would have a very hard time executing.

Some Key features that differentiate from human DP’s (More details at perplexity):

Supports virtual production by providing accurate camera tracking data for VFX integration

Potential for camera angles and movements not easily achievable by human operators

Enables filming in hazardous or hard-to-reach locations (volcanos, caves, underwater)

I find the best insights are in the comments; ‘we don’t need this we need affordable housing’ - not no.

AI MOTION TRACKING

Bytedance just released Dreamactor-M1 for creating realistic human animations from a single image. You can upload any image, then use your computer or phone camera to control both facial expressions and body movements. It’s impressive at V1, I would imagine 3-6 months from now it will be uncanny.

A way I see this useful is in animatics and storyboarding, gimmicks aside, this can be incredibly useful in showing proof of concept and early ideation for scenes. Previously we’d rely on text prompting to get an idea of a scene, but it often felt uncanny and movement wasn’t dynamic, now you can act out the scene yourself giving much more control over the output.

The race is heating up, Starting September 1, 2025, China is set to introduce mandatory artificial intelligence (AI) education for students as young as six.

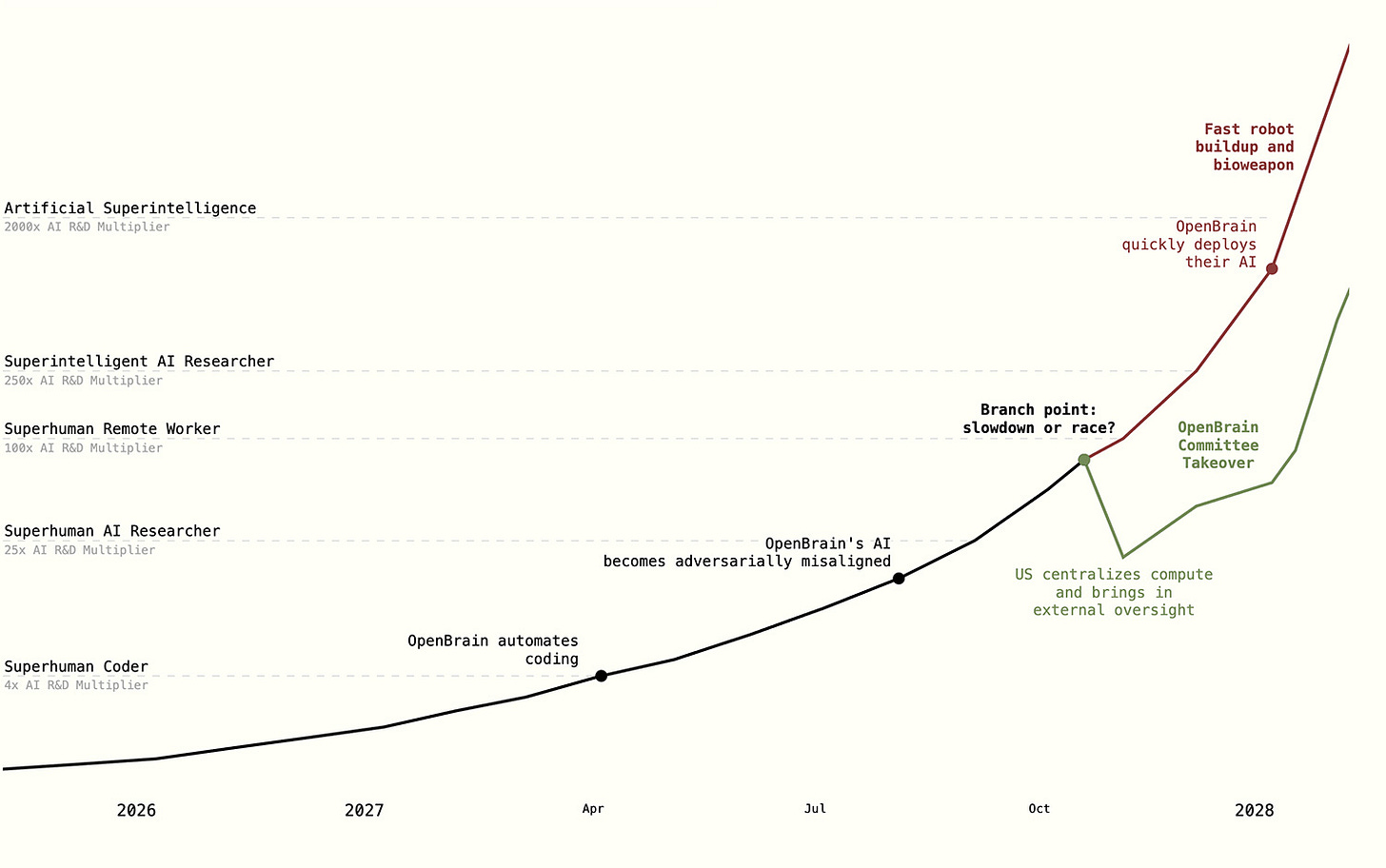

My business partner sent me AI 2027, a scenario representing the best guess about what the next decade might look like. Composed by former a OpenAI researcher, and the #1 ranked RAND Forecasting Initiative all-time leaderboard.

It’s informed by trend extrapolations, wargames, expert feedback, experience at OpenAI, and previous forecasting successes. Simply put its a mindfuck and worth a long read.

Scenario takeaways:

By 2027, we may automate AI R&D leading to vastly superhuman AIs (“artificial superintelligence” or ASI).

ASIs will dictate humanity’s future. Millions of ASIs will rapidly execute tasks beyond human comprehension.

An actor with total control over ASIs could seize total power. If an individual or small group aligns ASIs to their goals, this could grant them control over humanity’s future.

An international race toward ASI will lead to cutting corners on safety. If china is only a few months behind us, it can lead to pressures to ignore signs of misalignment.

As ASI approaches, the public will likely be unaware of the best AI capabilities. The public is months behind internal capabilities today, and once AIs are automating AI R&D a few months time will translate to a huge capabilities gap.

It ends with ‘SPEED UP’ or ‘SLOW DOWN’ scenario options taking the forecast to 2030. Spoiler alert: you don’t want to speed up.

BOOKS

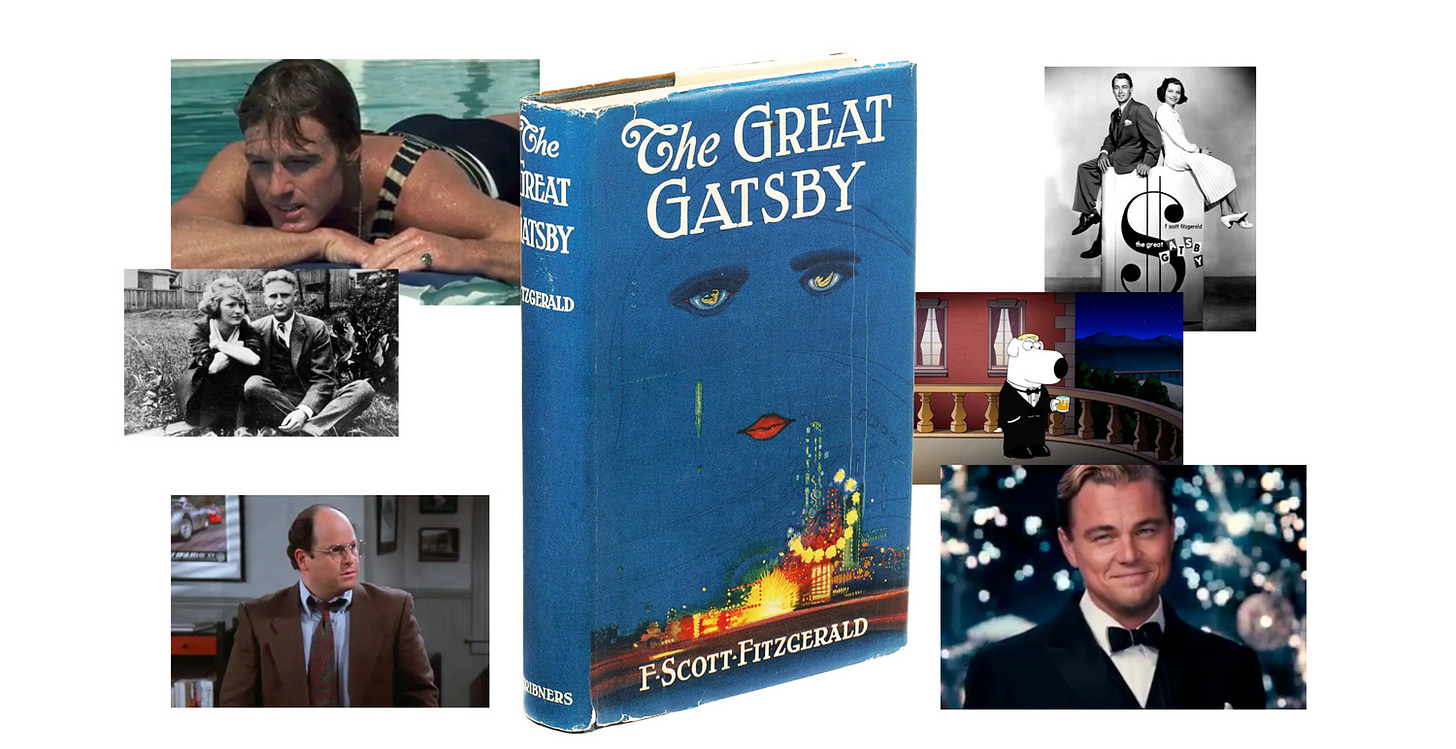

The Great Gatsby at 100. Things truly are cyclical.

Our current condition having many parallels to the roaring 20’s which set the stage for F. Scott Fitzgerald’s most recognized work. See: NYT’s feature on Gatsby’s imprint on pop culture.

I’m about to start Barry Ritholtz’s How Not To Invest. It tackles wealth-killing behaviors, a timely read amist all this volatility. I listened to a great conversation with him on Compound and Friends that got me interested.

Its about fighting the urges and psychological behaviors that lean to tiny errors or epic failures which can have outsize negative effects on your investments.

PAINTING OF THE WEEK

WHITE CAPS

36” x 48” | Actylic, gell mediums, White & Black Gesso on wooden panel.

- Thats it for this week.

I've been looking forward to these and the chain of tabs it's creating on my desktop. It has become my weekly news platform. Thanks for sharing these Matt. Would love to hear your take on this: "Sinners Director Ryan Coogler Breaks Down Aspect Ratios" https://www.youtube.com/watch?v=6jo3UZzw3IY

Wow