Weekly Intake - 11.2025

HAS APPLE PEAKED? SYD MEAD. A BIG WEEK FOR SPACE. EUROPEAN RESURGENCE. DEMNA. JONATHAN ANDERSON. FED'S DATA PROBLEM. MILLENNIALS ARE DOING ALRIGHT. JOB HOPPING ISN’T PAYING. ODYSSEY CAST IS STACKED.

“Be greedy when others are fearful, and be fearful when others are greedy" - Warren Buffet.

I forgot to be fearful in January…

HAS APPLE PEAKED?

Once synonymous with innovation, The brand has not blown me away in quite some time. Prof G markets dug into apples weird few years debating whether it ‘lost its mojo’ - Scott Galloway goes as far as saying he’s off-loading his entire portfolio of apple stock this year. (granted, he did very well, indicating he bought it at around $4 a share). Apple shares have fallen 16% this year, now with a PE at 38 and only 2% growth.

Tim Cook will remain one of the greatest CEO’s of our time, he is not worried about his job. During Cook's tenure, Apple's stock price surged by 1,785% and saw market capitalization increase by approximately $3.45 trillion, rising from around $350 billion in 2011 to over $3.8 trillion by early 2025.

Apple’s current lull in innovation could stem from being too comfortably profitable. Why innovate when you can sell a new phone with your eyes closed every 3 years (As of 2024, approximately 28% of the global smartphone market is held by Apple's iPhone), and the margins on AirPods are incredible?

GE had similar issues in the early 2000s - Over-expansion and Diversification being major factors in its downfall.

Balls Apple has fumbled:

Vision Pro was a flop, then abandoned due to weak sales.

Canceling the Apple Car after spending 1 billion a year for a decade (nearly 1/5th of its total R&D budget). They could have released a pre-order, captured tens of thousands of sales, and regained a hype cycle.

The phone has basically been the same for a decade.

Product launches are no longer must-see events, the most recent being a really underwhelming tweet:

Delaying their newest Siri update indefinitely under AI concerns doesn’t help, as they were already under heavy criticism for being so far behind in artificial intelligence generally. Apple’s top executive, who was overseeing Siri’s virtual assistant, told staff that delays to key features have been ‘ugly and embarrassing’ in a recent town hall meeting. There is now infighting between product and marketing teams as a decision to publicly promote the technology before it was ready-made matters worse.

What turns this around? Become innovative again. Apple sits on a war chest of cash, SPEND IT. % of revenue to r&d needs to be higher.

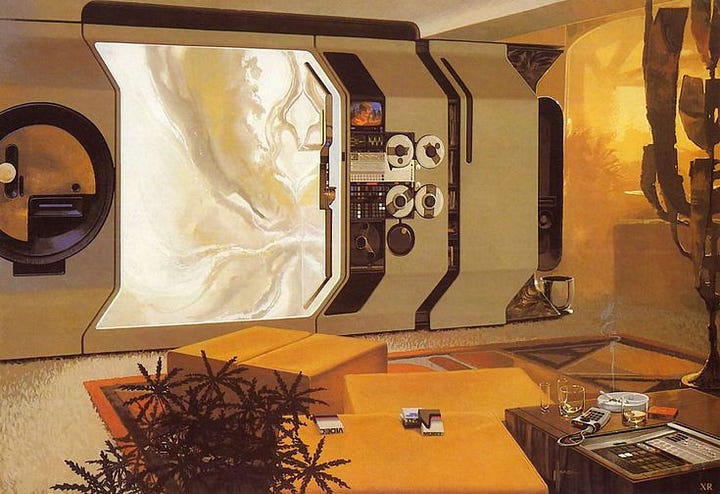

SYD MEAD: FUTURE PASTIME

Speaking of design lead futurism…Your favorite designer’s favorite designer has a retrospective in NYC through the end of May.

Outside of Mœbius, Syd Mead may have had the MOST impact on modern futurism. His work on films from Alien to Blade Runner, in turn, affected modern product design and architecture, so he literally shaped our vision of the future. Syd’s work has been a major inspiration to the sci-fi nerd in me since college; I’m very excited about this showcase.

SYD MEAD: FUTURE PASTIME

A Landmark Exhibition in New York City showcasing 40 years of Syd Mead’s visionary paintings

Curated by Elon Solo & William Corman

Opening March 27, 6:00 PM

March 27 through May 21, 2025

Tuesday–Sunday, 10 am–6 pm

534 W 26th St, NYC

ARTHUR C CLARK 1964 WOLRD’S FAIR PREDICTIONS

Continuing the futurism theme, my old high school classmate Tim Urban surfaces this Arthur C. Clark video from the 1964 World's Fair with some prolific predictions.

If you haven’t read The Complete Arthur C. Clarke's Space Odyssey Series, DO.

The Kubrick movie is a classic but more of a visual feast. The Books dig much deeper into the allegory about ‘humanity’s exploration of the universe—and the universe’s reaction to humanity’. For example, the purpose of the obelisk is never explained in the movie. They are also very fast reads, each coming in at less than 500 pages.

A BIG WEEK FOR SPACE

Lets continue this wormhole, I’m a huge space nerd.

The last 5 years have seen rapid advancement in our exploration and knowledge of the universe, and the curve is exponential. Last week was a big one.

Space X rescue mission. Two NASA astronauts who had been stuck onboard the International Space Station (ISS) since June 2024 landed safely Tuesday night after Space X recovered them in the crew dragon.

This is a David and Goliath story in that Space X was brought in by NASA to rescue the astronauts after they had been stranded for more than nine months due to the failure of Boeing’s Starliner capsule (a $4 billion contract awarded to Boeing). The astronauts will not be paid overtime for the calamity.

While Musk is extremely polarizing, Space X's work in advancing humanity to a multi-planetary species is incredible. Space Baron’s is a great read on the gatekeeping and strong-arm tactics Musk, Bezos, and Branson have had to endure to overcome the incumbent legacy aerospace and government monopoly on the space industry.

James Webb keeps delivering the hits. Earlier this month, NASA captured the birth of a Star using the James Webb Space Telescope. The image was captured from 450 light-years away, something previously unimaginable. Scientists now have a detailed look at a protostar, a young star still in the process of formation, which will also give us a greater understanding of how planets form.

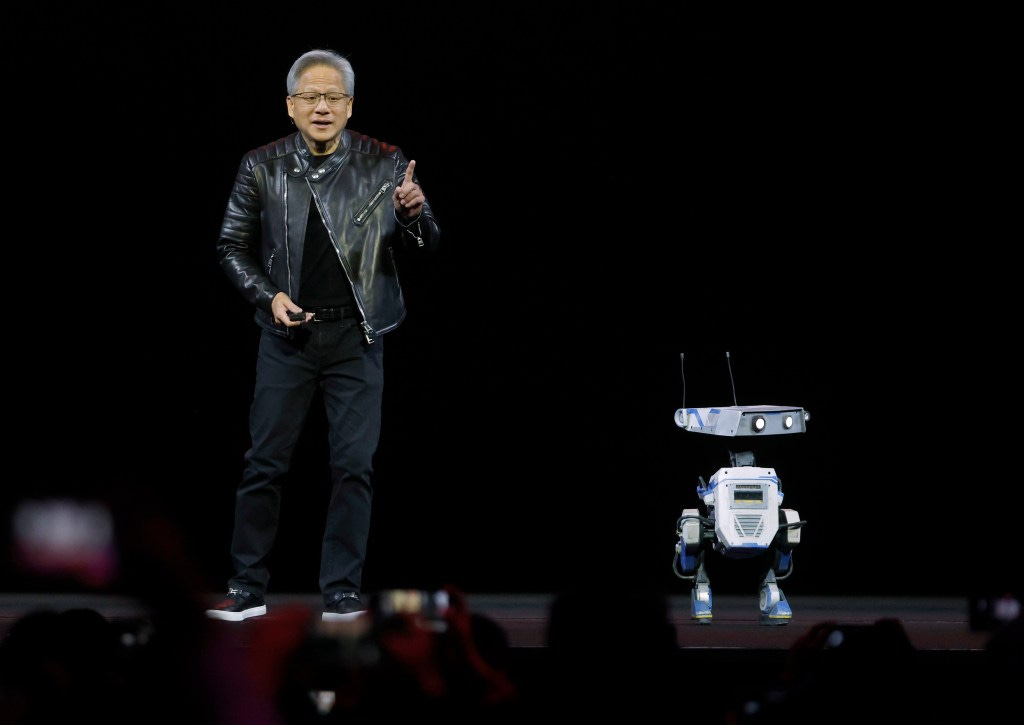

NVDA, DISNEY & DEEPMIND ARE DEVELOPING DROIDS

A childhood dream come true; I never expected to see real, functional droids in my lifetime. Nvidia’s partnership with Disney Research and Google DeepMind is a wanted alternative to Boston Dynamics' Skynet vibes (see their latest mobility tests of Atlas—imagine that chasing you).

This thing is cute and seems to have personality in how it interacts. Of course, it is a PR stunt to distract from more obvious military applications of said droids.

Powered by Nvidia’s Newton, a physics engine to simulate robotic movements in real-world settings, Nvidia CEO Jensen Huang announced at GTC 2025 on Tuesday.

Nvidia plans to release an early, open-source version of Newton later in 2025.

A EUROPEAN RESURGENCE

This has been a recurring topic across a lot of my podcast and news consumption over the past month.

European equities have outperformed U.S. stocks by the widest margin since 2000. The German DAX index has risen nearly 17% year-to-date, France’s CAC 40 has gained 11.5%, while the S&P 500's (YTD) total return is -4.26%.

The U.S. stock market now makes up 50% of the total market cap globally, meaning the rest of the world is CHEAP in comparison to how expensive US equities have become. If you believe in things being cyclical, we’re at the end of a 10 to 15-year run of US overperformance.

Outside the cyclical thesis, recent global events between Tariffs and the U.S. demanding at Davos that the EU cover a larger share of defense spending are catalysts, forcing the EU to awake from slumber. Changing US policy on Ukraine aid led to a massive run-up in European defense stocks.

See: EU Unveils $840 Billion Plan to Strengthen Defense

Europe is finally investing in itself and not just in Defense.

Ed Elson of Prof G Markets had an interesting perspective on the traditional 'risk-off' stance prevalent in European and UK markets, highlighting a historical scarcity of private equity (PE) and investment capital in these regions. This seems to be changing.

Some examples of Europe’s large innovation investments made recently:

Bloc-controlled satellite Internet: EU has set in motion a €10.6 billion plan to build a 290 satellite Internet system.

Space launch systems: Arianespace’s Ariane 6 rocket succeeded in its first commercial flight earlier this year.

France is building Datacenters:

Something said on last week’s Compound report sticks here, as much of this has already played out in the first four months of the year. The real money was made 6 months ago. ‘You can’t make money from a narrative because it’s already too late’

Credit to Scott Galloway for pushing this thesis when it was early enough to play on. (See his 2025 market predictions)

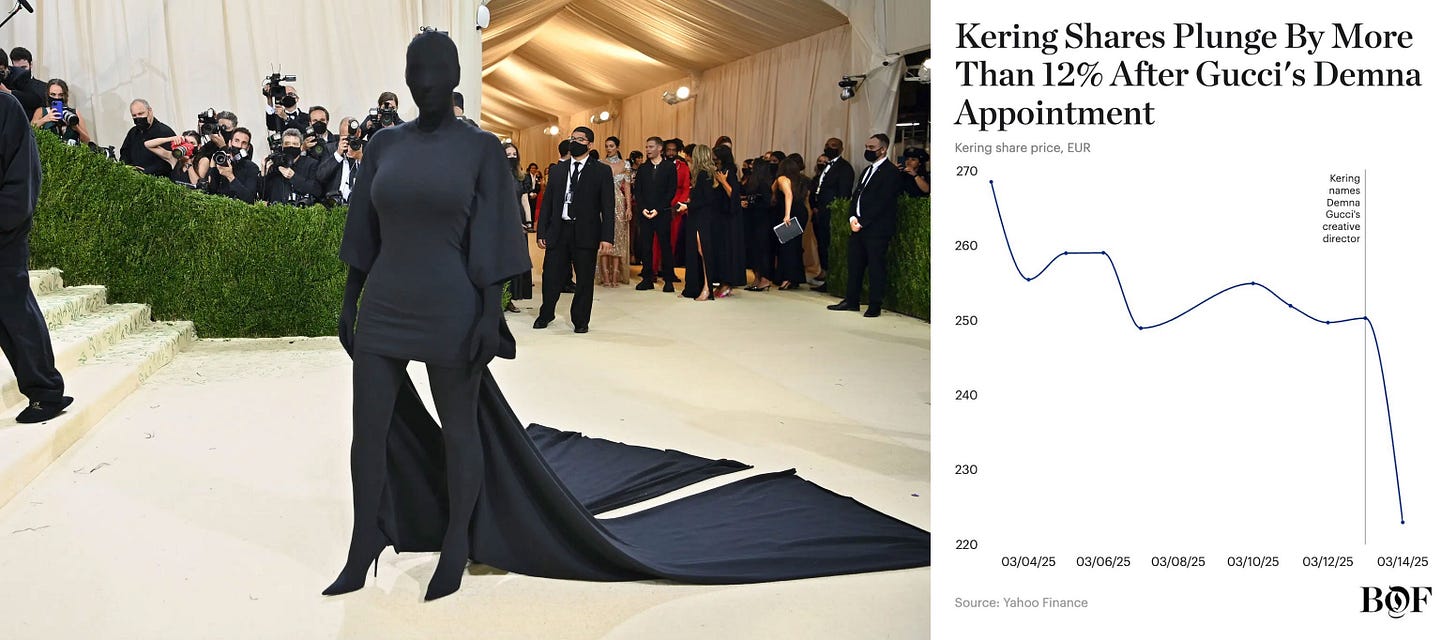

WAS DEMNA A DESPERATE MOVE?

This news caused a lot of “?!?” in my circles. That seems to be a wider sentiment, considering Kering Shares dropped 12% on the news.

Analysts at Jefferies said Demna’s appointment came as a surprise, while J.P. Morgan analysts called the move a “controversial choice,” citing early feedback on social media and fashion blogs and a “question mark” now hanging over the brand’s creative future.

-BOF

My initial reaction was that the brand fit is off, Demna is Berghain vibes, dark and almost sinister, Gucci is more maximal, colorful, playing with art references and codes. However, You cannot deny his control of hype cycles, celebrity affinity, and using sensation to drive brand. During his 10 years at Balenciaga, he grew revenue from an estimated $390 million to close to $2 billion. That sensationalism peaked in a negative spiral, his association with Kanye as he entered his most toxic antisemitic phase, into the bizarre 2023 campaign with pedophilic easter eggs riddled throughout.

Industry reporting leans toward Kering needing a reliable bet. Very few candidates with a track record are willing or able to take the position, meaning it reads more as a necessity than a strategy.

Demna will be the first “star” designer with a proven track record in Gucci’s 104-year history (NY Times).

There is no room for error here:

Gucci's prolonged sales decline, including a 24% drop in revenue in the fourth quarter of 2024 alone, has heavily weighed on Kering, with group shares down around 40% year-on-year. Source: Reuters

Gucci accounts for about half of group sales and two-thirds of profits.

This will come down to whether Demna can show a range or if he can show a departure, doing something different than Balenciaga.

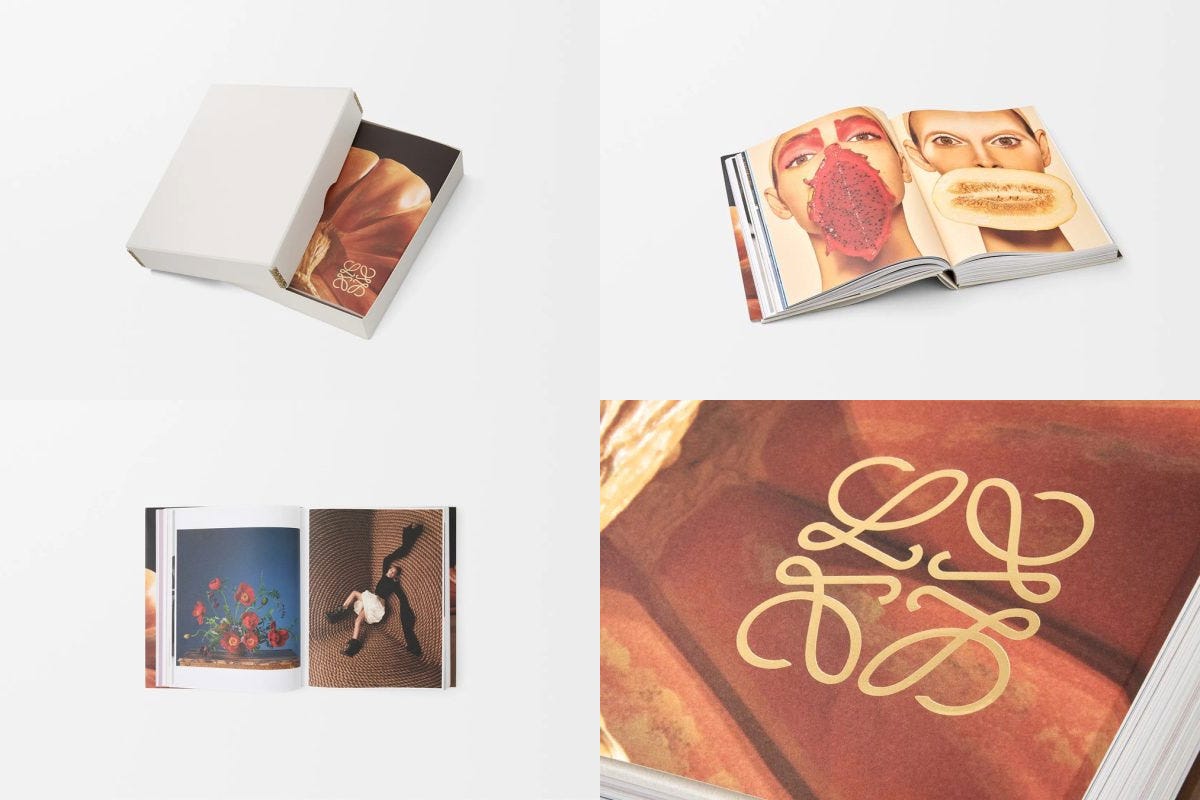

AS OPPOSED TO JONATHAN ANDERSON

Lvmh should do whatever it takes to Keep Jonathan Anderson within their ecosystem after his tenure at Loewe, which thrived under his direction.

There is much speculation that he will helm Dior. The social outpouring of his departure was very different than Gucci’s announcement of Demna, with much enthusiasm for his potential move, especially in China.

There is also something to be said about the value of tenure. Duration is fleeting. This is a trend beyond just fashion; we see it everywhere as younger generations don’t stay in one job very long. Anderson’s 11-year tenure is rare. Top designers in the industry typically change houses every five or so years.

JOB HOPPING ISN’T PAYING LIKE IT USED TOO

On the subject of job switching, it doesn’t pay off like it used to (WSJ). New data from the Bureau of Labor Statistics shows wage growth is slowing. This is an about-face from peak employment in 23, when switching jobs could net an average salary bump of 7.7%. This is a 180-degree shift in two years from the ‘quiet quitting’ era; in 2025, fewer Americans are quitting their jobs.

Massive layoffs in tech began a recalibration movement across many industries last year. The same positions are now being listed for significantly less than peak employment, with thousands of applications for each open role. This means people who negotiated their salaries during the pandemic have more incentives to stay at current positions and work towards raises.

The salary difference between those who stay in their roles and those who change jobs has collapsed to its lowest level in 10 years, according to the latest federal data.

-WSJ

THE FED HAS A DATA PROBLEM

Anthony Pompliano digs into the very very antiquated ways the fed receives data.

Our most critical economic policy decisions (e.g., interest rates) are made based on outdated and often inaccurate data or small sample pool surveys.

This leads to what feels like a consistently lagged policy. First, we took too long to raise rates; are we now taking too long to cut?

“The central bank didn’t raise interest rates until inflation was already out of control during the pandemic. We eventually saw inflation officially hit 9%, according to the government data. Inflation was not transitory as they predicted, and the American consumer suffered dearly.”

- Pompliano

Since real-time analytical data is widely available in the private sector, why would this data not be gathered through real-time credit/debit card spending, which could be gathered anonymously via card companies and banks?

Here is how the Consumer spending data in the US is currently collected:

Quarterly Interview Survey: This survey collects data on large and recurring expenditures, such as rent, mortgage, insurance, and utilities.

Diary Survey: This survey asks households to keep two 1-week diaries to record all purchases, focusing on smaller, more frequent items like food, meals, and personal care products.

Labor statistics are equally inaccurate. For example, the Bureau of Labor Statistics was forced earlier this year to revise the number of jobs created in the last year down by nearly 600,000.

MILLENNIALS ARE DOING ALRIGHT

The generation ridiculed for overspending on late’s and Avocado toast may surprise you. Millennials have outpaced older generations in building wealth since the COVID-19 pandemic, according to recent data from Wealthfront:

Millennials on the platform grew their wealth by 137% over the past five years. Meanwhile, Gen X investors grew their wealth by 76% over the same time period, and baby boomers grew theirs by 40%. In January 2020, Wealthfront’s average millennial client had an average of $45,600 saved and invested. Since then, that figure has grown to $108,130.

“The biggest factor we see contributing to millennials’ financial success is how they invest. Millennials are holding more in equities than previous generations were at their current age. This has led to a faster accumulation of wealth because millennials are investing with strategies that have a higher risk-adjusted return.

David Fortunato, the chief executive of Wealthfront

This generation also became obsessed with money. FIRE BURNOUT explores the dark side of savings obsession or the toll it took to save 1mm by 33 (a great piece in New York Magazine).

IS GEN Z REALLY THIS INSANE ABOUT WORK?

Much is said about the work ethics of Gen Z, and you can cherry-pick surveys or data points to tell any side of an argument, LIKE THIS ARTICLE, which is just a comical clic bait on Gen Z’s aversion to any notion of professionalism. some bars:

'I take 82-minute lunch breaks'

Maisy, 27, goes to yoga classes and calls them ‘doctor’s appointments’

“I love going out in the week and hanging at work. There is no point in being hungover at the weekend on your own time.”

However, this one surprised me: Bing watching TV while working? Based on Research by Tubi:

84% of employed Gen Z viewers said they watch TV or movies while working and 48% said they have lied to coworkers or bosses about it.

About 53% of respondents said they put off work to finish a show they were binge-watching and 52% said they do not want to return to the office because they will miss streaming during the work day. Meanwhile, 38% of viewers said they stream their favorite TV shows or movies while at their job site.

WOW.

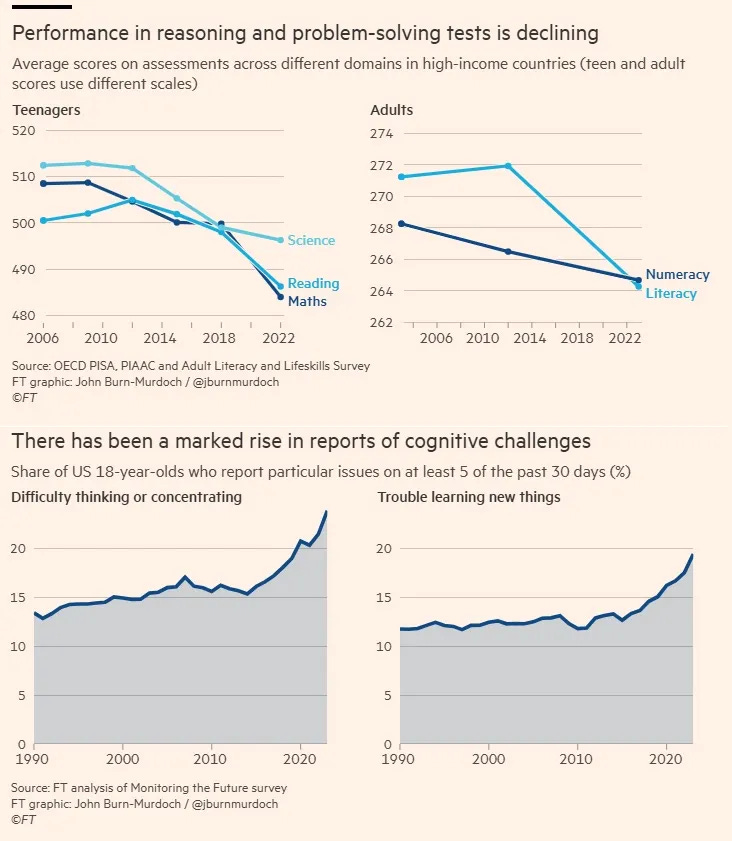

ARE WE GETTING DUMBER?

Mid covid I started to notice it was harder to read long form, I’ve been an avid reader my whole life, this was a marked change I really felt.

I used read 20-30 books a year (go goodreads challenge!). Long flights, I’d read - now I tune out, or worse I’m on my phone. Same with before going to bed, although keeping my phone completely out of the bedroom has been a helpful mandate for years. I’m not alone, Reading rates have plummeted. Fewer than half of Americans read a book in 2022.

FT’s Recent article “Have humans passed peak brain power?” analyzed multiple studies from around the world, coming to the conclusion that as a whole, “the average person’s ability to reason and solve novel problems” is declining. If you don’t have a FT subscription, or want the trendy TLDR - Dazed has a good take as well.

I initially put this to some lasting brain fog resulting from covid, but it seems to be several factors. This isn’t resulting from a biological change, its behavioral. Our attention span is getting attacked, the army of psychologists working in tech to manufacture addictive qualities such as doom scrolling and passive content consumption, have created an addiction economy.

“We have moved from finite web pages to infinite, constantly refreshed feeds and a constant barrage of notifications. We no longer spend as much time actively browsing the web and interacting with people we know but instead are presented with a torrent of content.”

- FT

This isn’t a Gen Z problem, although one of the very few things with bi partisan support is banning phones in schools. Research shows that declining attention spans, lower literacy, and struggles with critical thinking is affecting every generation.

Is this another hallmark in the decline of civilization as we know it? Or is this an evolution in the age of prompt and search intelligence? We’ve been losing hard skills for the past 75 years. Who knows how to hunt, farm, or have basic outdoor life skills? An event that takes away our modern comforts can leave us helpless. We love movies and shows that explore the post apocalyptic landscape, but were in now way prepared to live it.

The internet replacing the need to “KNOW” anything, it’s at our fingertips.

Prompting and knowing what to ask will be future forms of intelligence. Soon, we’ll have chips that provide all the knowledge anyway.

For those that buck our evolutional cognitive trend…

THANKFULLY HARVARD WILL BE FREE FOR FAMILIES MAKING $100k OR LESS

NEW AIR FRANCE CABINS

Complete privacy & Jacquemus pajamas. While many carriers are moving away from first class to focus on business travelers, Air France has doubled down with the latest update to its posh La Premiere suites.

A key target consumer is the private flyer, "We have clients who typically fly private but they experience the La Première product and they say, 'Well, it's a lot cheaper to get to Los Angeles and Tokyo this way,'" according to Air France-KLM CEO Ben Smith. Environmental optics are also a consideration especially with private flights tracked and shamed on social media. Complete confidentiality in the experience are also key factors for the airline's clients.

"We've seen that leisure travel has increased by 24% in 10 years, with a more recent surge in demand for luxury experiences,"

Air France CEO Anne Rigail

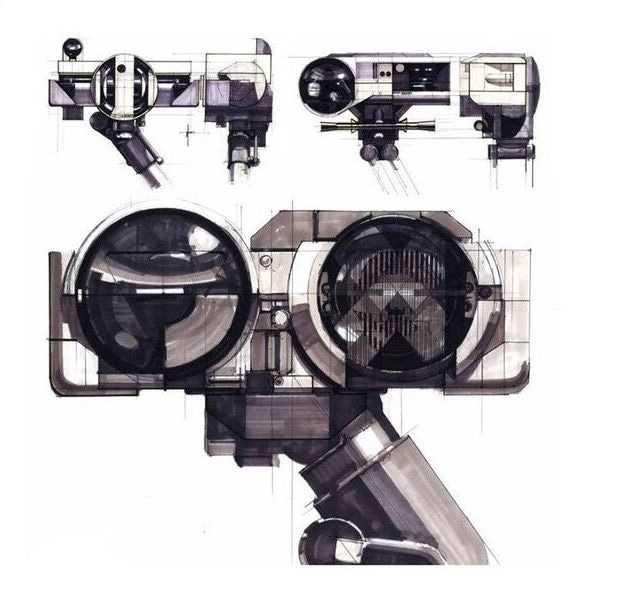

SIGMA - AN EVERYDAY CAMERA

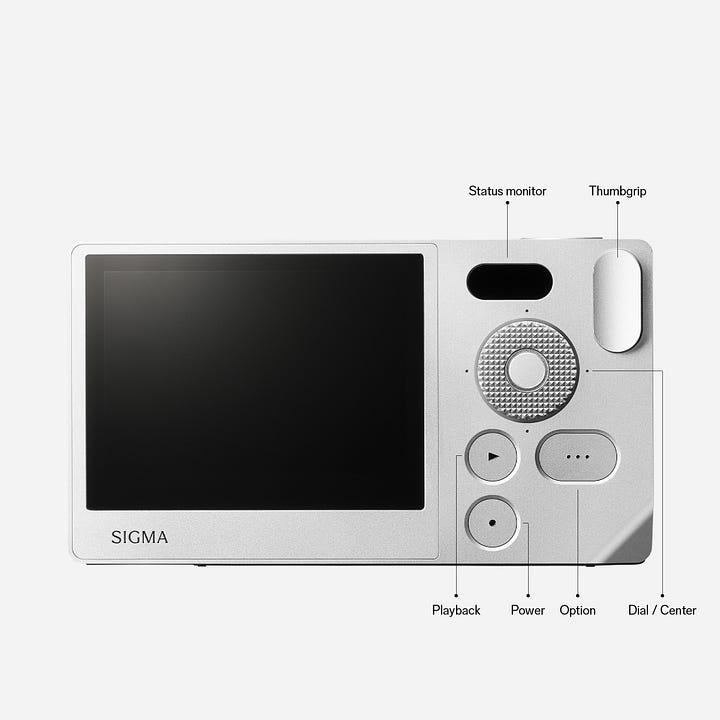

I love a simple camera, point and shoots specifically. Leica’s are beautiful works of art, but very complicated to use. I came across the Sigma BF Camera, what I like is its simplicity, yet it can take lenses of all types. Its also chic.

CHRISTOPHER NOLANS ODYSSEY CAST IS STACKED

Counterpoint: is it distracting? Could it be more interesting and immersive to leverage lesser-known talent?

- Matt Damon as Odysseus

- Tom Holland as his son Telemachus

- Anne Hathaway as Penelope

- Zendaya as Athena

- Charlize Theron as Circe

- Lupita Nyong’o as Clytemnestra

- Benny Safdie as Agamemnon

RESOURCES:

I stumbled across this archive of Design Manifestos. It’s robust, a great place for inspiration ranging from Apples 1997 ‘think different, to Charles Eames: Advice for Students, to Donald Judd’s: It’s hard to find a good lamp. 100’s of them.

- That’s it for this week